A Complete Guide to AR Automation

Cash flow defines business health and growth—but cash doesn’t move unless your collections do. Does your finance team's day-to-day still involve manual invoice management, time-consuming spreadsheet reconciliations, and endless email chains? It doesn't have to be this way.

Accounts Receivable (AR) automation transforms your AR processes from reactive admin tasks into proactive, strategic practices. In this comprehensive guide, we'll unpack everything you need to know—how AR automation works, the step-by-step pathway to implementation, and powerful examples from companies that have revolutionized their cash flow management with automation tools like Tesorio.

What is Accounts Receivable Automation?

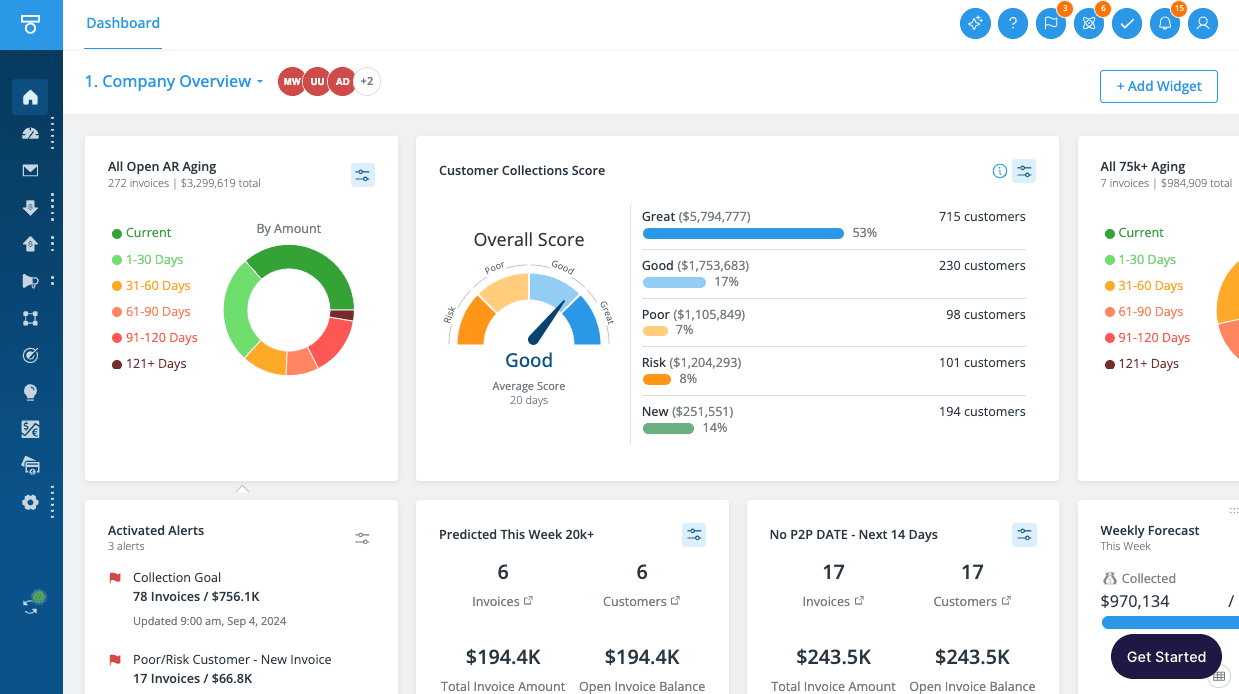

Simply defined, AR automation involves using technology to streamline and automate AR processes traditionally done manually—sending invoice reminders, reconciling payments, managing workflows, and forecasting cash flow. Modern platforms such as Tesorio utilize AI, smart workflows, and powerful integrations to provide intuitive dashboards and automated actions across your entire AR cycle.

The Benefits of AR Automation—Why Finance Teams Are Embracing It

Faster Collections and Dramatic DSO Reduction

The most immediate benefit of AR automation is the impact on your Days Sales Outstanding (DSO). By automating invoice follow-ups, reminders, payment collection portals, and real-time monitoring, automation accelerates AR collections significantly.

Discovery Education implemented Tesorio and reduced their DSO dramatically—from 128 to 43 days in just three months (a 66% improvement). Such rapid improvements create a massive impact on your company's working capital and liquidity.

Real-Time Cash Flow Visibility for Better Decisions

Manual AR processes rely heavily on spreadsheets, resulting in stale information. AR automation gives finance teams a live view of cash flow status via real-time dashboards detailing invoice aging, campaign performance, customer payment behaviors, and predictive insights.

Couchbase, using Tesorio, notably reduced their forecasting cycles from over a week to mere hours, increasing accuracy and enabling agile financial decision-making.

Increased Productivity Without Increasing Headcount

Automation substantially reduces the volume of repetitive activities within your AR workflow. Tesorio users frequently triple productivity, cutting manual tasks in half. Your team can handle more customers, drive collections proactively, and free up valuable time for strategic tasks—no additional headcount needed.

Enhanced Customer Experiences & Improved Relationships

AR automation improves your customer interactions significantly. Offering intuitive payment portals that accept multiple payment types (ACH, credit cards, wires), let customers track payments, dispute invoices, and manage their own accounts increases overall customer satisfaction.

According to research, businesses leveraging automated payment portals improve the rate of invoice resolution by 25%, creating a better overall customer experience.

Reliable Reconciliations via Automated Cash Application

AR automation platforms accelerate cash applications by matching payments to open invoices automatically. Instead of manual hours spent cross-checking bank statements and invoices, matching occurs rapidly and accurately.

Tesorio customers regularly reduce reconciliation time by over 75% and improve ledger accuracy, enabling a smoother monthly financial close.

5 Steps to Unlocking Powerful Cash Flow with AR Automation

Ready to automate your AR workflows? Follow these five strategic steps to gain substantial benefits immediately.

Step 1: Deploy Intelligent, Segmented Collections Campaigns

Remove the "one-size-fits-all" approach. Instead, tailor automated collections campaigns based on customer profiles, risk assessment, or outstanding invoice age. Tesorio’s automation easily allows precise, targeted outreach—improving immediate responses and reducing overdue invoices significantly.

Best practices:

Use automated templates segmented by customer type (SMB, enterprise, high-risk).

AI-driven recommendations tailor messaging to customer profiles for improved effectiveness.

Strategically schedule reminders to customers' time zones for maximum responsiveness.

Pro Tip: Tesorio-automated campaigns yield up to a 50% reduction in overdue invoices within just one quarter.

Step 2: Drive Real-Time Visibility with Powerful Dashboards

Ditch spreadsheets. Automation pairs dashboards with real-time insight into invoice aging, customer payment behavior, and projected collections. Your finance team regains significant hours previously lost to reporting, allowing powerful, proactive cash management.

Best practices:

Customize dashboards to track KPIs: DSO, aging buckets, or regional collector performance.

Use predictive alerts to flag high-risk accounts early and proactively respond.

Pro Tip: Companies leveraging Tesorio’s visibility and automation typically reduce DSO by an average of 33 days.

Step 3: Offer Frictionless, Secure Customer Payment Options

Customer friction blocks swift collection. Enable customers with straightforward, integrated payment portals. These portals allow easy invoice payment, payment promises logging, and structured invoice inquiries directly within reminder emails.

Best practices:

Offer multiple payment methods (ACH, wires, credit cards) for flexibility.

Integrate single-click payment options directly into invoice reminders.

Pro Tip: Businesses that fully integrate self-service payments realize 25% faster invoice resolution and increased customer satisfaction.

Step 4: Streamline Cash Application & Automate Reconciliations

Automated cash application engines instantly match payments received directly with outstanding invoices. This drastically reduces AR workload, prevents reconciliation errors, and maintains real-time ledger accuracy.

Best practices:

Link automated cash applications directly to bank data for auto-ingestion of payment details.

Configure smart matching rules to accurately reconcile transactions easily and quickly.

Pro Tip: Companies automating cash application with Tesorio cut reconciliation time by up to 75%, drastically simplifying their month-end closing process.

Step 5: Connect Workflows Into a Single Unified Platform

AR automation isn’t about isolated features. Instead, integrate campaign automation, online payments, cash reconciliation, and forecasting intelligence in one powerful, interconnected platform. This centralization provides deeper financial insights, predictive AI recommendations, and holistic team collaboration.

Best practices:

Sync your AR workflows with treasury and FP&A forecasting tools.

Leverage Tesorio’s AI-driven recommendations for next-best actions based on real-time collections insights.

Pro Tip: Discovery Education’s unified AR automation approach with Tesorio slashed DSO by 66% while fostering strategic collaboration across finance teams.

Common AR Automation Implementation Challenges (& How to Overcome Them)

Resistance to Change

Overcome skepticism about new processes by demonstrating quick-value wins via smaller automation projects and expand incrementally.

Data Silos

ERP, CRM, and bank feeds must integrate effectively. Choose platforms like Tesorio embedded with extensive integrations to consolidate data sets into intuitive workflows.

Manual Flexibility Requirements

Automation must enhance—not limit—team choices. Ensure your system supports override rules, manual approvals, and flexible escalation pathways.

Visibility Gaps

Automated dashboards must supply actionable insights. Real-time AR health and predictive analytics visibility enable proactive interventions and responsiveness.

FAQs

What Does Tesorio’s AR Automation Include?

It covers smart campaigns, payment portal, AI-driven decision recommendations, cash application integration, and advanced analytics.

Can I Selectively Deploy AR Modules?

Absolutely; modularity allows strategically adopting collections campaigns, online payments, or cash application independently.

Does Automation Really Reduce DSO?

On average, customers achieve DSO improvements from 33–66 days within the first few months.

How Quickly Can Implementation Happen?

Teams can go live within weeks—fully operational with specialized onboarding and customizable templates.

Unlock Your Cash Potential with AR Automation (Today!)

AR automation isn’t theory, it’s a strategic necessity. Companies that automate effectively see significant DSO improvements, higher productivity without additional overhead, better customer experiences, and stronger cash flow fundamentals.

Ready to eliminate your AR frustrations and convert your finance team into a strategic financial powerhouse?

Schedule your live demo today and discover firsthand how Tesorio's AR automation platform transforms your AR processes and cash flow.