Accounts Receivable Automation: The Fast Track to Real-Time Cash Flow

Every CFO I speak with eventually circles back to the same constraint: capital that could fund hiring, product bets, or acquisitions is stuck inside receivables. When you automate Accounts Receivable (AR) on a connected financial operations platform, booked revenue converts to usable cash sooner, freeing up working capital without adding debt or dilution.

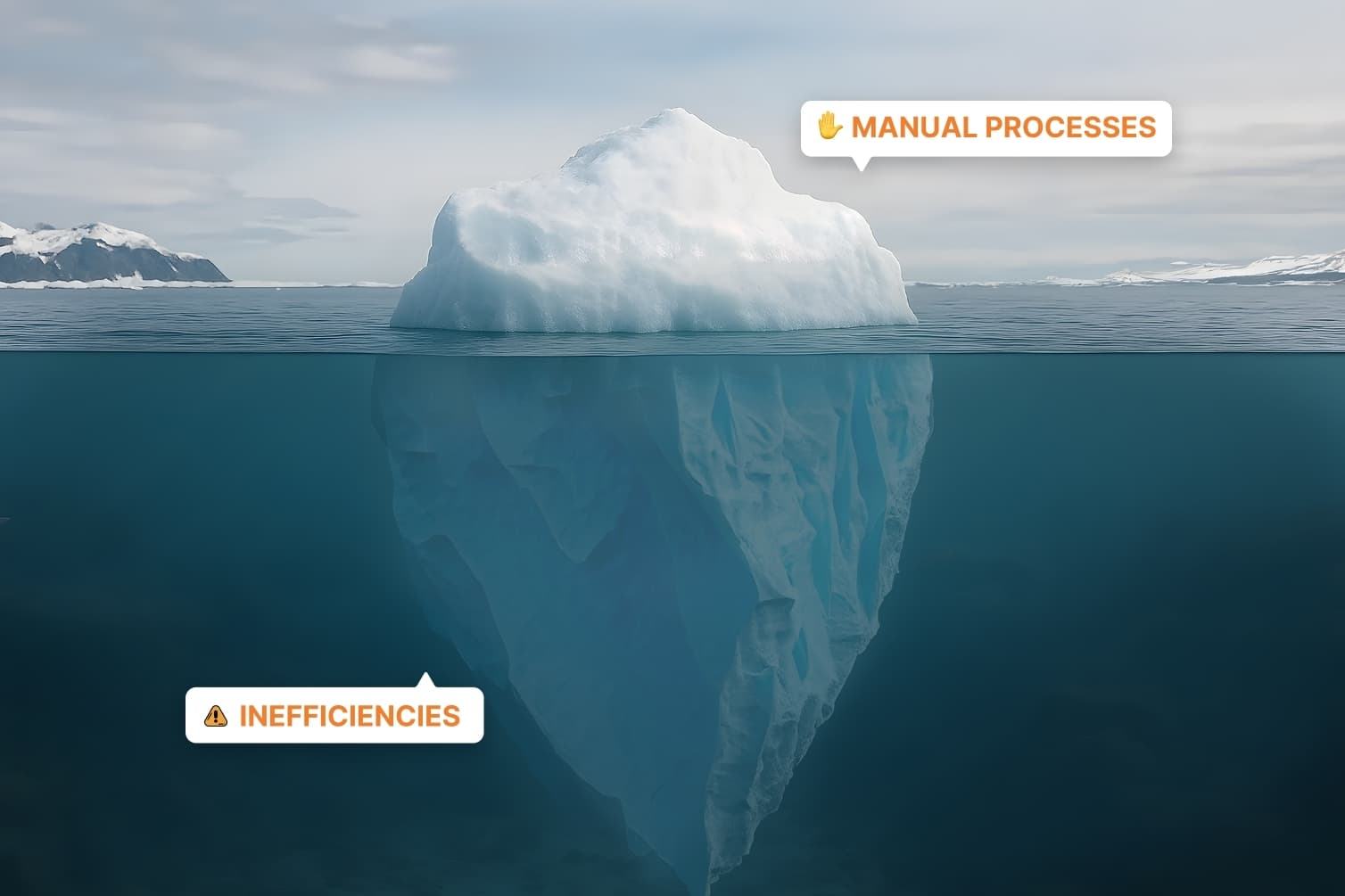

The Hidden Cost of Cash Flow Inefficiency

Bottleneck | What Happens | Why It Hurts | How Leading Teams Fix It |

|---|---|---|---|

1. Siloed Cash Intelligence | ERP, CRM, billing, and banking systems keep their own ledgers; analysts spend hours reconciling. | While teams untangle data, millions sit idle and strategic moves stall. | Stream data from every source into one live AR workspace so the entire team acts from a single truth. |

2. Static Forecasting Loops | Forecasts are built on last month’s data and manual edits. Business conditions have already changed. | Out-of-date projections force leaders into defensive cash management. | Pair predictive analytics with live AR inflows so rolling forecasts update continuously and surface liquidity gaps early. |

3. Manual Collections Drag | Calendar-based reminders treat every customer the same; follow-ups slip, DSO stretches. | Each day of delay raises borrowing needs and opportunity cost. | AI-powered workflows score each account, prioritize outreach, and auto-personalize messages, shrinking DSO while scaling team capacity. |

The Compounding Power of Faster Cash

Tesorio customers cut Days Sales Outstanding by an average of 33 days, nearly halving the typical 65-day cycle. That improvement doesn’t just pad metrics; it injects fresh working capital that can:

Accelerate product roadmaps

Fund market expansion without outside financing

Strengthen the balance sheet against volatility

Multiply that effect across thousands of invoices and real-time cash visibility becomes a durable competitive moat.

Three High-Impact Plays to Master AR Automation

Connect Your Data

Ingest ERP, CRM, billing, bank, and email feeds into a unified AR hub. A single view of cash eliminates swivel-chair reporting and manual reconciliations.Forecast with Intelligence

Layer machine-learning models on live inflows and outflows. When variance alerts fire proactively, finance can re-allocate capital days, or weeks, before a pinch shows up on the P&L.Automate & Personalize Collections

Deploy behavior-based workflows that adapt cadence and tone by risk profile. Analysts handle only the exceptions; the platform handles the rest.

Proof in Practice: Discovery Education trimmed DSO 66 % in twelve months, while Couchbase doubled collections productivity and cut overdue receivables by 50 %, results they describe as “impossible to imagine…if not for Tesorio.

Building a Culture of Cash-Flow Intelligence

Cash metrics should live on every department dashboard, not just in month-end finance packs.

Real-time performance reviews beat static retrospectives; they spotlight issues while there’s still time to act.

Predictive alerts must trigger preventive action before cash surprises hit earnings.

When AR automation underpins this culture, finance evolves from record-keeping to revenue enablement.

How Fast Can Your Cash Move?

Walk through your receivables cycle and pinpoint the manual steps that still slow the release of earned revenue. Automate those constraints and you convert real-time cash flow from a back-office chore into strategic firepower, one invoice, one day, one decision at a time.