CFOs No Longer Have The Luxury Of Waiting. How They’re Taking Immediate Action On Cash Flow

By Max Dame

In the past, finance teams operated on more flexible timelines for processing financial data and updates.

In 2025, CFOs demand immediate access to financial data, making real-time insights into cash flow management critical. Consequently, short-term cash flow performance has become the cornerstone of financial stability.

In conversations with CFOs and finance leaders, it’s clear that while market uncertainty, evolving hiring practices, and the rise of AI are reshaping the financial landscape, some fundamentals remain steadfast. We identified three key attributes—visibility, predictability, and control—as the framework for effective cash flow management in this dynamic environment.

The Three Pillars of Financial Health

Visibility: Removing Blind Spots in Financial Data

One of the biggest challenges for CFOs today is getting a clear, real-time view of their company’s financial health. Many still rely on static reports, but by the time those numbers are finalized, they no longer reflect reality. In an environment where crucial drivers of cash flow can shift daily, waiting for the books to close before making decisions is simply too risky.

CFOs need continuous visibility—not just a historical snapshot from last month or last quarter, but live, actionable data that allows them to anticipate and respond to financial changes immediately. Removing these blind spots now is critical.It’s not just about having data; it’s about having data you can trust, when you need it most.

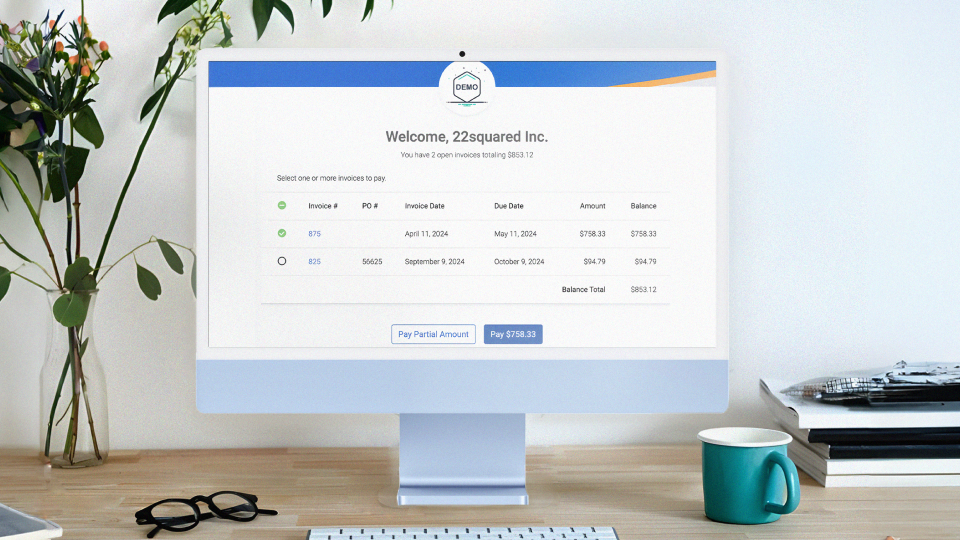

At Tesorio, we take this a step further by ensuring both speed and reliability in financial data. Every data point is meticulously verified and continuously updated, so finance teams aren’t just reacting faster—they’re making smarter, more confident decisions based on precise, trustworthy insights. Instead of relying on assumptions, CFOs can navigate their financial landscape with clarity, knowing that every move is backed by accurate, up-to-the-minute intelligence.

Predictability: Seeing Around the Corner

Understanding what lies ahead is just as important as knowing where you stand today.

One of the biggest frustrations in finance is being blindsided by unexpected cash flow disruptions—late payments, vendor shifts and sudden expenses. The ability to “see around the corner” allows CFOs to anticipate problems before they escalate.

For example, if an entire customer segment starts paying later than usual, it could be an indicator of a structural issue within that segment. This is information you need to know immediately so you can take action before it impacts your business, adjust forecasts, and follow up.

To enhance predictability, AI-driven cash flow forecasting automates pattern recognition, allowing finance teams to stay ahead of challenges before they escalate.

Control: Taking Action When It Matters

The final pillar, control, enables finance leaders to implement timely interventions that stabilize and drive financial growth.

Knowing there’s a cash flow issue isn’t enough—what matters is how quickly you act on it. If certain customers are paying late, are you automatically following up? Are you adjusting payment terms? Are you running campaigns to prevent delays?

With Tesorio, finance teams can implement corrective measures instantly, ensuring stability and continued growth. The best CFOs don’t just report on financial performance—they actively shape it.

Why Cash Flow is the #1 Priority Right Now

The past two years have been a wake up call for finance leaders. Between the banking crisis and venture funding slowdowns, it became clear that cash flow is everything.

I tell my team all the time:

“Cash isn’t as easy to get as it was just two or three years ago.”

For a long time, businesses could easily raise capital or refinance debt when they needed to. Now? That’s no longer a given. If you don’t have total control over your cash flow, you lack clarity in a market where liquidity is king.

CFOs need a daily, real-time understanding of their cash position to avoid being blindsided.

AI is Transforming Cash Flow Forecasting

Short-term cash forecasting is one of the most painful, time-consuming tasks for finance teams.

Ninety percent of companies still rely on a manual process for a 13-week cash forecast.

- Gathering customer payment trends

- Tracking vendor invoices

- Adjusting for changing payment terms

- Managing bank transactions and seasonality

Instead of spending days sorting through spreadsheets, AI can process thousands of customer payment behaviors instantly.

For example, I always ask:

“If you have a few thousand customers, and one always pays 20 days late while another always pays five days early—how do you predict that?”

Spreadsheets can do it, but it’s slow and full of human error. AI, on the other hand, delivers an instant, accurate forecast—something that used to take a finance team a full week to compile.

This isn’t some futuristic concept—it’s happening now.

Is It Time to Re-engineer Your Finance Function?

You hear it all the time: “Finance teams are being asked to do more with less.”

But here’s my take—

“We’re not being asked to do more with less. We’re the ones pushing ourselves to do more.”

Finance teams hold themselves to an incredibly high standard. We pride ourselves on running lean, efficient operations. But sometimes, that mindset can hold us back.

I’ve seen CFOs hesitate to invest in better tools because they don’t want to spend the money. But finance leaders have to invest. Whether it’s a better system, better processes, or the right people.

Cutting costs at the expense of efficiency is a bad trade-off.

CFOs Need to Be Hands-On with AI

When new technology emerges, I don’t just assign it to my team, I test it myself.

When ChatGPT launched, I didn’t wait for someone to summarize it for me. I played with it. I tested it. And now I use it every day.

That’s exactly how finance leaders should approach AI and automation.

If you’re a CFO and you’re not experimenting with AI tools, you’re already behind. AI isn’t replacing finance teams, but it is changing our jobs for the better. The teams that embrace it now will be the ones leading the future.

Final Thoughts

CFOs today aren’t just reporting numbers, we are shaping business strategy, making real-time decisions, and driving growth.

That’s why visibility, predictability, and control aren’t just financial buzzwords, they are the foundation of modern CFO leadership.

At Tesorio, we’re building for that future, where AI-driven finance gives teams real-time insights, better forecasting, and the ability to take fast action.

For those of us in finance, this is one of the most exciting times in history.

The companies redefining efficiency today will be the ones rewriting the rules tomorrow.