How AI is Fixing Late Payments: Automating Cash Collections

By Fabio Fleitas

Introduction: The Late Payment Problem and the AI Solution

Cash flow isn’t just a financial metric—it’s the lifeblood of business growth. But for too long, finance teams have been stuck in a cycle of chasing payments, dealing with inefficiencies, and reacting to cash flow issues rather than preventing them. The old way of managing collections simply doesn’t work anymore.

At Tesorio, we’re changing that. I’ve seen firsthand how AI can eliminate manual tasks, reduce DSO, and give finance teams real-time control over their cash flow—helping some of the smartest finance teams at companies like Veeva, Discovery, and Box stay ahead with automated cash flow management.

The Journey to Tesorio: Identifying a Broken System

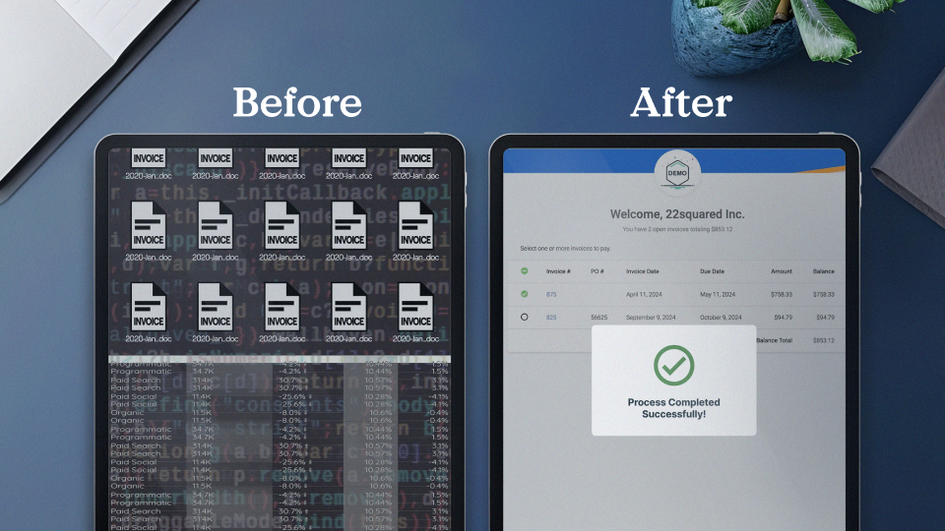

Before building Tesorio, I didn’t come from a finance background, but when I learned how manual and frustrating the collections process was—sending emails, PDFs, and chasing payments for work already done—it felt almost ridiculous in the digital world. Consumers had seamless ways to pay, yet businesses were stuck in outdated workflows. I knew there had to be a better way. My co-founder, Carlos, had spent years in finance and saw these inefficiencies up close. Together, we talked to CFOs and finance leaders, and one thing became clear—collections were one of the biggest bottlenecks in financial operations.

“We literally had dinners with finance executives, just asking them: What are your biggest problems? And collections came up again and again.”

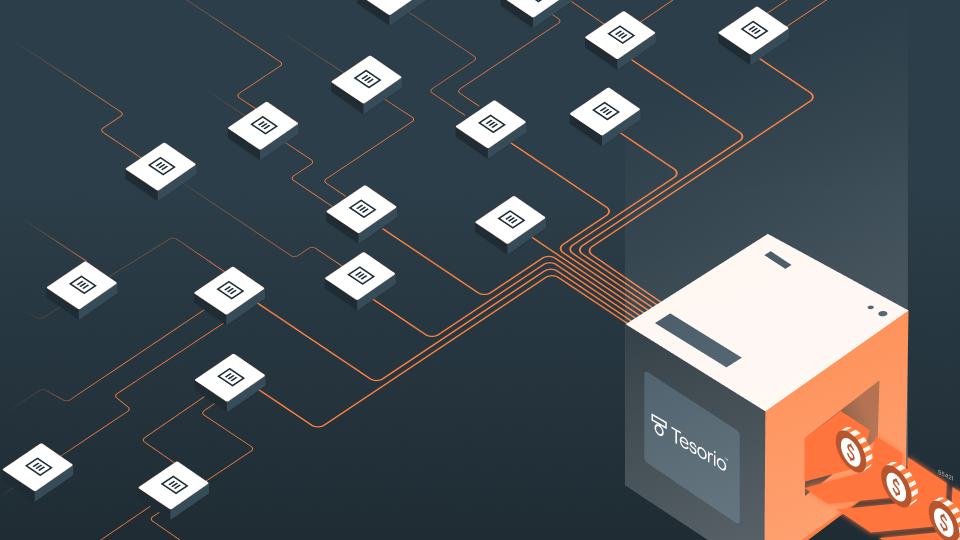

That insight led us to create Tesorio—the first AI-powered connected financial operations platform that turns revenue into real cash by automating the collections process end to end.

The Problem: Why Late Payments Are Holding Businesses Back

Traditionally, businesses assumed that once an invoice was sent, payment would follow. But the reality is far from that. Finance teams spend hours sending manual follow-ups, tracking payments in spreadsheets, and struggling to reconcile cash flow data across multiple systems. The biggest issues they face include:

- Lack of visibility: Invoices get lost, customers forget, and finance teams don’t have real-time payment insights.

- Manual processes: Teams rely on outdated methods—sending emails manually, logging into customer portals, and chasing payments without automation.

- Siloed financial data: ERP, CRM, and banking systems don’t always communicate, creating gaps in cash flow forecasting.

- Long payment terms: While Net 30 is common in the U.S., some regions see payments delayed 90 to 180 days—straining cash flow, adding stress, and forcing finance teams into constant follow-ups.

“Finance teams in large companies manage thousands of invoices at any given time with only a handful of people. That’s where AI can truly make a difference.”

How Tesorio Fixes the Cash Flow Problem

At Tesorio, we built a platform that eliminates the friction in collections. Here’s how it works:

1. Automated Invoice Follow-Ups

Our AI-driven system sends personalized payment reminders before invoices are due. It also escalates reminders when necessary, so finance teams don’t have to chase customers manually.

2. Predictive Payment Modeling

AI analyzes historical payment behaviors to predict which invoices might be paid late and proactively suggests interventions. This allows finance teams to act before cash flow problems arise.

3. Automated Cash Application & Reconciliation

Tesorio integrates directly with bank feeds, ERPs, and accounting systems, automating cash reconciliation and eliminating manual data entry.

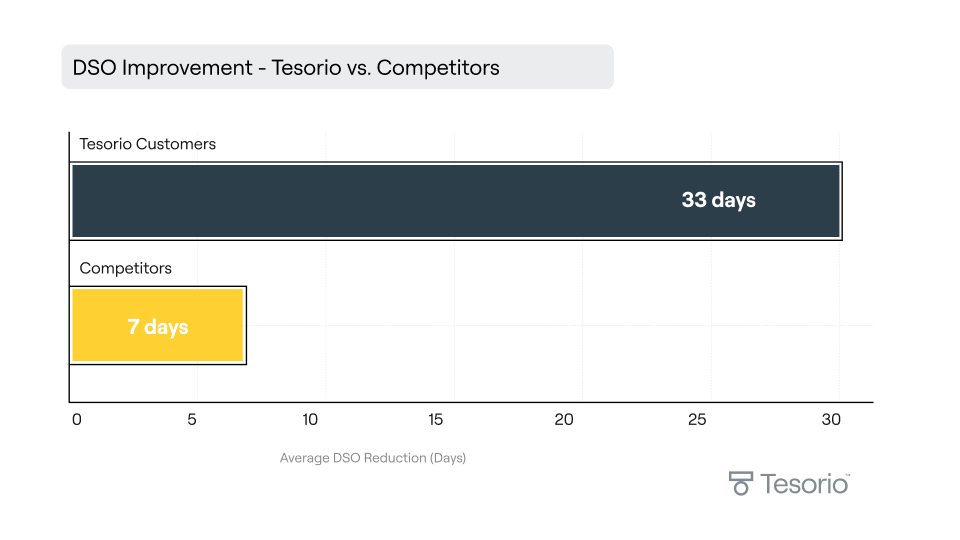

Our customers have seen an average reduction of 33 days in their payment cycle, unlocking millions of dollars in cash flow.

4. AI-Powered Supplier Portal Automation

Many companies require suppliers to log into portals to submit invoices instead of sending them via email. Previously, this required tedious manual work. Now, Tesorio’s AI agent logs in, submits invoices, and ensures they’re processed correctly—saving finance teams hours of repetitive work.

“There was no way to automate portal submissions before, but AI finally makes it possible.”

The Future of AI in Finance

AI isn’t just making finance teams more efficient—it’s changing the way finance works entirely. With AI-driven collections, forecasting, and reconciliation, finance teams can proactively manage cash flow instead of reacting to problems.

*Industry benchmarks indicate an average DSO of 59 days, with significant variations across sectors. Companies leveraging automation and AI-driven collection strategies have achieved substantial reductions in DSO. For instance, Tesorio users have reduced their DSO by an average of 33 days, enhancing liquidity and operational efficiency. Sources: -Allianz Trade DSO/WCR Report Allianz-trade.com -PwC Working Capital Study 24/25 pwc.com

"Saying you won’t use AI today is like refusing to use the internet in the early 2000s. You’ll just fall behind."

At Tesorio, we believe finance teams should be strategic drivers of business growth, not just back-office functions. AI is enabling that shift right now.

Final Thoughts

Late payments don’t just slow down finance teams—they hold businesses back from growing. Tesorio isn’t just automating collections—it’s redefining how finance teams operate.

For CFOs and finance leaders looking to reduce manual work, improve cash flow, and unlock working capital, AI-powered automation is no longer optional—it’s essential.

“The real impact of AI isn’t in replacing jobs; it’s in giving teams the tools to work smarter and scale without adding headcount.”

At Tesorio, we’re building for the future—where finance teams aren’t chasing payments, they’re owning cash flow and driving business growth.