How to Automate AP Forecasting and Forecast Cash Flow in Real Time

Forecasting cash flow in real time is no longer a “nice to have”—it’s essential for CFOs and finance teams aiming to hit targets and stay liquid in uncertain markets. Yet many teams still wrestle with manual spreadsheets, siloed systems, and incomplete data when it comes to accounts payable (AP).

That’s where Tesorio steps in.

Tesorio brings together AP and AR data in one place, helping finance teams automate AP forecasting, improve accuracy, and make smarter decisions—without manual guesswork.

In this guide, you'll learn how to:

Automate AP forecasting with real-time insights

Plan payments based on cash availability

Prioritize payables to preserve liquidity

Adjust payment timing dynamically

Align AP with your overall cash strategy

Step 1: Aggregate Real-Time AR & AP Data in One Platform

To forecast cash flow in real time, you need complete visibility across your receivables and payables. Disconnected systems slow you down and leave gaps in your forecast. Tesorio automatically syncs AR and AP data across your finance stack.

Best Practices:

Connect ERP, bank, and payment systems to a centralized view

Tag transactions by vendor, due date, and priority

Validate historical trends against real-time activity

Ensure AP and AR data refresh daily

Pro Tip: Finance teams using Tesorio’s unified platform reduce manual data consolidation time by up to 75%.

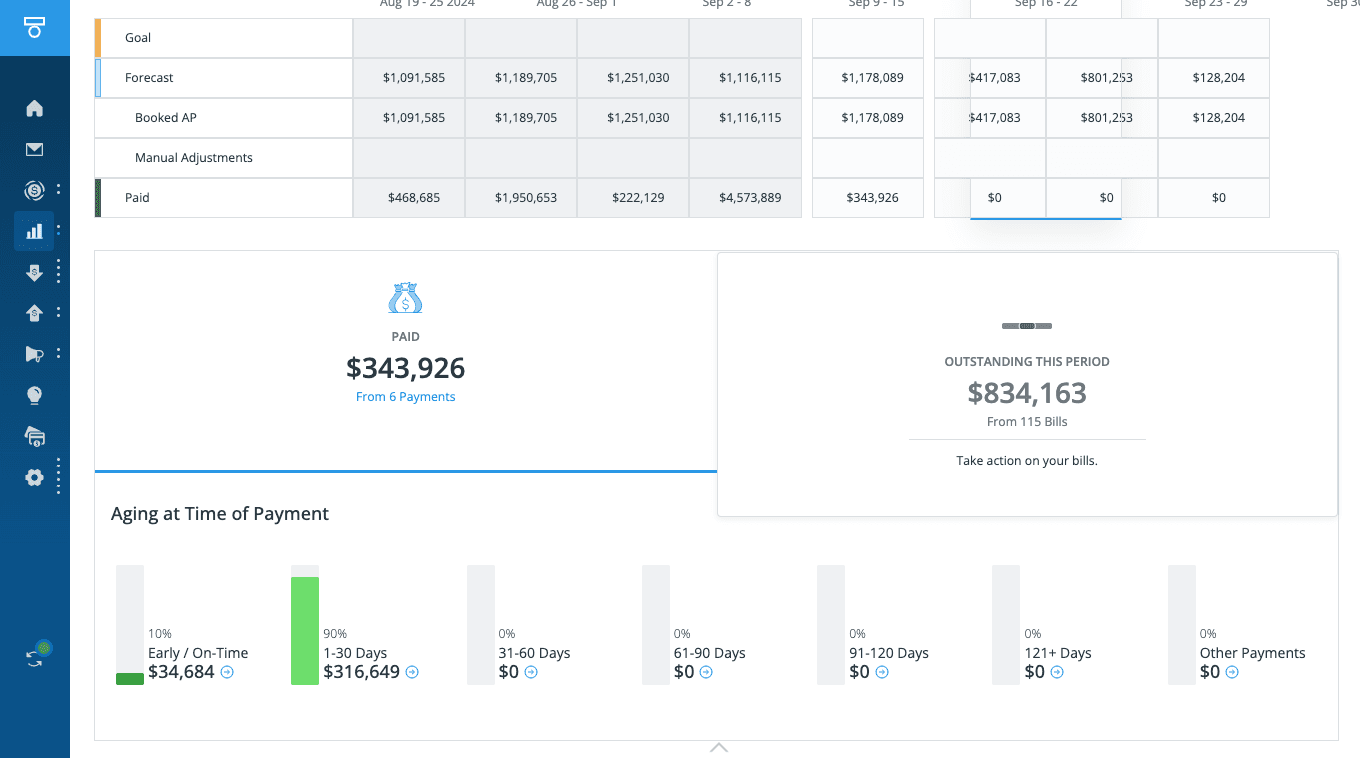

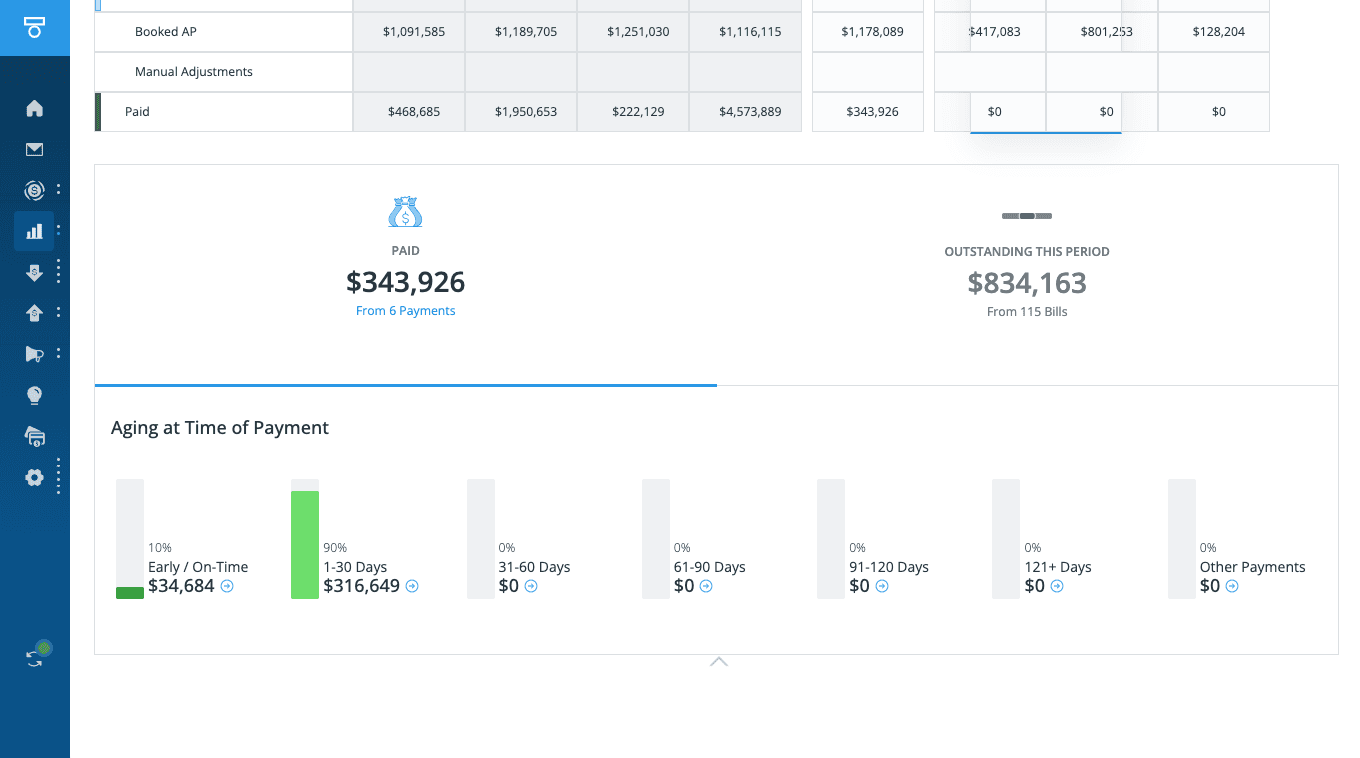

Step 2: Plan AP Runs Based on Real-Time Cash Position

Stop guessing what you can pay and when. With automated AP forecasting, you can run weekly or monthly payment cycles based on your actual cash availability—today and 13 weeks out.

Best Practices:

Run payment simulations to test different scenarios

Align payment timing with inflow predictions

Create payment buffers for high-risk AR accounts

Set AP guardrails tied to liquidity KPIs

Pro Tip: Planning AP runs in sync with AR inflows helps avoid cash crunches while preserving supplier relationships.

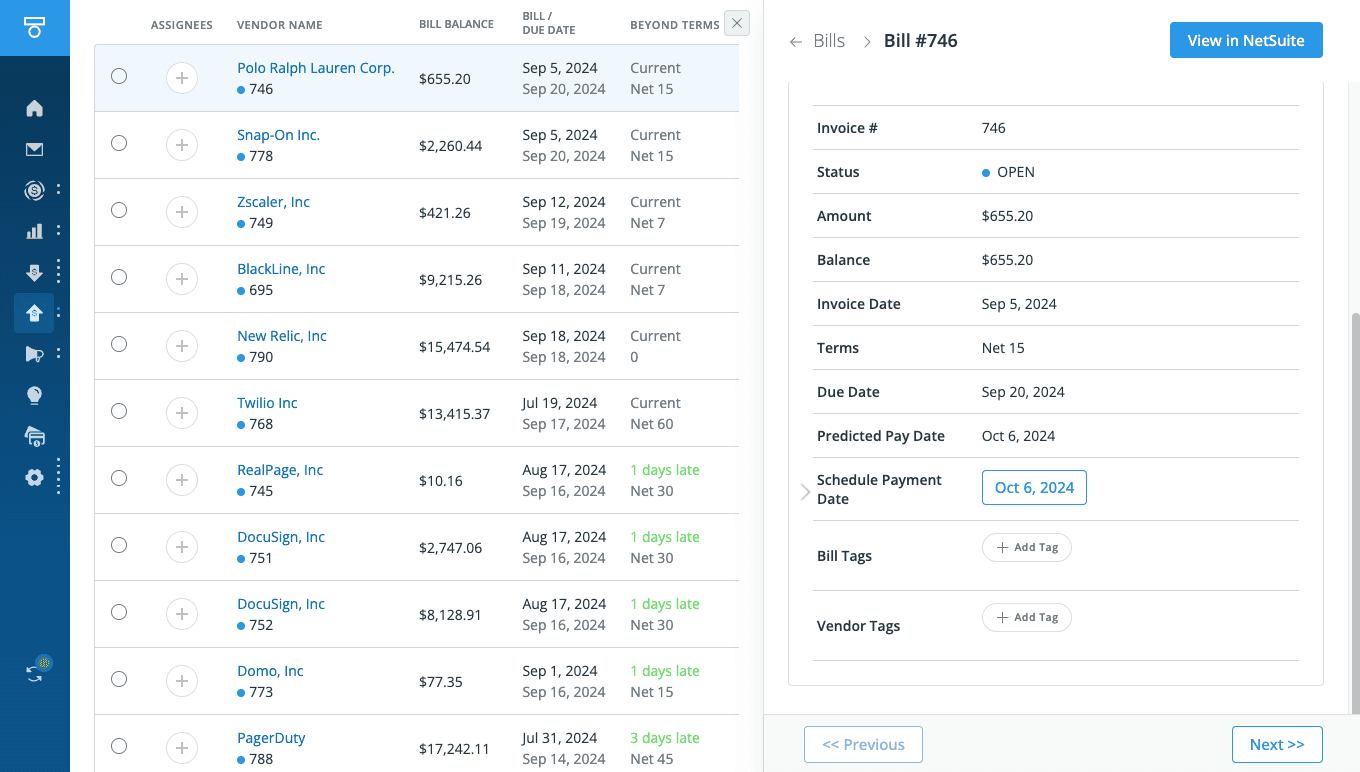

Step 3: Prioritize Payments Based on Strategic Value

Not all invoices are created equal. Automating AP forecasting allows you to rank payments by urgency, vendor relationship, and impact on operations—so you can protect flexibility without risking key partnerships.

Best Practices:

Use AI to flag critical or recurring vendors

Set rules to defer low-priority payments

Enable approvals for urgent, off-cycle payments

Tie payment decisions to cash forecast thresholds

Pro Tip: Tesorio users report up to 30% more working capital efficiency by prioritizing AP payments dynamically.

Step 4: Modify Payment Dates and See Instant Forecast Impact

Need to push a payment out a week? With traditional tools, you’d update a spreadsheet and cross your fingers. Tesorio lets you shift AP schedules and instantly see how that affects your cash forecast—so you can make data-backed decisions in seconds.

Best Practices:

Simulate changes to payment timing for large invoices

Create approval workflows for payment reschedules

Track cumulative cash impact of payment adjustments

Set alerts for breaching liquidity thresholds

Pro Tip: Teams that test different AP timing scenarios are 2x more likely to stay within their cash flow targets during downturns.

Step 5: Align AP Forecasting with Company Liquidity Goals

Real-time forecasting isn’t just about visibility—it’s about control. With Tesorio, you can align your AP plan with your broader liquidity strategy, ensuring that you're always prepared for investment opportunities or external shocks.

Best Practices:

Sync forecasts with treasury and FP&A teams

Define weekly and monthly liquidity targets

Highlight gaps between forecasted vs. required cash

Include AP strategies in board-level reporting

Pro Tip: Companies that align AP with cash targets report 50% fewer missed liquidity benchmarks.

Automate AP, Forecast Better, and Take Control

Forecasting AP is the missing piece for finance teams striving to forecast cash flow in real time. When you automate the process with Tesorio, you’re not just saving time, you’re building a future-proof cash strategy.

👉 Ready to automate AP forecasting? Book a demo with Tesorio today.

FAQs

What is automated AP forecasting?

Automated AP forecasting uses real-time data and AI to predict outgoing payments, helping finance teams manage cash outflows with precision.

How does Tesorio automate AP forecasting?

Tesorio connects to your ERP and banking systems, aggregates payable data, and lets you simulate, adjust, and forecast AP runs in real time.

Why is it important to forecast AP in real time?

Because static forecasts don’t reflect today’s cash position. Real-time insights let you avoid surprises and control liquidity more effectively.

Can I simulate different payment schedules in Tesorio?

Yes. You can adjust due dates and payment timing to see immediate impacts on your forecast and cash runway.

What happens if I delay a payment in the system?

Tesorio instantly recalculates your cash forecast based on the new date, helping you plan smarter and prevent liquidity issues.

How does this integrate with AR forecasting?

Tesorio combines AR and AP data into one forecast so you can plan inflows and outflows together—no more siloed reports.

Will this work for international or multi-entity teams?

Absolutely. Tesorio supports multi-entity setups and can forecast in different currencies and time zones.

Can this help me hit liquidity targets?

Yes. Tesorio lets you set and track liquidity benchmarks, prioritize payments, and course-correct in real time.