How to Automate Collections Email Campaigns and Reduce DSO

Collections can be time-consuming, inconsistent, and easy to miss when managed manually. Follow-ups fall through the cracks. Customers get generic reminders that don't reflect their payment history. And finance teams spend more time chasing invoices than improving strategy.

Tesorio solves this with automated collections campaigns that drive consistent, effective outreach. Powered by real-time data and tailored segmentation, these campaigns reduce DSO, improve customer communication, and free your team to focus on higher-value work.

Here’s how to unlock faster payments and smarter collections through five key capabilities built into Tesorio’s automated campaigns.

Step 1: Trigger Instant Follow-Ups Automatically

Manual outreach is reactive and prone to delays. Tesorio eliminates that lag by enabling dynamic email templates that trigger automatically based on invoice age, status, or behavior.

Best Practices:

- Create templates for reminders at 3, 7, and 14 days past due.

- Set up pre-due reminders to reduce the need for escalations.

- Use dynamic fields to personalize messages with invoice amounts and due dates.

Pro Tip: Timely follow-ups reduce forgotten invoices and improve first-contact resolution—directly accelerating payments.

Step 2: Deliver Tailored Communications at Scale

Your enterprise clients shouldn’t receive the same email as your startup customers. Tesorio’s automation allows for customized messaging across different segments.

Best Practices:

- Write message variations based on customer type or size.

- Include different tone and escalation levels for SMBs vs. strategic accounts.

- Personalize sender details to reflect account owner or collections lead.

Pro Tip: Personalized communication improves response rates and preserves customer relationships, even during tough conversations.

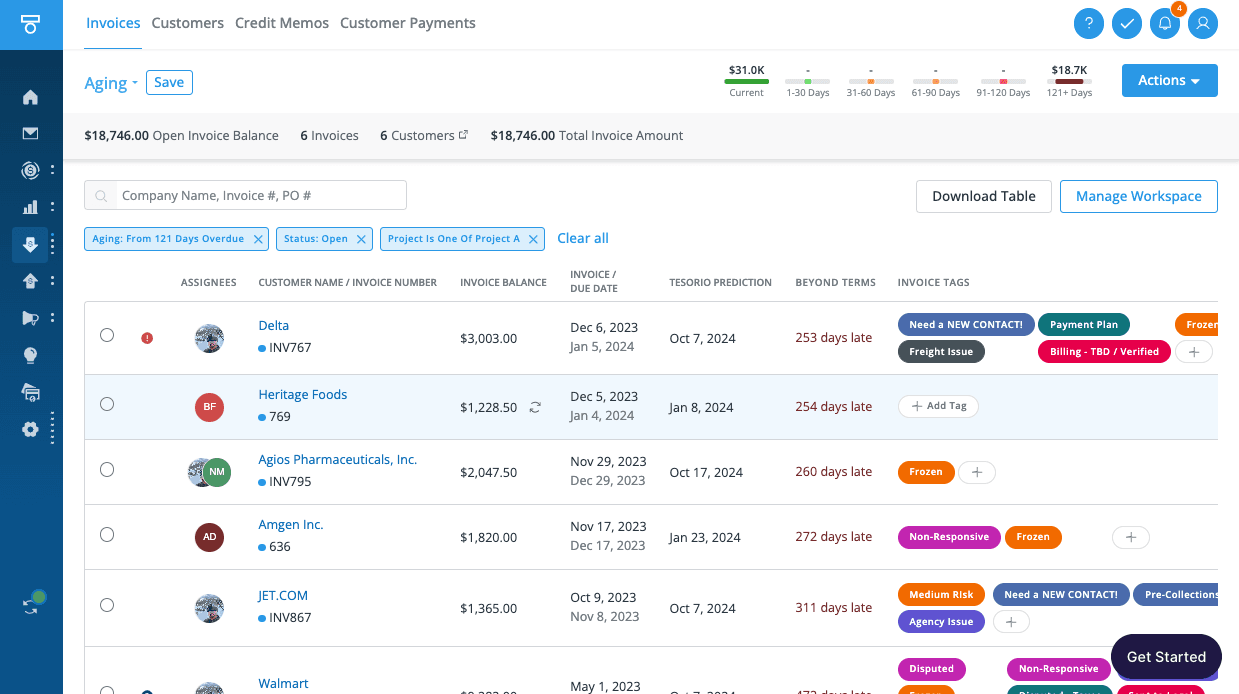

Step 3: Use Segmentation to Target the Right Accounts

Tesorio makes it easy to segment customers based on payment behavior, risk score, or open balance.

Best Practices:

- Tag accounts with custom labels like “High Risk,” “VIP,” or “Net 60.”

- Use filters like aging buckets or invoice count to define campaign audiences.

- Adjust message frequency and tone based on DSO impact.

Pro Tip: Smarter segmentation makes your automation feel personal—leading to faster responses and fewer escalations.

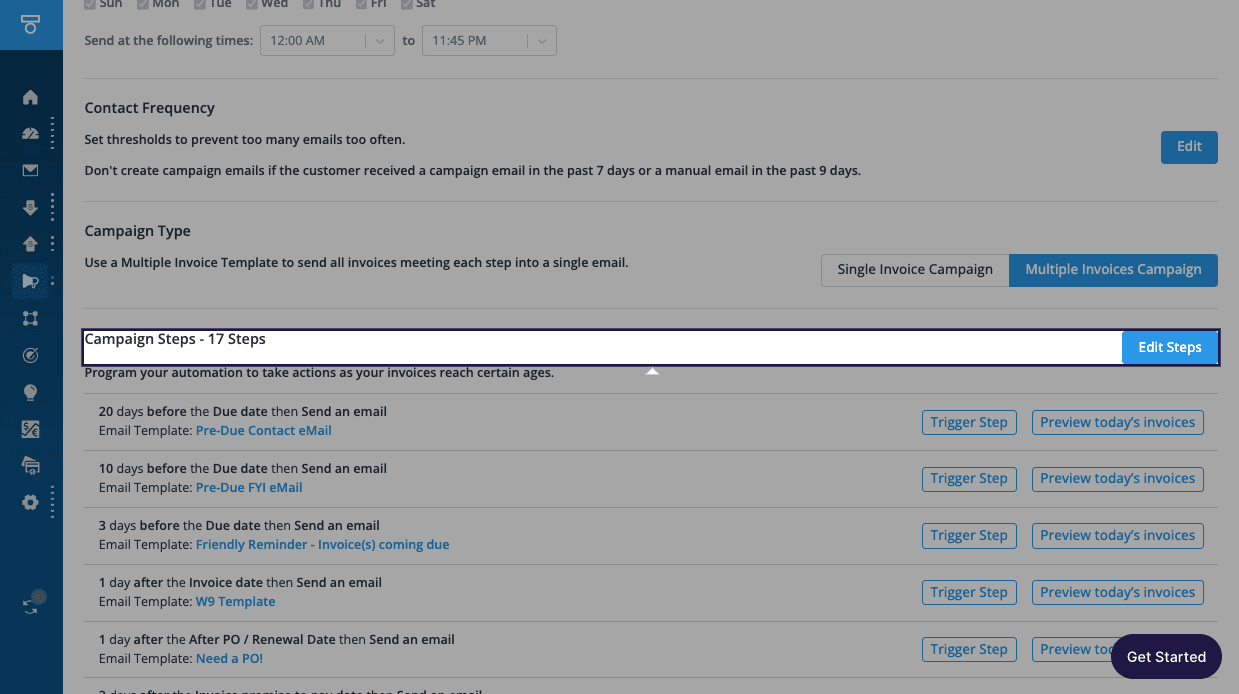

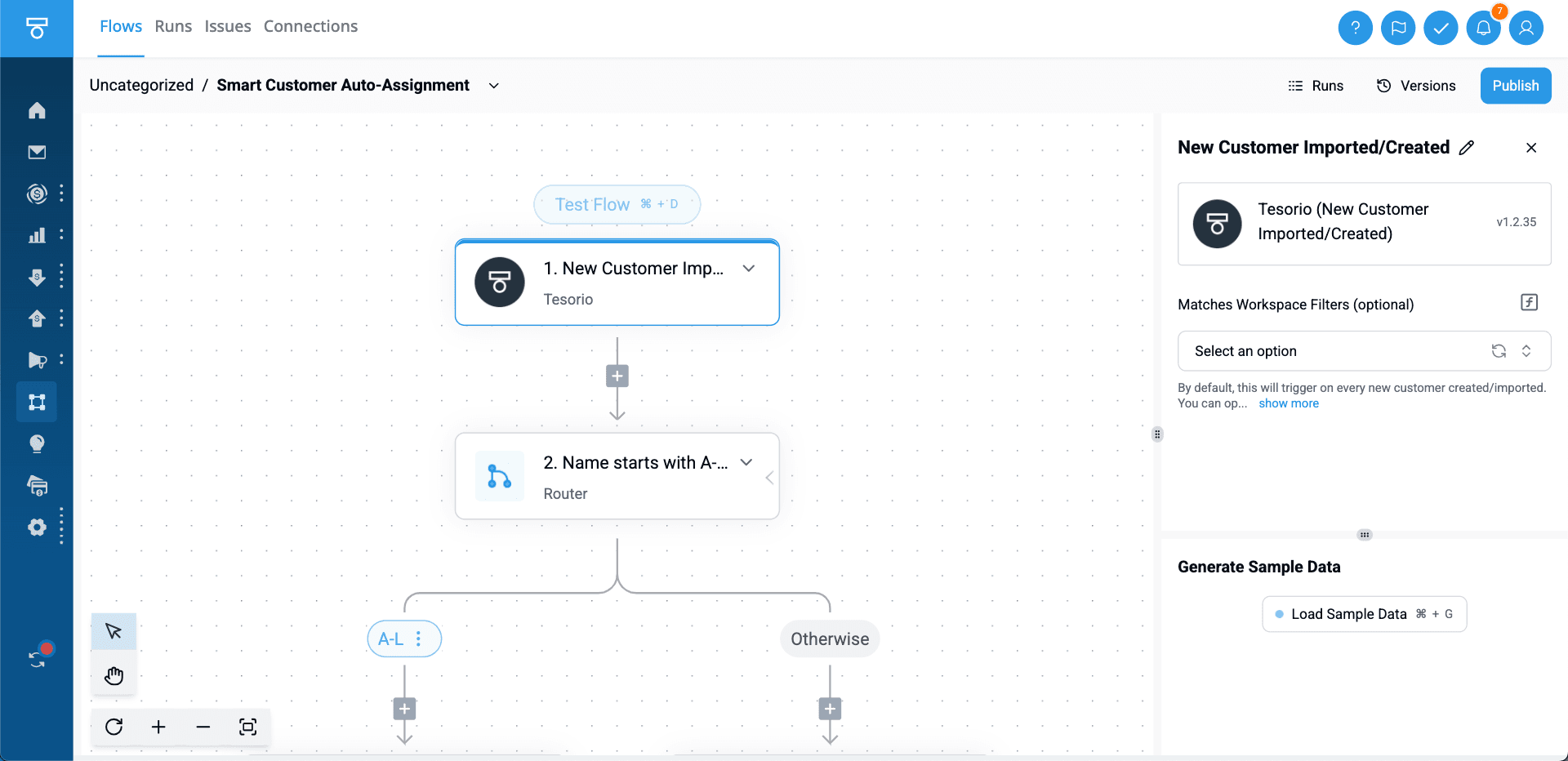

Step 4: Build End-to-End Automated Workflows

Eliminate the repetitive work. Tesorio’s workflows run automatically behind the scenes, keeping collections moving, even when your team isn’t logged in.

Best Practices:

- Set up multi-step sequences (e.g., reminder → escalation → final notice).

- Schedule workflows to run daily, weekly, or based on invoice events.

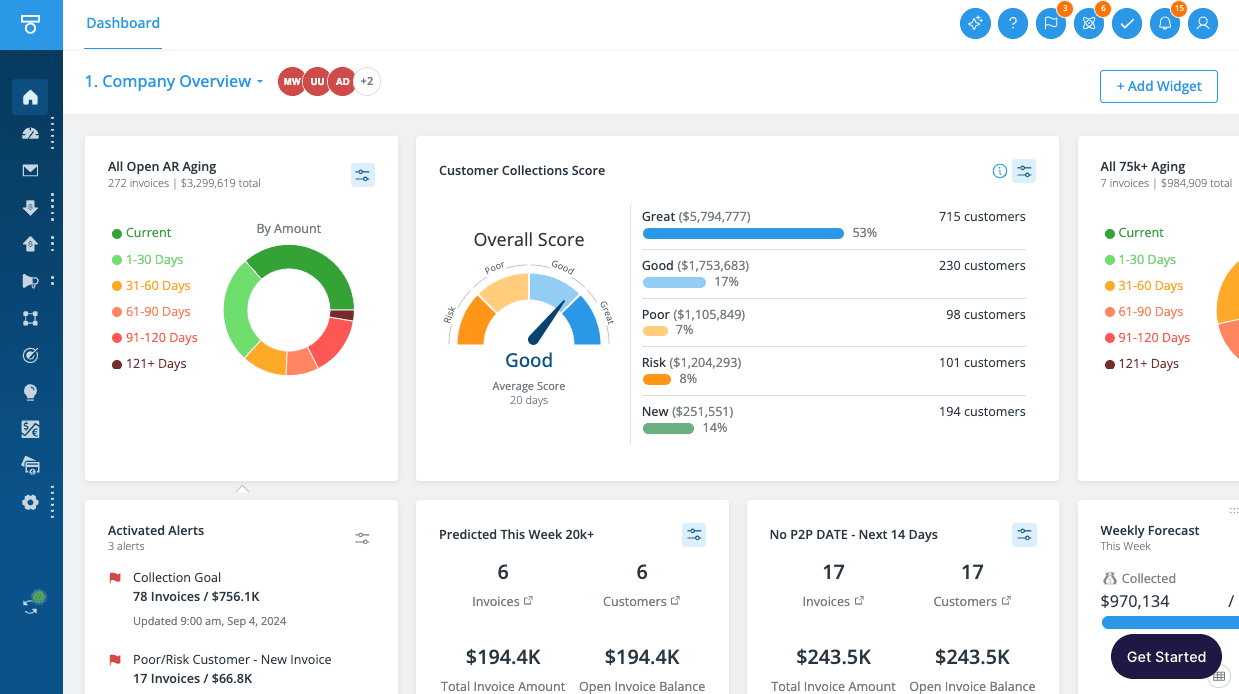

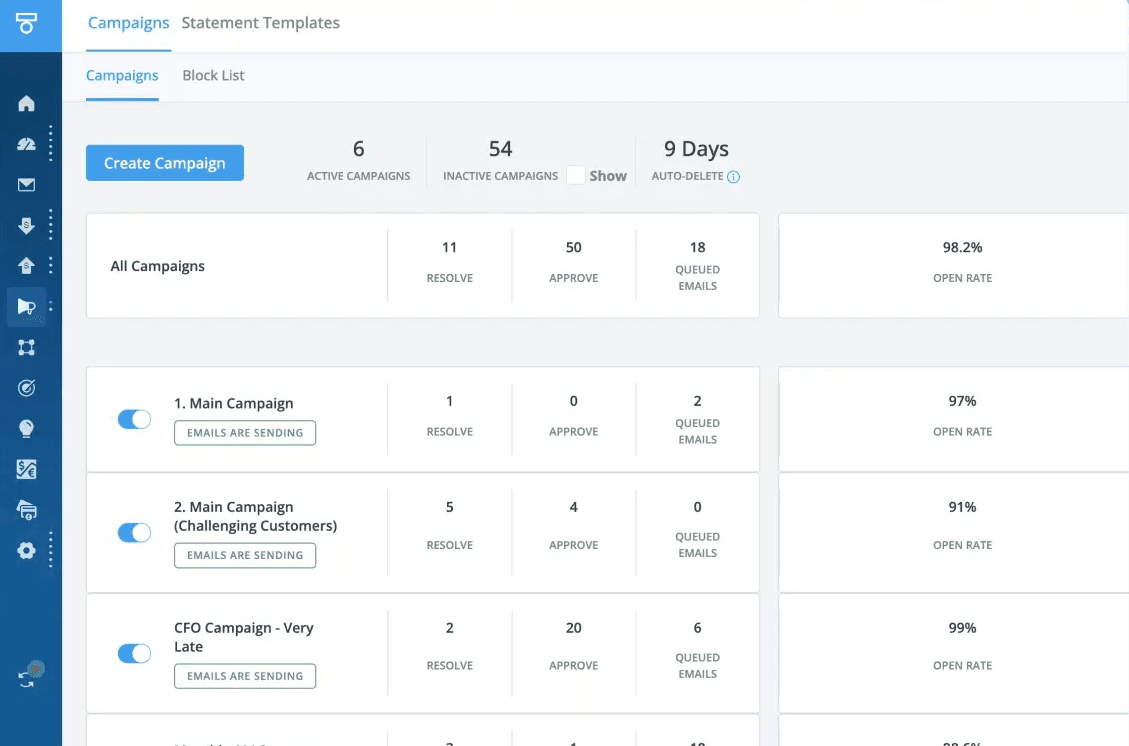

- Monitor campaign success rates and iterate using dashboard metrics.

Pro Tip: Automated workflows free your team from chasing emails, and give them back time to focus on high-value strategy and exceptions.

Step 5: Scale with Confidence Across the Customer Base

As you grow, manual collections don’t scale. With Tesorio, email campaigns can be duplicated, adjusted, and applied across new business units, geos, or teams.

Best Practices:

- Clone successful campaigns and customize for new segments.

- Use campaign performance data to test and improve message content.

- Align campaign structure with your collections strategy and DSO goals.

Pro Tip: Teams using Tesorio automate up to 70% of collections emails, without sacrificing tone, timing, or control.

Why It Works: Trusted by Leading Finance Teams

Tesorio is a consistent leader in AR automation and collections performance. Our customers reduce DSO by up to 33 days, save hundreds of hours per quarter, and align collections with customer success.

See how top-performing teams use automated campaigns to:

- Shorten payment cycles

- Improve collections team productivity

- Maintain strong customer communication at scale

Try the Collections ROI Calculator

Want to see how much time and cash flow your team could recover with automated collections campaigns?

Use our interactive ROI calculator to estimate the impact of:

- Instant Follow-Ups: Send automated emails based on invoice triggers

- Tailored Communications: Deliver targeted messaging to each customer

- Targeted Segmentation: Prioritize follow-ups based on risk, tags, or account type

- Automated Workflows: Reduce manual effort and improve consistency

FAQs

How do automated collections campaigns reduce DSO?

By triggering reminders at the right time, sending personalized messages, and following up without delay, automated campaigns accelerate payment without requiring manual effort.

Can we customize email templates by customer type?

Yes. Tesorio allows for full customization of tone, sender, messaging, and sequence by segment.

How are campaigns triggered?

You can trigger emails based on invoice age, due date, tags, risk score, or other customer-specific fields.

Can we track the performance of each campaign?

Yes. You’ll see open rates, success rates, and resolution timelines directly in your campaign dashboard.

Is this secure and compliant?

Absolutely. Tesorio complies with SOC 2 and integrates with SSO (Okta, Azure, OneLogin) to ensure secure access.

The best-performing AR teams aren’t just sending reminders, they’re scaling precision, segmentation, and speed through automation. Whether you're dealing with a growing customer base or aging receivables, Tesorio helps streamline every step of the collections process.

Throughout this guide, you’ve seen how automated email campaigns can help your team:

- Trigger perfectly timed follow-ups

- Communicate more effectively with every customer type

- Segment intelligently based on risk and behavior

- Scale outreach without scaling headcount

Teams using Tesorio report reducing DSO by up to 33 days and reclaiming hundreds of hours previously lost to manual workflows. If you're ready to move beyond spreadsheets and inconsistent follow-ups, now is the time to modernize your collections engine.

Want to see how your team can automate collections without sacrificing control or customer experience? Book a Demo and experience the platform first-hand.