How to Build, Customize, and Automate Your Finance Processes—Without IT

Manual finance processes cost time, create errors, and limit how fast finance teams can move. But traditional automation tools often require IT support or technical expertise, making them out of reach for most AR teams. That’s where Tesorio Workflows changes the game: a no-code platform that lets finance teams build and run powerful automations—without writing a single line of code.

In this article, we’ll walk through five steps to help finance professionals build, customize, and automate collections workflows without depending on IT—and show how this shift creates real-time visibility, improves cash flow, and frees up teams for strategic work.

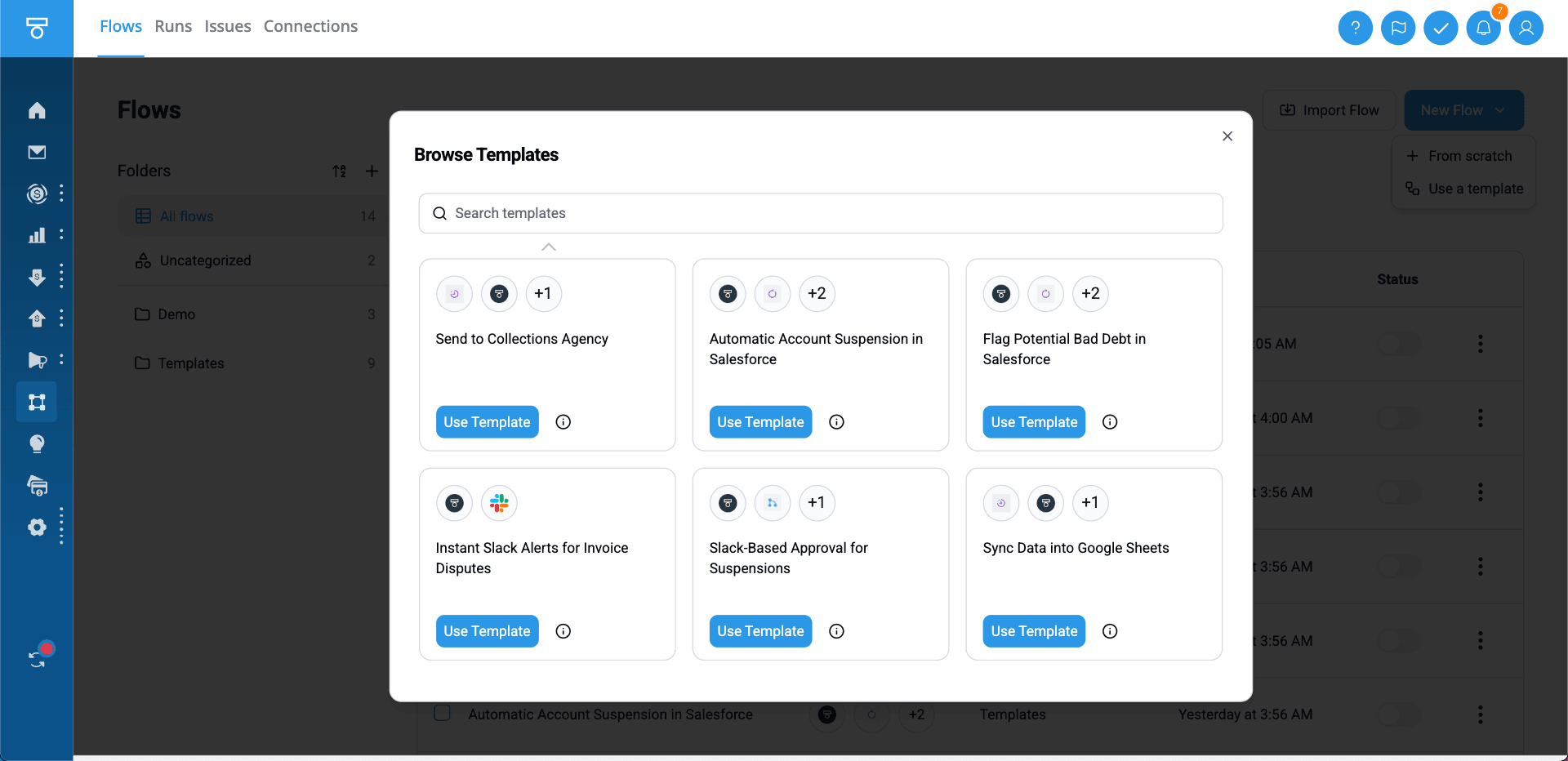

Step 1: Start Fast with No-Code Templates

Forget the blank canvas. Tesorio Workflows includes ready-to-use templates that help finance teams launch automations in minutes.

Best Practices:

- Select templates designed for AR tasks like collections, invoice assignments, and reminders.

- Use the visual builder to set rules, triggers, and actions—no code or IT required.

- Assign owners and deadlines to ensure follow-through and accountability.

Pro Tip: Teams using templates go live 3x faster than teams building from scratch—and often launch their first workflow on Day 1.

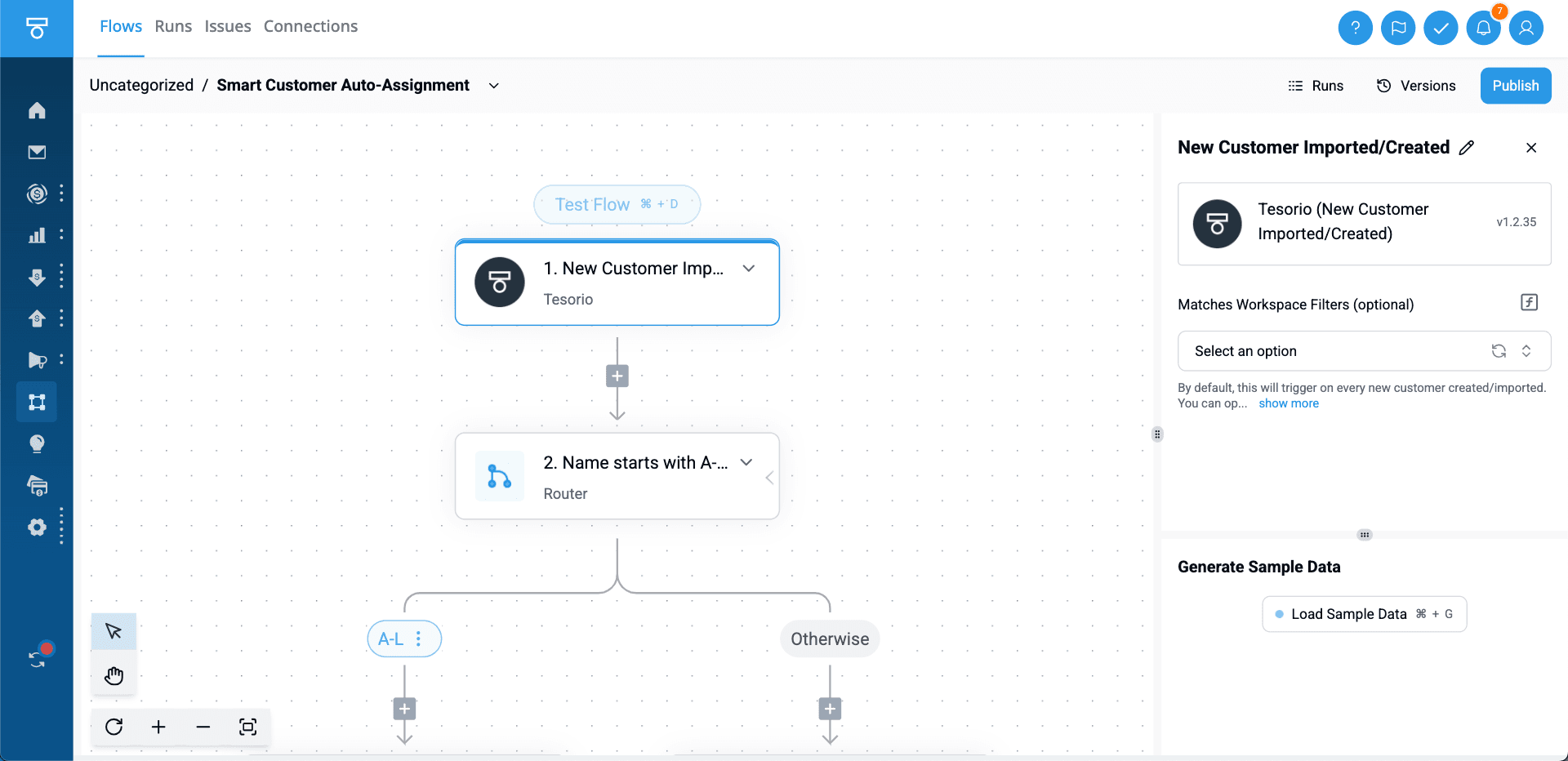

Step 2: Customize Workflows to Match How Your Team Works

Every finance team is different. Tesorio lets you tailor each automation to your existing collections strategy, from segmentation to follow-up cadence.

Best Practices:

- Define triggers based on invoice aging, account size, or customer risk score.

- Route tasks to specific team members based on territory or ownership.

- Layer in follow-up logic based on customer history or payment status.

Pro Tip: Custom workflows give finance teams full control—eliminating spreadsheets and reducing process gaps.

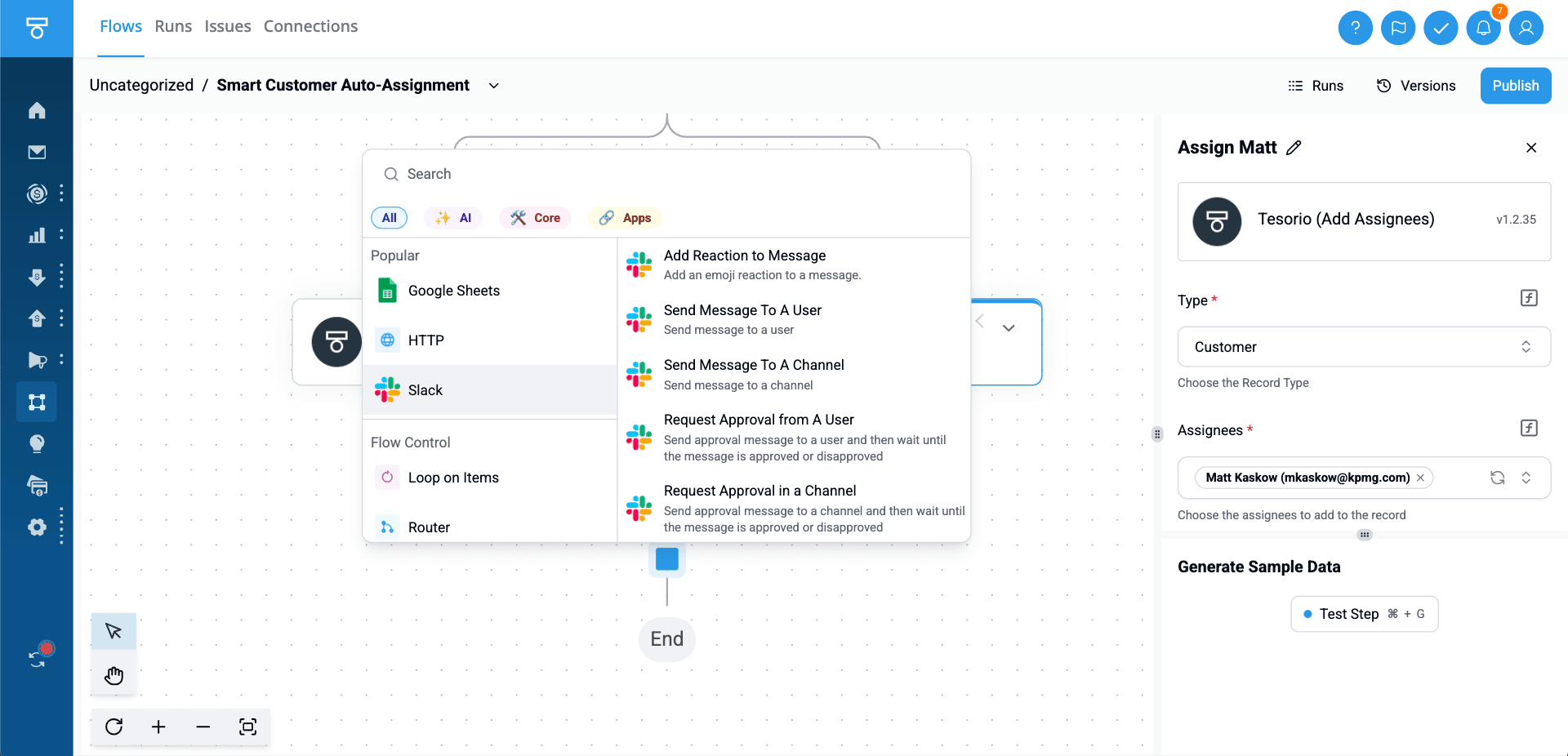

Step 3: Automate Real-Time Actions Across Tools

Most tools just sync data. Tesorio takes action. That means your workflows can create notes, assign tasks, or trigger escalations—automatically and in real time.

Best Practices:

- Integrate with Slack or email to notify teams instantly when action is needed.

- Trigger updates in your ERP or CRM based on payment behavior.

- Automate internal collaboration, like flagging high-risk accounts or sending reminders.

Pro Tip: Customers using real-time workflows reduce manual task management by up to 70%, saving hours each week.

Step 4: Connect ERP, CRM & AI for Smarter Decisions

Tesorio doesn’t just connect systems—it lets your data drive your collections strategy. Workflows can pull signals from your ERP, CRM, and AI models to automate smarter, faster.

Best Practices:

- Use ERP data to trigger invoice reminders based on status and payment terms.

- Pull CRM ownership data to assign follow-ups automatically.

- Integrate with AI risk models to prioritize outreach by likelihood of payment.

Pro Tip: Finance teams using integrated workflows see DSO drop by 20–30% thanks to better timing, visibility, and prioritization.

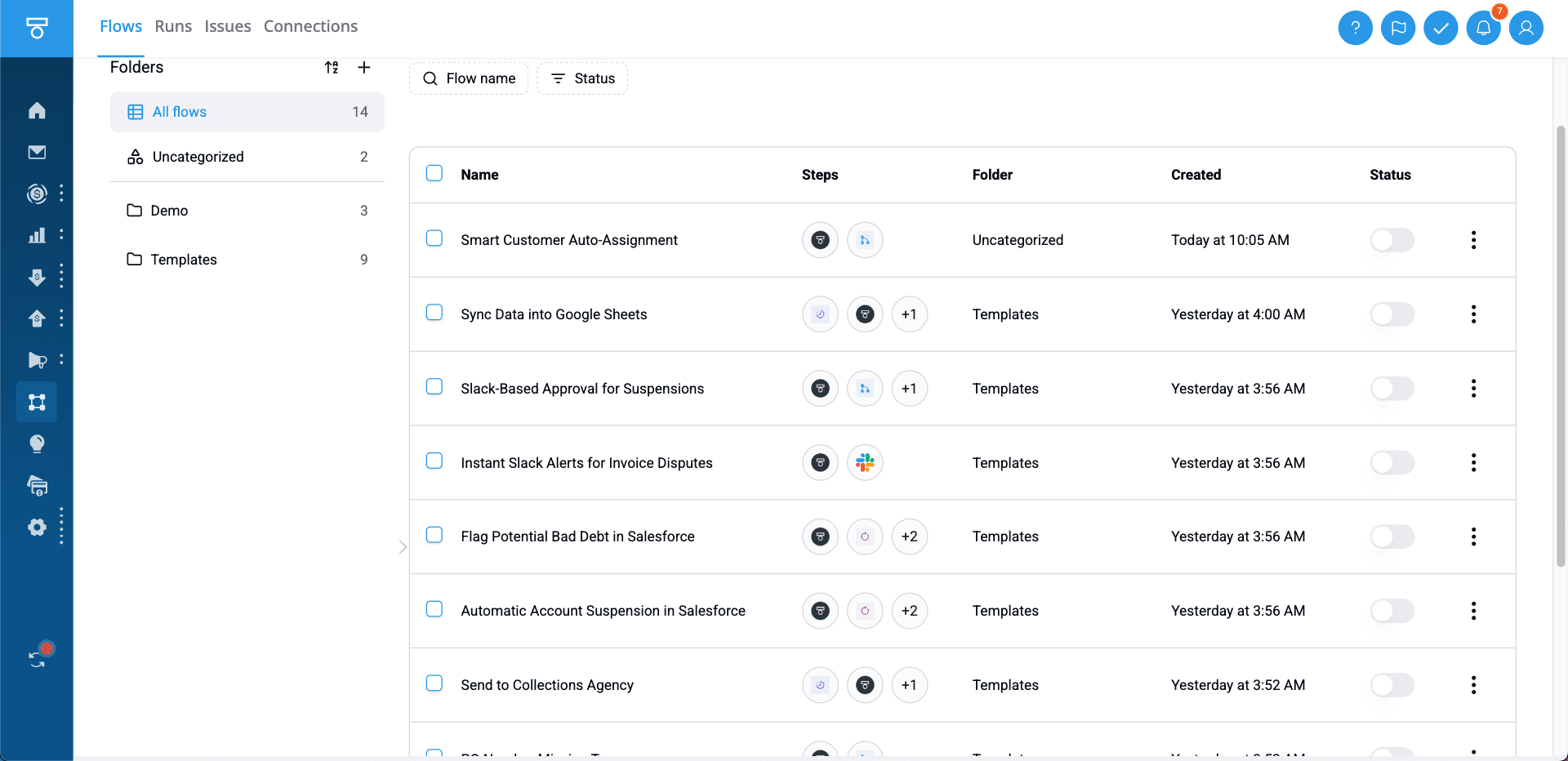

Step 5: Scale What Works with Workflow Templates

Great workflows shouldn’t stay siloed. With the upcoming Tesorio Workflows Gallery, finance teams can share, adapt, and scale best practices across teams and regions.

Best Practices:

- Use pre-built workflows from other teams or industries as a starting point.

- Customize shared workflows to match your collections strategy.

- Standardize processes across business units to drive consistency and control.

Pro Tip: Sharing workflows cuts onboarding time in half and helps teams scale automation without reinventing the wheel.

Get Started—Without IT

Automation doesn’t have to be technical. With Tesorio Workflows, finance teams can finally automate the way they work—without waiting on developers, tickets, or consultants. Build fast. Customize deeply. Iterate on your own.

Ready to build finance workflows without IT? Book a demo today and take the first step toward smarter, scalable finance operations.

▽ FAQs

What is Tesorio Workflows?

Tesorio Workflows is a no-code automation platform built for finance teams to automate AR and collections processes—without IT involvement or technical skills.

Can I automate finance tasks without knowing how to code?

Yes. Tesorio is designed with pre-built templates and a visual builder so you can launch automations in minutes, without writing a single line of code.

What kinds of finance workflows can I automate?

You can automate collections, invoice follow-ups, task assignments, payment reminders, risk escalations, and much more.

Does Tesorio Workflows integrate with my ERP or CRM?

Absolutely. Tesorio connects with ERP and CRM platforms to sync and act on data in real time—so your workflows run exactly when they need to.

How do real-time workflows reduce manual work?

By triggering task assignments, reminders, or invoice updates instantly based on payment behavior or account status, Tesorio eliminates the need for repetitive admin tasks.

Can using Tesorio Workflows really help reduce DSO?

Yes. Companies using Tesorio’s connected workflows report a 20–30% drop in DSO by reaching the right customers at the right time.

How does the Workflows Gallery help my team?

The Workflows Gallery (coming soon) will give you access to shared templates from other finance teams. You’ll be able to adopt and adapt proven automations quickly.

How fast can we go live with a Tesorio workflow?

Most teams launch their first workflow in under a day using templates. No developers or IT tickets required.

What industries benefit most from Tesorio Workflows?

SaaS, professional services, manufacturing, and logistics companies with large AR teams or complex invoicing cycles see the most immediate ROI.