How to Forecast Cash Flow in Real-Time: A Step-by-Step Guide for Finance Teams

Introduction: Why Real-Time Cash Flow Forecasting Matters

In today’s volatile market, cash is more than king—it’s the lifeblood of operational stability. Yet, most finance teams still rely on outdated spreadsheets, disconnected systems, and manual processes to manage cash flow. The result? Missed targets, late decisions, and a constant scramble for visibility.

Enter Tesorio.

Tesorio’s real-time cash flow platform replaces guesswork with precision. By automating collections, analyzing payment behavior, and consolidating data into dynamic dashboards, Tesorio empowers finance teams to move from reactive to proactive.

In this guide, you'll learn how to:

Aggregate real-time financial data

Leverage AI to improve forecast accuracy

Automate collection processes

Use predictive analytics for better decisions

Build customizable dashboards for visibility

Let’s dive in.

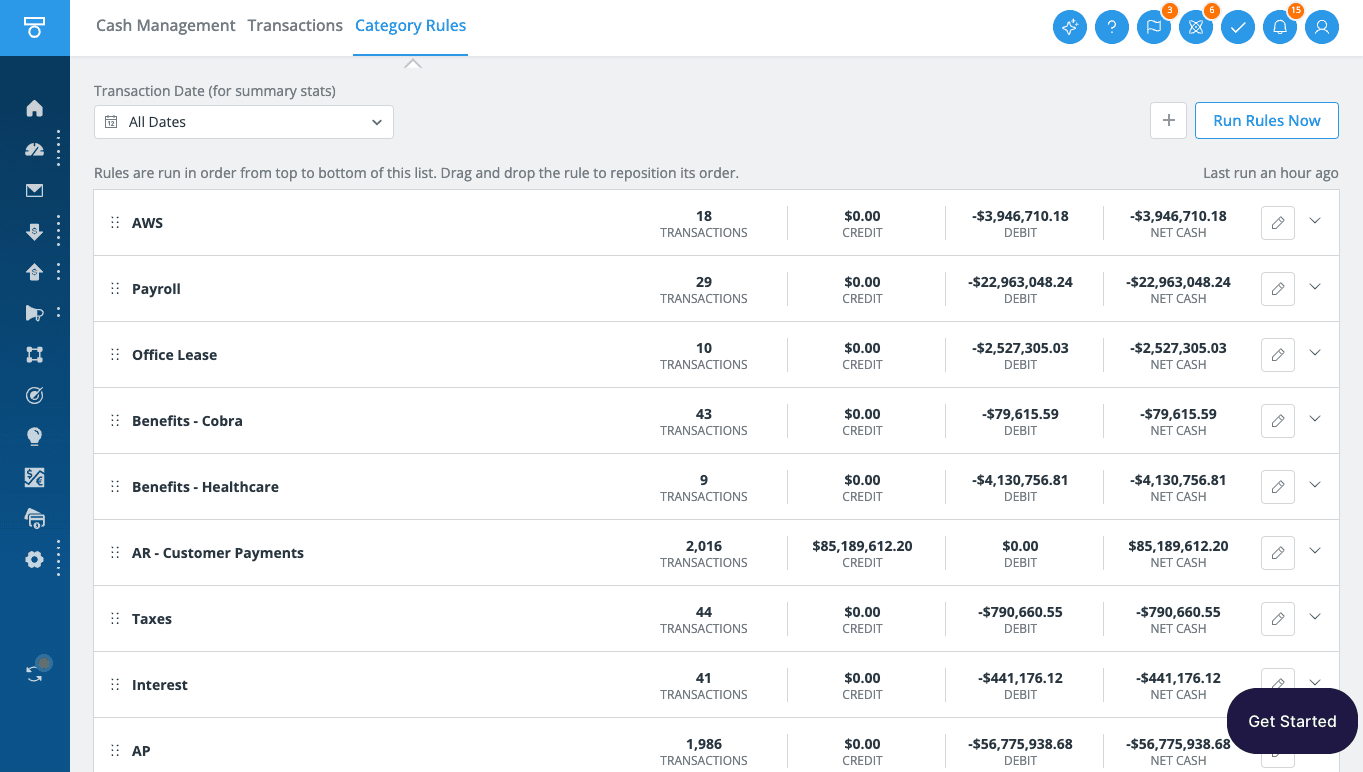

Step 1: Aggregate Real-Time Data Across Finance Operations

The foundation of accurate forecasting is unified, real-time data. Siloed systems and delayed reporting create blind spots that compromise decision-making. By centralizing AR, AP, contract, and bank data, finance teams get a live snapshot of their cash position.

Best Practices:

Connect ERP, CRM, and banking systems via APIs

Standardize data inputs across departments

Validate historical cash flow trends with real-time overlays

Sync invoice and payment data automatically

Pro Tip: Companies that centralize cash data see up to 40% faster forecast generation compared to manual methods.

Step 2: Automate Collections to Accelerate Inflows

Delayed receivables can derail even the most accurate forecast. Automating collections with intelligent workflows ensures consistent follow-ups and faster payments.

Best Practices:

Set trigger-based reminder workflows for upcoming and overdue invoices

Segment customers by payment behavior to customize outreach

Include embedded payment links in follow-ups

Track email engagement and payment intent signals

Pro Tip: Tesorio users reduce Days Sales Outstanding (DSO) by an average of 12 days within the first quarter.

Step 3: Use Predictive Analytics to Spot Trends and Risks

Traditional forecasting reacts to the past. Predictive analytics let you anticipate the future. Tesorio’s AI models detect customer payment patterns and potential delays, helping you course-correct before issues arise.

Best Practices:

Train forecasting models using historical and behavioral data

Set alerts for high-risk accounts based on prior delays

Include external factors (e.g., seasonality or economic indicators)

Use what-if scenarios to simulate cash impact

Pro Tip: Early intervention based on predictive signals can improve forecast accuracy by up to 35%.

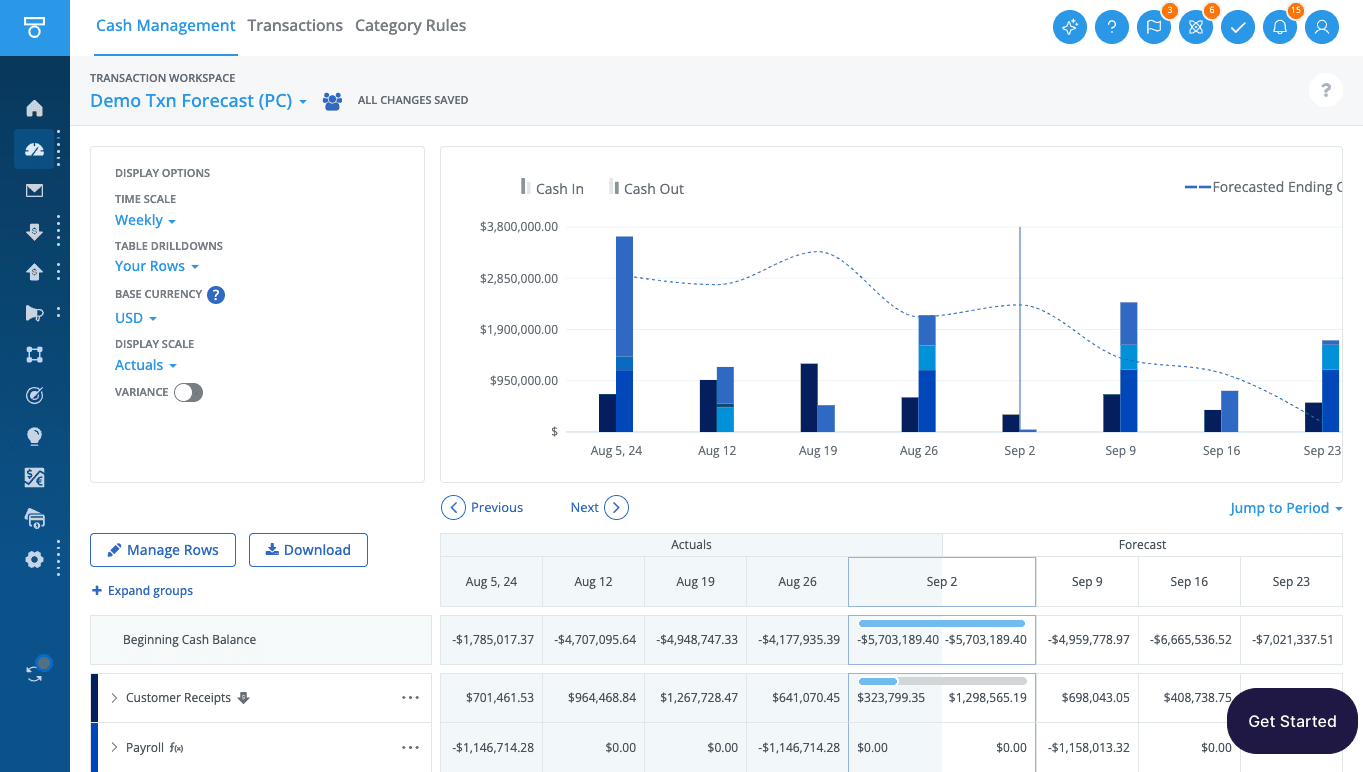

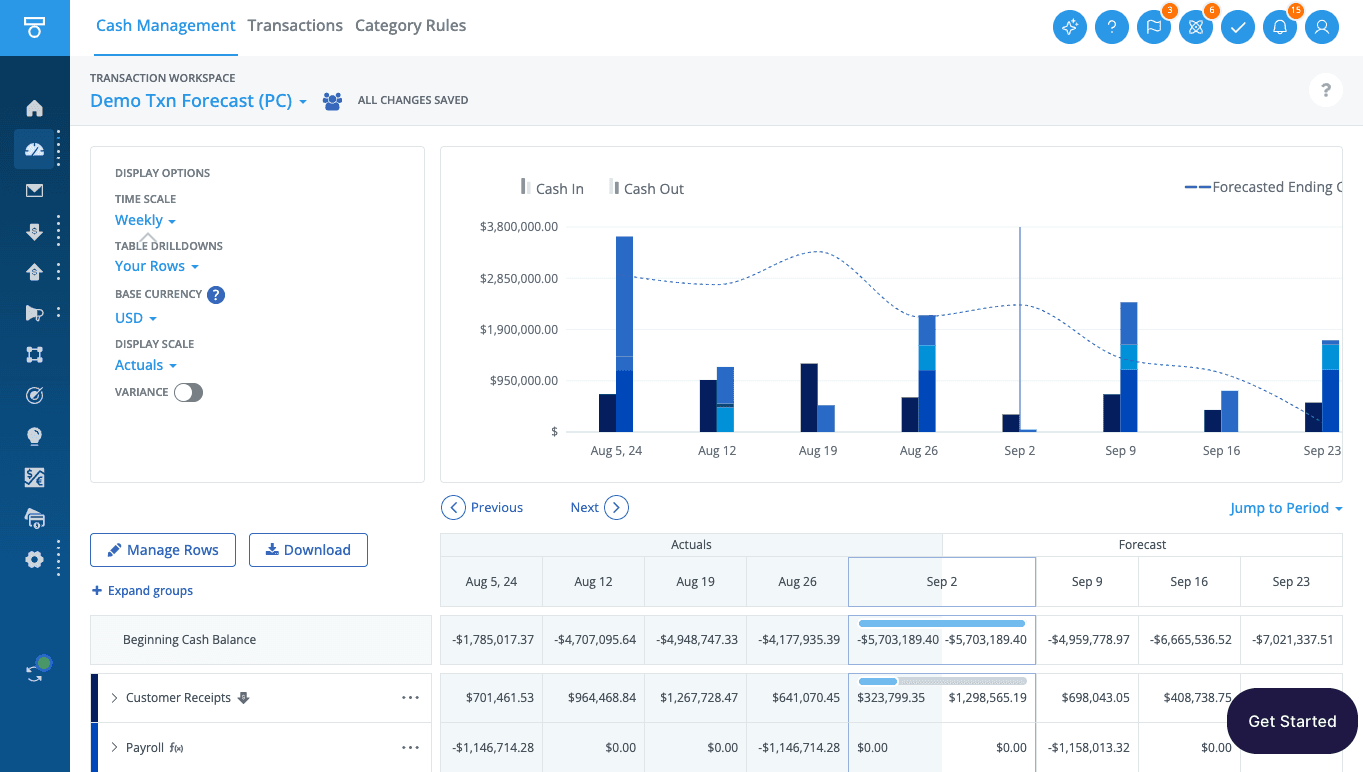

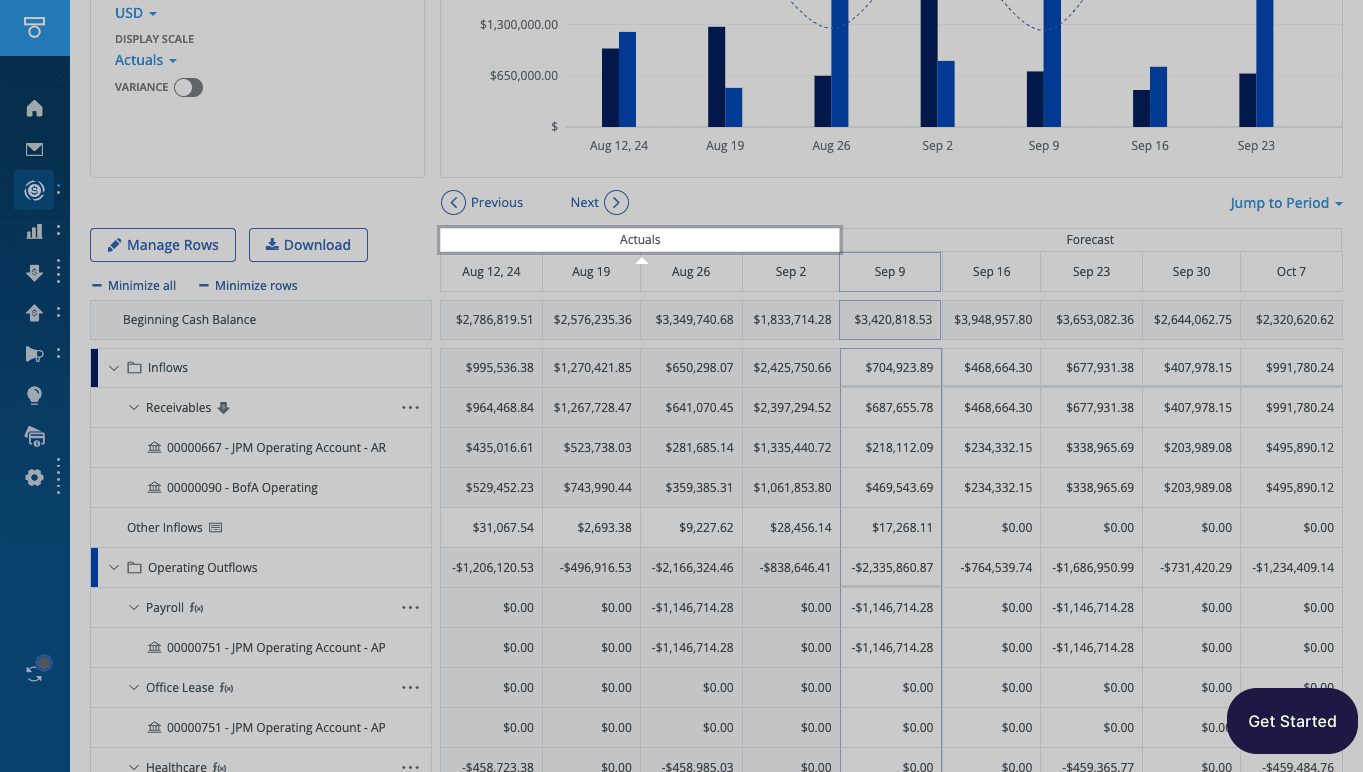

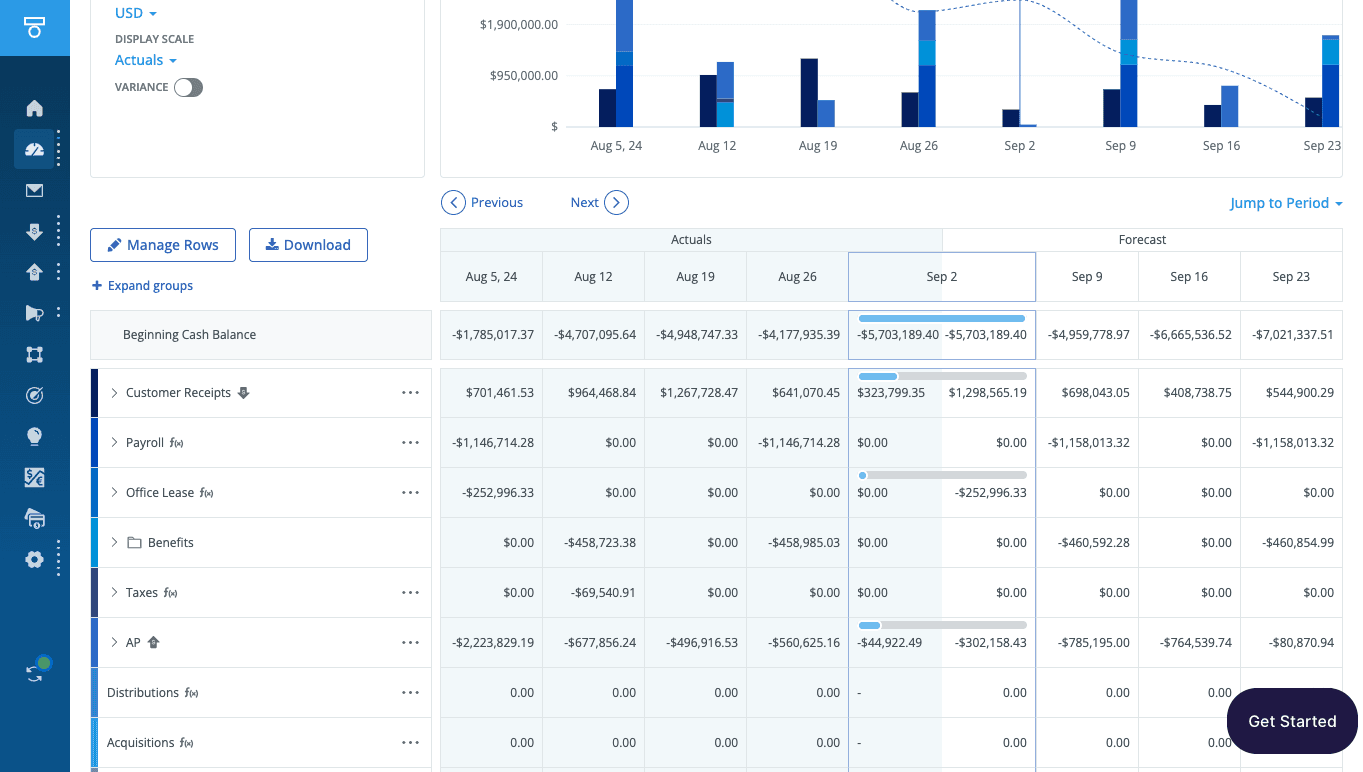

Step 4: Build Customizable Dashboards for Stakeholder Visibility

One-size-fits-all reports rarely serve the needs of diverse finance stakeholders. Tesorio’s dashboards allow CFOs, controllers, and analysts to view the metrics that matter most—when and how they need them.

Best Practices:

Customize dashboard views per stakeholder (CFO vs AR team)

Embed cash flow KPIs in weekly business reviews

Add real-time visualizations for at-a-glance clarity

Enable drill-downs into variances and drivers

Pro Tip: Teams that operationalize real-time dashboards improve internal alignment and reduce cash flow surprises by 50%.

Step 5: Continuously Refine Your Forecasting Models

Forecasting is never one-and-done. Leading finance teams treat forecasting as an iterative process—constantly testing assumptions, refining inputs, and learning from variances.

Best Practices:

Run monthly forecast accuracy reviews

Create a variance dashboard that auto-updates

Involve cross-functional teams to validate assumptions

Set up alerts for significant deviations

Pro Tip: Forecasting becomes a strategic asset when it’s 80–90% accurate 13 weeks out—a benchmark achieved by top-performing Tesorio clients.

Build a Smarter, Faster Finance Function with Real-Time Forecasting

Real-time cash flow forecasting transforms finance from a reactive cost center into a proactive growth enabler. With Tesorio, you get the tools to automate collections, predict outcomes, and make informed decisions that drive results.

👉 Ready to forecast cash flow in real time? Book a demo with Tesorio today.

FAQs

What is real-time cash flow forecasting?

It’s the process of continuously updating your cash position using live data from financial systems. It enables faster, more accurate decision-making.

How does Tesorio help forecast cash flow in real time?

Tesorio integrates with your ERP and other systems to consolidate data, apply predictive models, and surface insights via dashboards and alerts.

Can I automate collections with Tesorio?

Yes. You can create intelligent workflows that send follow-ups, track engagement, and adjust based on customer behavior.

What KPIs should I track in my cash flow dashboard?

Focus on cash runway, net cash flow, AR aging, collections rate, and DSO—customized per stakeholder role.

How accurate are predictive analytics for finance?

With proper data and training, AI-driven forecasts can improve accuracy by 30–50% over manual methods.

How often should I update my cash forecast?

Ideally, in real time. At minimum, weekly updates with monthly variance reviews can keep you on track.

Does this work for companies with multiple entities?

Absolutely. Tesorio supports multi-entity consolidations and can segment forecasts by region, currency, or business line.

Is this solution scalable as we grow?

Yes. Tesorio is built for growth-stage to enterprise companies and scales seamlessly with your finance tech stack.