How to Speed Up the Cash Application Process with Tesorio

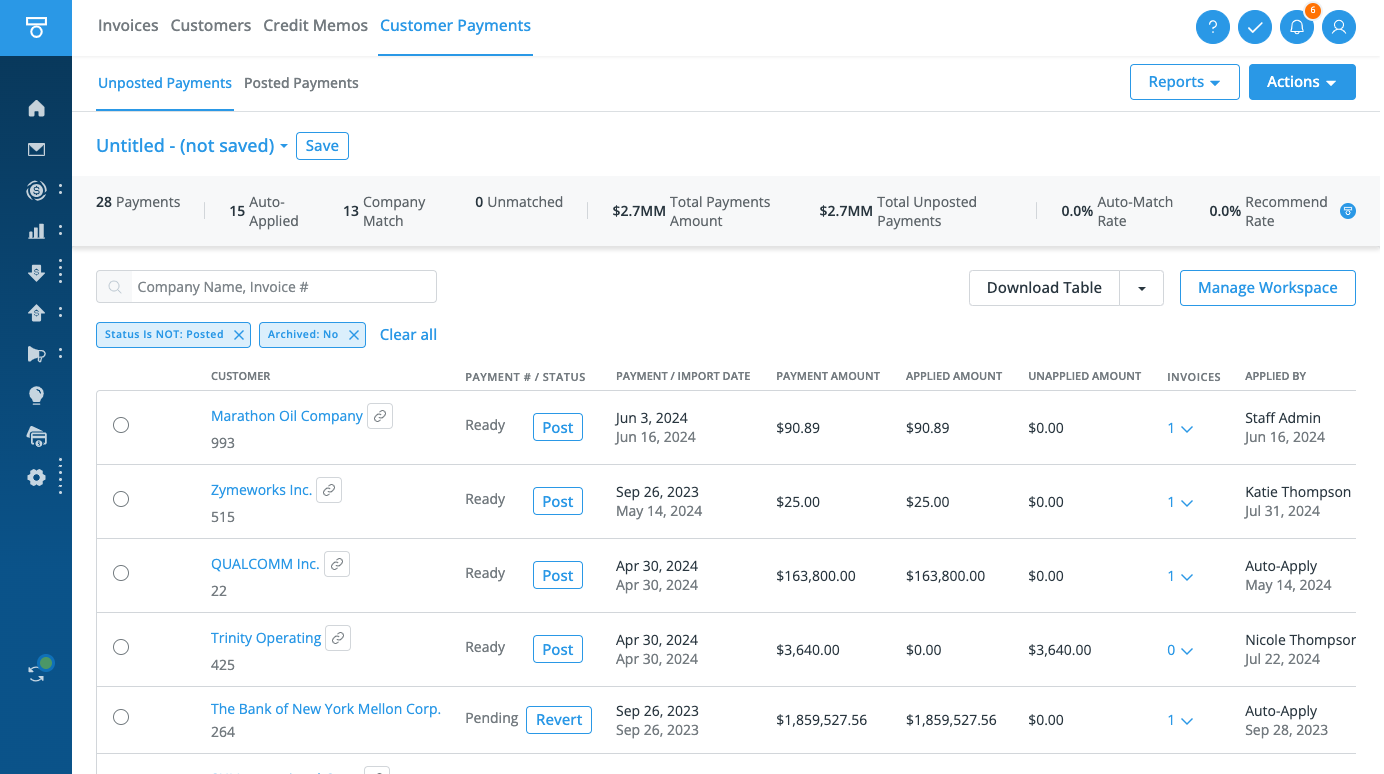

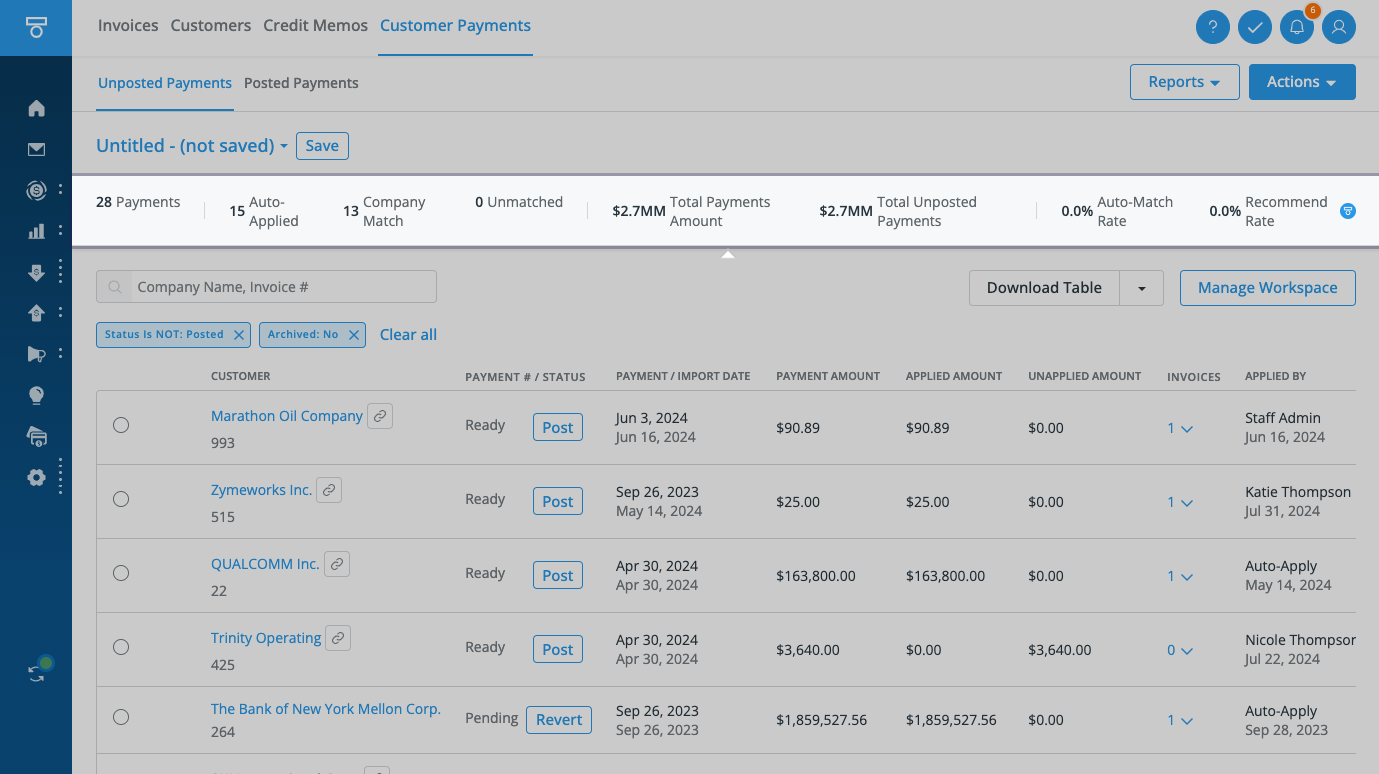

Cash application is a critical step in accounts receivable management—but when done manually, it slows everything down. Errors creep in, payments get delayed, and teams waste time on low-value tasks. Companies that automate payment matching reduce reconciliation time by up to 80%, accelerating cash flow and cutting DSO.

Tesorio’s automated cash application tools take the manual work out of the equation. With real-time bank imports, seamless auto-posting, smart matching recommendations, and fully integrated updates, your team can move faster, stay accurate, and improve visibility across the board.

In this guide, we’ll walk through five proven steps to speed up cash application and optimize your collections workflow.

1. Enable Real-Time Bank Imports for Instant Payment Data

Waiting for batch uploads or manual bank file imports causes delays in reconciliation. Real-time transaction data ensures immediate visibility into incoming payments, reducing processing time.

Best Practices:

- Direct bank connections provide real-time data for faster reconciliation.

- BAI file support ensures compatibility for seamless payment tracking.

- Automated bank imports eliminate the need for manual file uploads.

Pro Tip: Companies integrating real-time bank imports reduce cash application time by 50%, leading to improved cash flow forecasting and fewer reconciliation discrepancies.

2. Automate Payment Matching & Reduce Manual Reconciliation

Manual matching of incoming payments with invoices is time-intensive and prone to errors. Tesorio’s AI-driven payment matching automates the process, ensuring fast and accurate allocation.

Best Practices:

- Leverage AI-powered payment recognition to match payments with invoices instantly.

- Set up auto-matching rules based on payment reference details.

- Minimize manual intervention by automating exception handling.

Pro Tip: Finance teams that automate payment matching reduce reconciliation efforts by 70%, freeing up resources to focus on high-value financial activities.

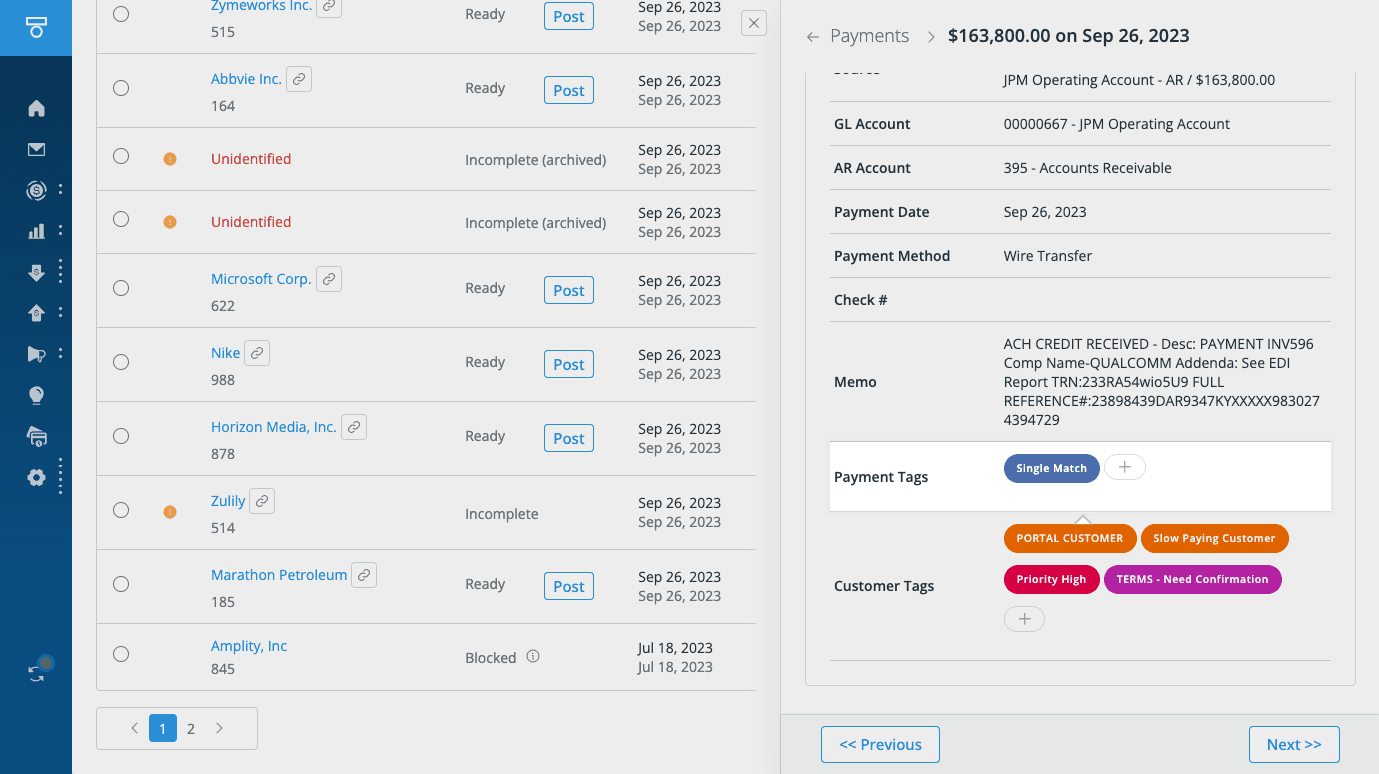

3. Enable Seamless Auto-Posting to Your ERP

Disconnected systems create inefficiencies in financial reporting. Automating the posting of payments directly into your ERP ensures accuracy and eliminates duplicate data entry.

Best Practices:

- Integrate with your ERP to maintain it as the system of record.

- Enable auto-posting for all incoming payments to avoid delays.

- Reduce dependency on manual validation with real-time updates.

Pro Tip: Businesses using automated ERP posting cut their reconciliation time by 80%, improving financial accuracy and reducing operational workload.

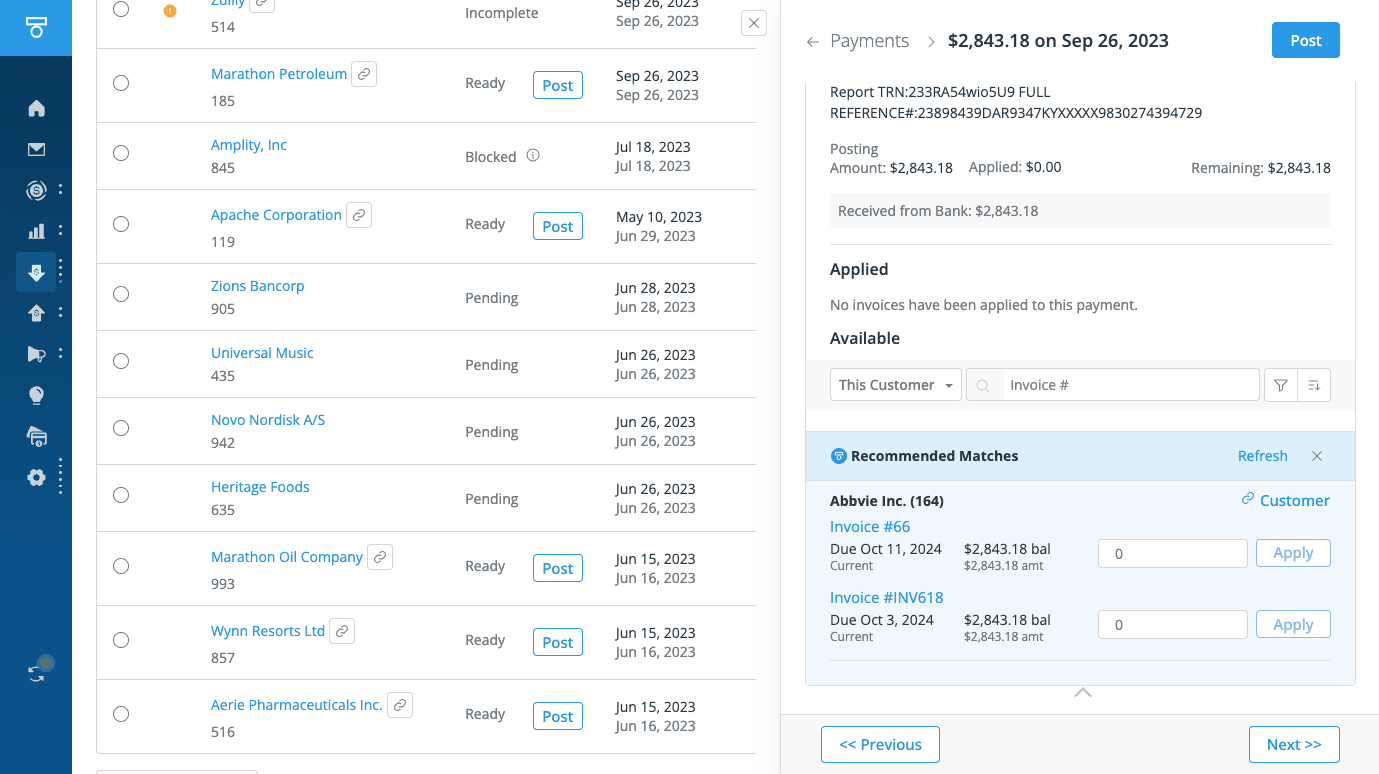

4. Leverage Smart Recommendations to Ensure Accuracy

Mismatched payments and invoice errors slow down cash application. AI-driven recommendations analyze transaction patterns and suggest the most accurate match.

Best Practices:

- Use AI-powered suggestions to match payments to customers in real time.

- Reduce errors by relying on machine learning-based recommendations.

- Ensure consistent accuracy with automated exception handling workflows.

Pro Tip: Companies using smart recommendations experience 30% fewer misapplied payments, reducing delays and customer disputes.

5. Maintain Complete Integration for Real-Time Reporting

A disconnected reconciliation process leads to miscommunication and inaccurate reporting. Tesorio’s integrated cash application updates your collections and cash forecasts instantly, ensuring data consistency.

Best Practices:

- Ensure all reconciliation data updates in real-time within Tesorio.

- Improve forecasting accuracy by integrating collections insights with cash application results.

- Eliminate miscommunication between AR and treasury teams with a unified platform.

Pro Tip: Companies that maintain fully integrated reconciliation workflows experience 20% faster month-end closing, improving financial visibility and decision-making.

Accelerate Cash Application with Tesorio

Eliminating manual reconciliation and automating payment matching isn’t just about efficiency—it’s about unlocking cash flow, reducing errors, and enabling finance teams to operate strategically. Tesorio empowers businesses to automate their cash application process, ensuring payments are matched, posted, and reported with precision.

Ready to transform your reconciliation process? Book a demo today and see how Tesorio can streamline your cash application workflow.

▽ FAQs

How does automating cash application help businesses reduce DSO?

Automating cash application ensures faster payment reconciliation, real-time bank data imports, and AI-driven invoice matching, reducing the time needed to process payments and lowering Days Sales Outstanding (DSO).

Follow-up: Can automating cash application help with forecasting?

Yes! By integrating real-time cash insights with AI-driven forecasting, finance teams gain a more accurate view of expected inflows, improving overall working capital management.

What’s the fastest way to match payments to invoices?

Using AI-powered payment matching eliminates manual reconciliation errors and speeds up the process. Tesorio automates invoice matching based on historical payment data, ensuring accuracy.

Follow-up: How does AI improve payment accuracy?

By leveraging machine learning algorithms and predictive analytics, Tesorio not only automates invoice matching but also detects inconsistencies and high-risk mismatches before they impact cash flow. This ensures that finance teams can focus on exception management instead of manual reviews.

How can real-time analytics improve cash application efficiency?

Real-time payment tracking and reporting provide instant visibility into cash inflows, helping finance teams make faster, data-driven decisions while reducing errors in forecasting.

What’s the best way to prevent mismatched payments?

Leveraging AI-driven recommendations helps detect anomalies in payments and suggests accurate invoice matches. Companies using automated recommendations reduce misapplied payments by 30%.

How do I integrate cash application automation with my ERP system?

Tesorio’s seamless ERP integration allows payments to be automatically posted, ensuring that your ERP remains the single source of truth without manual intervention.