How to Unlock Faster Collections with Smart AR Automation

Cash flow is the lifeblood of every growing business, but it doesn’t move unless collections do. Yet, most finance teams still rely on spreadsheets, manual email follow-ups, and siloed data—slowing down collections and dragging out DSO.

Tesorio’s Smart AR Automation changes that. It turns your AR function into a strategic engine of cash acceleration. In this article, we break down how to put your collections process on autopilot in five steps—using proven automation tactics, real customer outcomes, and Tesorio’s connected platform.

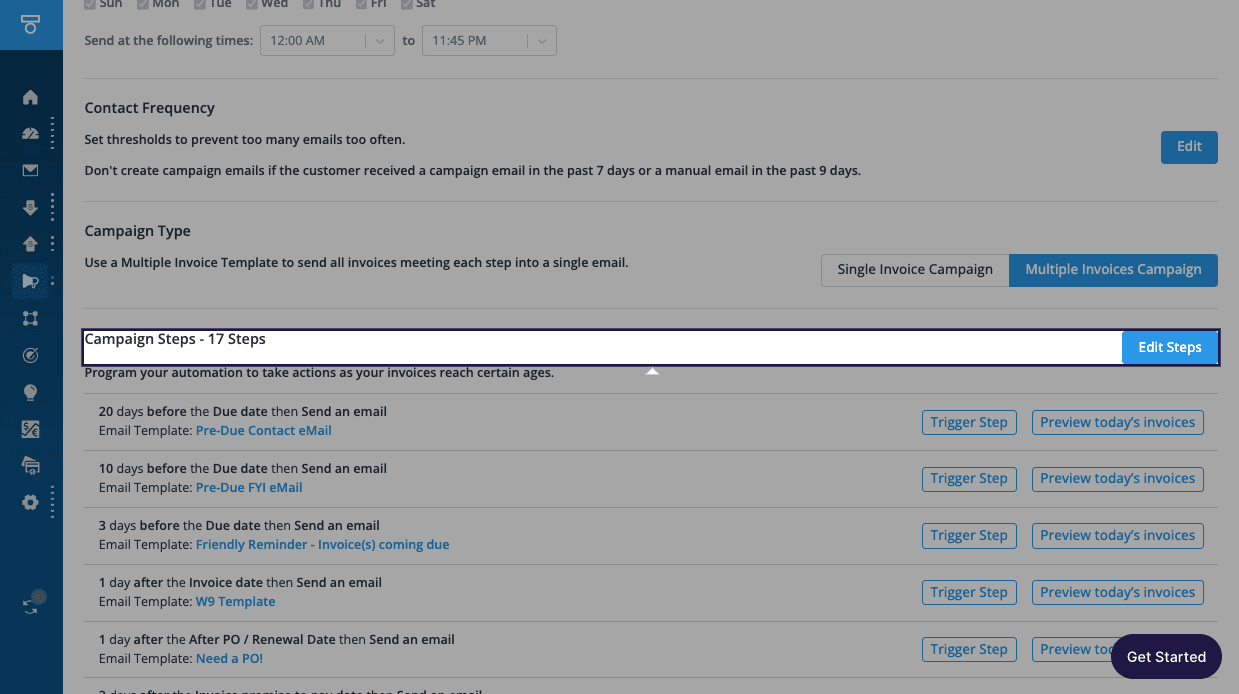

Step 1: Create Smart Collections Campaigns

Tailored campaigns replace one-size-fits-all emails. Tesorio enables you to set up segmented, automated dunning workflows that trigger based on invoice age, risk level, or customer type.

Best Practices:

- Build campaign templates by persona (e.g., SMB vs. Enterprise).

- Use AI recommendations to personalize language and subject lines.

- Schedule email send windows based on customer time zones.

Pro Tip: Tesorio customers using smart segmentation reduce overdue invoices by up to 50% in the first 90 days.

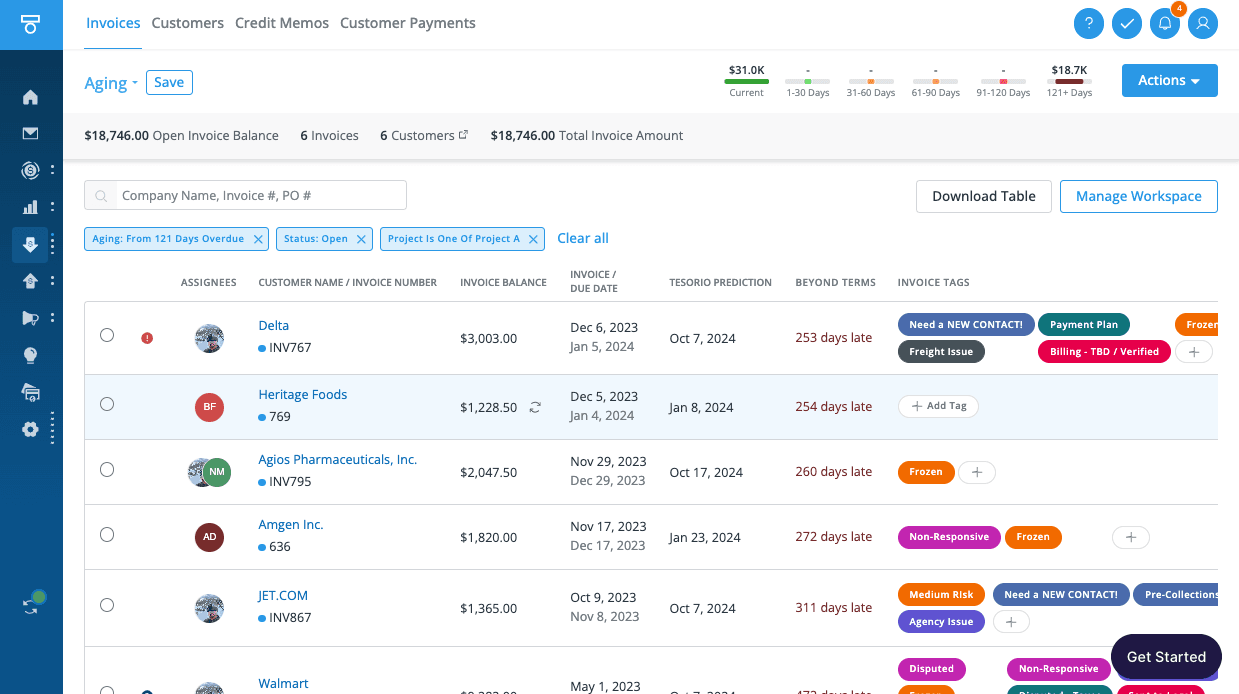

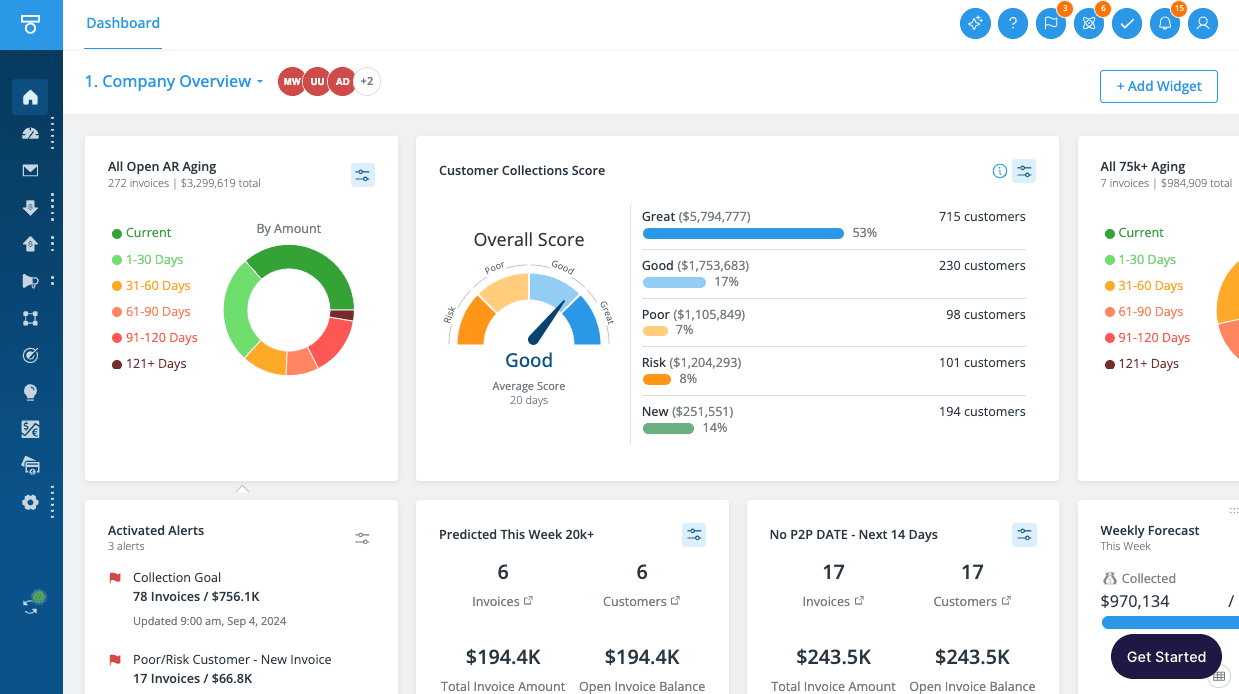

Step 2: Track Cash Flow in Real-Time Dashboards

Knowing who owes you and when they’ll pay shouldn’t require a spreadsheet. Tesorio gives you real-time dashboards that display payment behavior, invoice aging, and campaign performance at a glance.

Best Practices:

- Use customizable widgets to monitor collections by collector, aging bucket, or region.

- Track campaign performance to adjust strategies on the fly.

- Flag high-risk accounts with predictive analytics.

Pro Tip: Companies leveraging real-time visibility improve forecasting accuracy and reduce DSO by an average of 33 days.

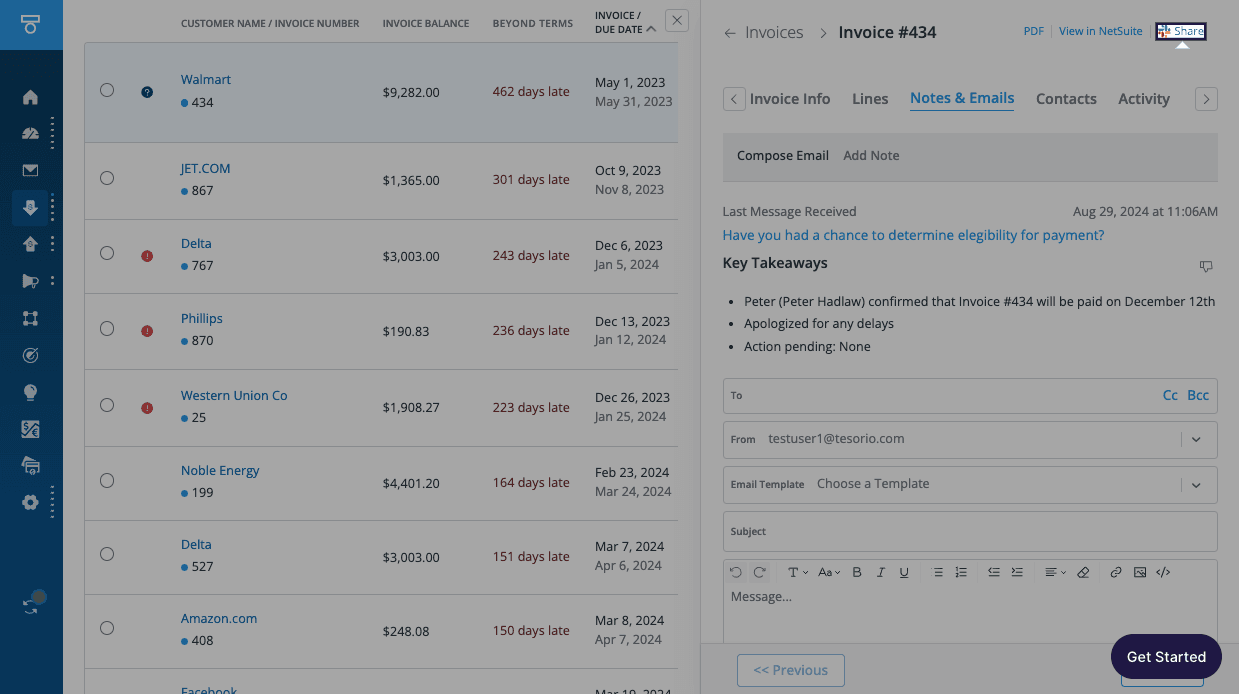

Step 3: Enable Secure Online Payments

Friction kills collections. Tesorio’s built-in Payment Portal lets customers view invoices, pay online, set up autopay, and log payment promises—all in one place.

Best Practices:

- Offer flexible options: credit card, ACH, and wire.

- Enable one-click payments directly from reminder emails.

- Let customers dispute or inquire from within the portal.

Pro Tip: Businesses that implement self-service payments see 25% faster invoice resolution and a better customer experience.

Step 4: Accelerate Cash Application

Applying payments shouldn’t take hours. Tesorio’s Cash Application module auto-matches incoming payments with open invoices, reconciling them in minutes.

Best Practices:

- Integrate with bank feeds to auto-ingest payment data.

- Use smart matching rules (by amount, invoice number, payer).

- Review and approve with one click in the review queue.

Pro Tip: Customers using automated cash application reduce reconciliation time by 75% and keep their AR ledger up to date with less effort.

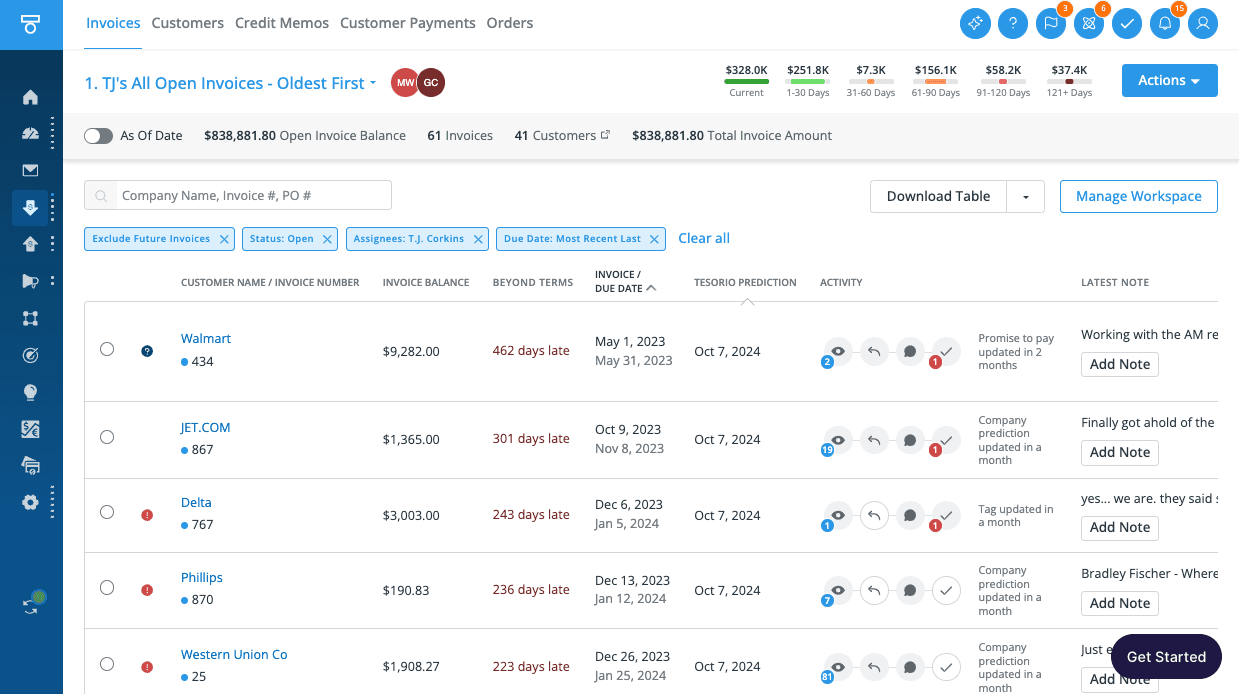

Step 5: Connect Everything for End-to-End Automation

Tesorio isn’t just a toolkit—it’s a connected platform. By bringing together campaigns, payments, application, and forecasting, finance teams finally get full control over collections.

Best Practices:

- Use AI to recommend next actions based on invoice behavior.

- Sync campaign outcomes with cash forecasting models.

- Collaborate across AR, FP&A, and Treasury in a shared workspace.

Pro Tip: Discovery Education cut their DSO by 66%—from 128 to 43 days—by integrating collections automation with forecasting.

Common Challenges in AR Automation

Even with the right tools, teams can face friction when implementing automation. Here are a few hurdles and how to overcome them:

1. Resistance to Change Finance teams used to manual workflows may hesitate to adopt automation. Start small with one campaign or workflow, then expand.

2. Data Silos If ERP, CRM, and bank data live in separate systems, automation may break. Tesorio integrates them into a single source of truth.

3. Manual Overrides Automation fails if it doesn't allow flexibility. Tesorio supports approval queues, override rules, and manual escalations as needed.

4. Visibility Gaps Without real-time insights, automation can't adapt. Dashboards and alerts ensure you can take action immediately.

Real-World Results: Discovery Education Case Study

Discovery Education, a global edtech company, implemented Tesorio to unify their collections workflows, automate follow-ups, and sync outcomes with forecasting. Within three months, they reduced DSO by 66%, dropping from 128 to 43 days. Their finance team reclaimed over 200 hours per quarter, reallocating time toward strategic planning and partner collaboration.

FAQs

What does Smart AR Automation include?

Tesorio Smart AR Automation includes campaigns, cash application, payment portal, and AI-driven insights across your receivables workflows.

Follow-up: Can I use just one part of the suite, like campaigns? Yes. Tesorio’s modular design allows teams to start with the most pressing workflow.

How does it help reduce DSO?

By automating follow-ups, removing friction in payments, and providing real-time visibility, Tesorio accelerates collections. Customers typically reduce DSO by 33 to 66 days.

Follow-up: What are typical results for mid-market companies? Many see DSO drops of 20–30% within a quarter.

Can I integrate Tesorio with my ERP and bank?

Yes. Tesorio connects with systems like NetSuite, Sage Intacct, and your banks to sync invoice and payment data.

Follow-up: Is the integration bi-directional? Yes. Changes made in either system reflect automatically, reducing sync issues.

How does AI improve collections?

AI powers smart segmentation, follow-up timing, risk alerts, and next-step recommendations—helping teams prioritize the right accounts.

Follow-up: Does the AI learn over time? Yes. It continuously adjusts based on payment behaviors and team inputs.

How quickly can we go live?

Most customers are fully up and running in just a few weeks, with dedicated onboarding and templates to speed implementation.

Follow-up: Can we customize templates during onboarding? Absolutely. Tesorio tailors workflows to your AR policies.

Want to collect cash faster—without adding headcount? Book a demo today to see how Tesorio’s Smart AR Automation can help you reduce DSO and accelerate growth.