Introducing the Cash Application Agent: AI-Powered Reconciliation That Unlocks Cash Faster

Manual cash application slows everything down—from reconciliation to reporting. The Cash Application Agent changes that.

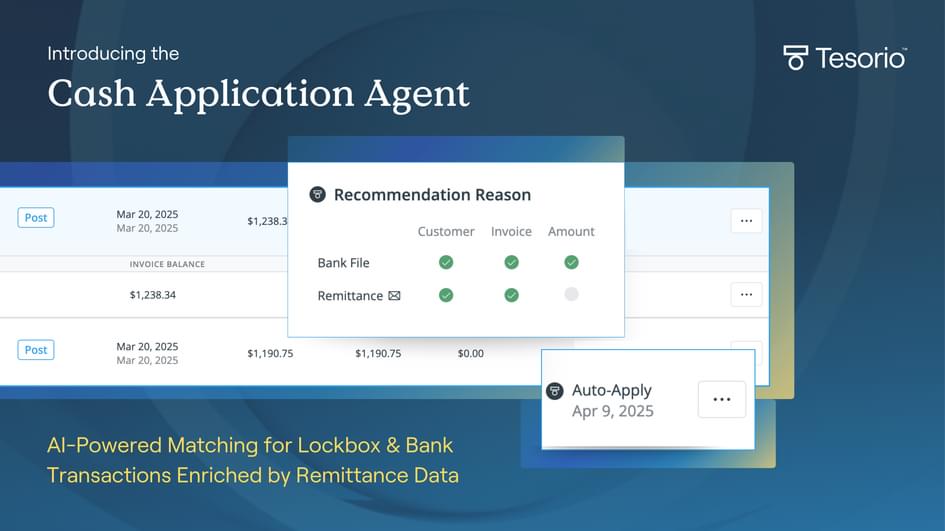

Today, we're excited to announce the launch of our Cash Application Agent, a major evolution of our Cash Application solution that transforms how finance teams handle payment reconciliation.

Why Manual Cash Application Holds Teams Back

Without automation, cash application remains one of the most costly and risk-prone parts of the finance function.

Payments sit unapplied for days, locking up cash that could be reinvested. Customers get chased for money they’ve already paid, straining relationships and damaging trust. Collectors waste valuable time on false follow-ups instead of focusing on accounts that actually need attention. And the ripple effects hit hard: reconciliation delays lead to late reporting, distorted forecasts, and potential compliance issues—especially for public companies under tight filing deadlines.

Meet the Cash Application Agent

The Cash Application Agent is built to eliminate these risks, bringing AI-powered accuracy and speed to the matching process.It gives teams the real-time visibility they need to close faster, forecast more accurately, and operate with confidence.

The Agent brings powerful automation to the core matching process—here’s how it works:

- Lockbox and Remittance Automation: Extracts payment details from lockbox PDFs and increases match accuracy with remittance emails and attachment data using advanced document understanding.

- Unified Cash View: Syncs matched payments to your ERP and collections workflows for real-time visibility into working capital.

- Multi-Invoice Matching: Applies payments to one or many open invoices, even when remittance details are incomplete or inconsistent.

- Dynamic Learning: Learns from historical matched payments to continuously improve accuracy and reduce exceptions over time.

Early Adopters Are Seeing the Impact

From improved match rates to fewer exceptions, teams using the Cash Application Agent are experiencing faster, more accurate reconciliation—without the manual lift.

"As we scale, applying payments from lockbox files against open invoices was consuming too many team resources. Now, with Tesorio’s Cash Application, automation handles the majority of our growing invoice volume. Our automatch rate has steadily climbed above 90% which has allowed our team to save time every day."

- Alex Wilcox, Senior Operational Finance Manager at Verkada

“Tesorio’s email remittance auto-match is a total game-changer. What used to require manual hunting and endless clicks now runs automatically behind the scenes with no extra effort from our team. We saw about a 20% jump in auto-matching performance. Their team made the transition seamless, and we’re big fans of the Cash Application Agent!”

- Jonah R., Senior Accounting Manager at User Interviews

The Cash Application Agent takes manual reconciliation off your plate—so your team can focus on what matters most.

Beyond Efficiency: The Broader Business Impact

But the benefits go beyond efficiency. When payments are matched and posted immediately, you achieve the core objectives of effective cash application:

- Improving Cash Flow: Timely and accurate cash application ensures that funds are immediately available for reinvestment, planning, and day-to-day operations. This supports better forecasting and creates a more stable financial foundation.

- Enhancing the Customer Experience: Prompt payment posting builds trust with your customers. When payments are applied correctly, it prevents confusion, eliminates billing disputes, and streamlines future transactions.

- Maintaining Accurate Records: Each properly matched payment ensures that your financial reporting is precise, your audits are easier, and your leadership team can make decisions with confidence.

The impact? Better visibility, cleaner forecasts, faster reconciliation, and collections that scale without adding headcount.

A New Era of Connected Financial Operations

The Cash Application Agent is the latest milestone in Tesorio’s mission to close the loop across the order-to-cash lifecycle. By handling the complexities of payment matching, the Agent unlocks cash faster, sharpens forecasting, and gives finance teams real-time visibility to act with confidence.

This launch builds on Tesorio’s recent AI innovations, following the release of the Supplier Portals Agent, which automates invoice submission and tracking across platforms like Coupa and Ariba. Together, these advancements reflect Tesorio’s momentum toward more connected, autonomous financial operations—equipping teams to turn revenue into cash faster, with less manual work.

See the Agent in Action

If you’re ready to stop matching payments by hand and start unlocking working capital faster?

Or, explore it yourself → Take the tour!