Is the CFO's Grip on Excel Loosening?

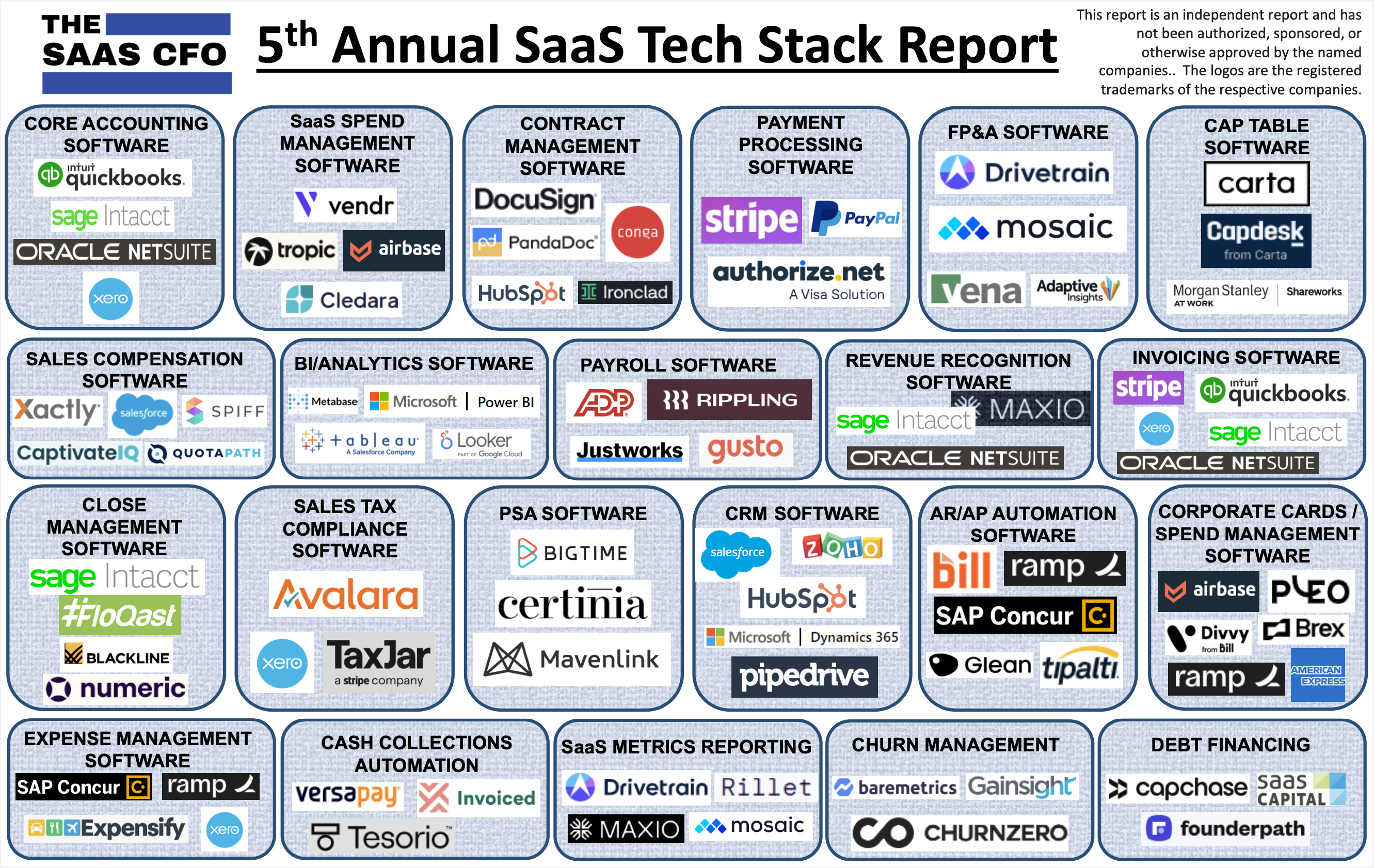

SaaSCFO’s fifth annual Finance & Ops SaaS Tech Stack report is out, and we’re pleased to be at the top of the Cash Collections Automation category in its inaugural year. Ben Murray, the brains and muscle behind the SaaSCFO blog, surveys hundreds of SaaS Finance and Ops leaders every year to find out what tools they’re using. He’s been doing it since before the term “Office of the CFO” became a thing. This transformation has been a long time coming, and CFOs are leading their companies through their most strategic decisions. As we like to say, they’ve gone from bouncers shutting down people’s dreams for exciting projects to the DJs of the party, driving sustainable growth in exciting and innovative ways.

And there’s one thing everyone needs to fund innovation—cold, hard cash. Keeping your customers happy at every step is critical, so we best remember that “closed won” is not done. Customer success and relationship management must extend even to the most awkward conversations, like getting paid when you’re owed. The report reads, "The last mile of cash collections is an ignored one. We invoice the customer and then have to manually call and email the customer for payment. I experienced this pain point first-hand as a CFO.”

This is such a delicate topic that the blunt automation that we all experience in our inboxes from outbound sales and marketing teams never made its way to accounting. Of the 535 survey respondents who were asked what solution they use for Cash Collections Automation, 61% of companies responded N/A, and 20% of customers are using spreadsheets to manage collections. Tesorio was the next most popular answer. What excited us the most about this report is that this category is just getting started. People are catching on to the fact that this last step of the customer experience journey can be scaled with the right partner.

In general, it’s no surprise that the use of spreadsheets is prevalent across all categories in the report. Based on our experience working with CFOs, we have some theories about why they’re sticking to traditional methods versus using SaaS platforms.

The first is muscle memory. The best chefs bring their own knives to the kitchen because they know how they cut and they feel like they can work faster with tools they’re comfortable with. Excel has been on the market for 40 years, and finance professionals have honed their Excel skills in college. It’s hard to give up a solution you have mastered and loved. I’m ok with admitting that I still plan vacations and shopping lists in Excel after a decade in finance.

The second is fear of failure. With oversight over technology spending, CFOs have seen their fair share of failed implementations or SaaS solutions that didn’t achieve what they were promised in the sales cycle. Excel is dependable, doesn’t require onboarding or support, and is essentially free to use. And if you’re the one who usually says ‘No’ to budget and headcount requests, there is the undeniable pressure of wanting to lead by example.

But the technology tides are turning, and there are clear indications that the CFO’s grip on Excel might be loosening. The underlying infrastructure in financial processes has been overhauled over the last five years. Finance teams expect a shift in their technology like other departments have seen.

First-generation workflow automation tools made it possible to work faster and track progress. But these were point solutions that still siloed data, so finance professionals still needed to bring disparate data together in Excel for full reporting.

Today, platforms that bridge finance dataflows to business workflows across systems allow finance teams to finally stop using Excel as their integration tool. And, beyond that, these platforms unlock entirely new opportunities.

First, cross-departmental business data is now accessible. Analog processes are now digital and accessible. Cash dataflows can be joined and controlled via API across tools like Salesforce, Gmail, NetSuite, and Zuora, providing visibility.

Second, cash is now programmable. Today you can access bank data and move cash with APIs, and companies like Marqeta, Modern Treasury, and MasterCard Track enabled rule-based payments.

Finally, extracting value from so much data is easier today than ever before. AI and ML have been democratized. From infrastructure to methodologies to faster research cycles, talent and tools are more prevalent and accelerating.

Will next year’s Finance & Ops SaaS Tech Stack report show an increase in platforms and less reliance on spreadsheets? Would love your insight.