Strategically Leveraging AI for Financial Operations: Balancing Innovation and Execution

Artificial intelligence has transformed from a buzzword into an essential strategic lever for finance teams. For CFOs and finance leaders, the question is no longer whether to adopt AI, but how to implement it strategically to maximize cash flow performance while maintaining operational control.

The root problem is clear: Finance teams today are forced to navigate a fragmented ecosystem of disconnected systems and disparate data sources. Many spend valuable hours sorting through multiple tools and manual spreadsheets to reconcile financial data—time that could be better spent driving strategic insights and proactive cash flow management. At Tesorio, we empower organizations to shift from reactive, labor-intensive processes to a unified, AI-driven approach that not only automates cash flow forecasting and collections but also reduces the Days Sales Outstanding (DSO).

In a recent strategy session, our team gathered to discuss how best to leverage AI for both immediate wins and long-term success. The conversation covered two critical areas:

Differentiating What We Are Known For Versus How We Generate Leads

While Tesorio is best known for turning revenue into cash, our growth strategy involves using AI to fill the marketing funnel and capture high-intent leads. Instead of simply slapping “AI” onto every feature, we use it purposefully in areas such as long-tail keyword advertising, dynamic landing page creation, and digital worker deployment. This ensures our message balances visionary innovation with real, measurable impact.

Balancing Short-Term Execution with Long-Term Strategic Innovation

Our approach is built on winning in the short, medium, and long term. Immediate experiments, like using Google’s Gemini to curate niche long-tail keywords for targeted landing pages, demonstrate how AI can drive cost-effective, high-intent traffic while building toward a broader vision. We refer to this product evolution as “revisionist history”, a deliberate strategy of showcasing our platform’s evolution over the past 6-12 months. By highlighting milestones such as enhanced email data parsing, automated AP Portal monitoring, and personalized collections communications, we demonstrate how Tesorio continuously re-architects its solution to connect fragmented financial data into actionable insights.

Our session also revealed the need for two tiers of user engagement within our platform:

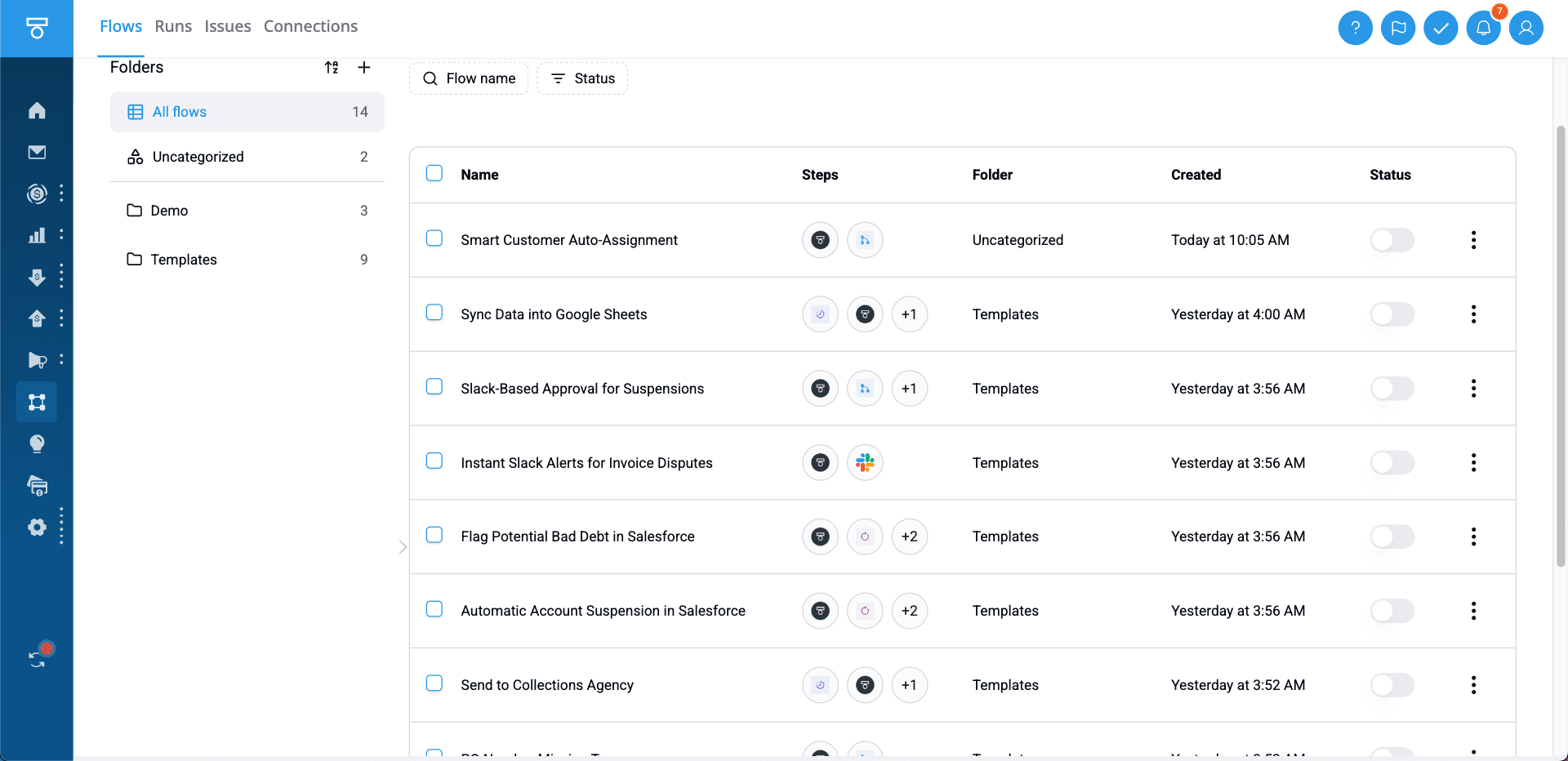

A streamlined “black box” mode that automates routine tasks for the majority of finance professionals, allowing them to focus on strategic work rather than cumbersome details.

An advanced “sandbox” mode tailored for super users, those with higher technical aptitude who wish to customize workflows extensively. This community-driven approach not only fosters innovation but also encourages sharing of best practices across our user base.

Collaboration between technical and marketing perspectives is central to our strategy. By connecting the dots between technical insights (like those provided by Fabio) and market-oriented approaches, we ensure that our AI initiatives are both cutting edge and market-ready. Innovative experiments—such as generating dynamic ad copy and landing page headers with AI, are just the beginning. Our goal is to create a comprehensive, unified financial operations platform that marries forecasting, collections automation, and AP monitoring within one cohesive system.

Tesorio’s strategic blueprint is clear:

• Use AI to integrate and automate financial data across forecasting, collections, and AP portal monitoring.

• Create a dual-narrative that reinforces our core identity, turning revenue into cash, while leveraging targeted AI experiments to drive lead generation.

• Empower our community of super users to customize and innovate through an advanced sandbox mode, fostering a hive-mind of shared expertise.

By balancing innovative experimentation with pragmatic, phased execution, Tesorio is set to redefine financial operations. Our approach transforms cash flow management from a series of reactive processes into a proactive, strategic engine for business growth.

FAQs:

What does Tesorio’s AI platform do differently from traditional finance tools?

Tesorio’s platform centralizes fragmented financial data and uses AI-powered predictive analytics to automate collections, forecast cash flow, and reduce DSO. Unlike traditional solutions that rely on manual processes, our platform seamlessly integrates with your existing ERP and CRM systems to deliver real-time, actionable insights.

How does AI help reduce Days Sales Outstanding (DSO)?

By analyzing historical and real-time payment data, our AI model accurately predicts when customers will pay. This enables finance teams to prioritize collection efforts based on actual risk and customer behavior, automate personalized outreach, and proactively manage overdue accounts—leading to significant improvements in cash flow and reduced DSO.

What is “revisionist history” in Tesorio’s product strategy?

“Revisionist history” refers to revisiting and showcasing our product milestones and enhancements over the past 6-12 months. By highlighting how we’ve re-architected key features such as email data parsing, AP Portal monitoring, and personalized collections workflows, we demonstrate our ongoing commitment to innovation and create a compelling narrative for our customers and leads.

How are long-tail keyword ads used in our AI strategy?

We are experimenting with using AI tools like Google’s Gemini to identify and group low-traffic, high-intent long-tail keywords. This strategy allows us to create customized landing pages with dynamic, AI-generated header text and ad copy. The approach ensures we capture cost-effective, highly qualified leads through digital advertising.

Who benefits most from the sandbox (advanced) mode of Tesorio’s platform?

While our streamlined mode serves most finance professionals by automating routine workflows, the sandbox mode is designed for super users with a higher technical aptitude. This mode enables them to deeply customize workflows and share their innovations with our broader community, thus delivering additional value through collaborative best practices.

By embracing AI-driven financial operations, Tesorio is not just automating tasks—it is transforming how companies manage cash flow. Our integrated approach combines advanced predictive analytics, intelligent collections automation, and a unified platform to deliver measurable business outcomes. Are you ready to transform your financial operations and reduce DSO? Contact Tesorio today to learn more about our innovative solutions and start your journey toward a smarter, connected financial future.