Tesorio's Product Highlights: AR Automation Innovations

Q2 2022 Highlights

The Tesorio team has been busy this quarter innovating in Accounts Receivable Automation. Here are some quick highlights that were released this quarter.

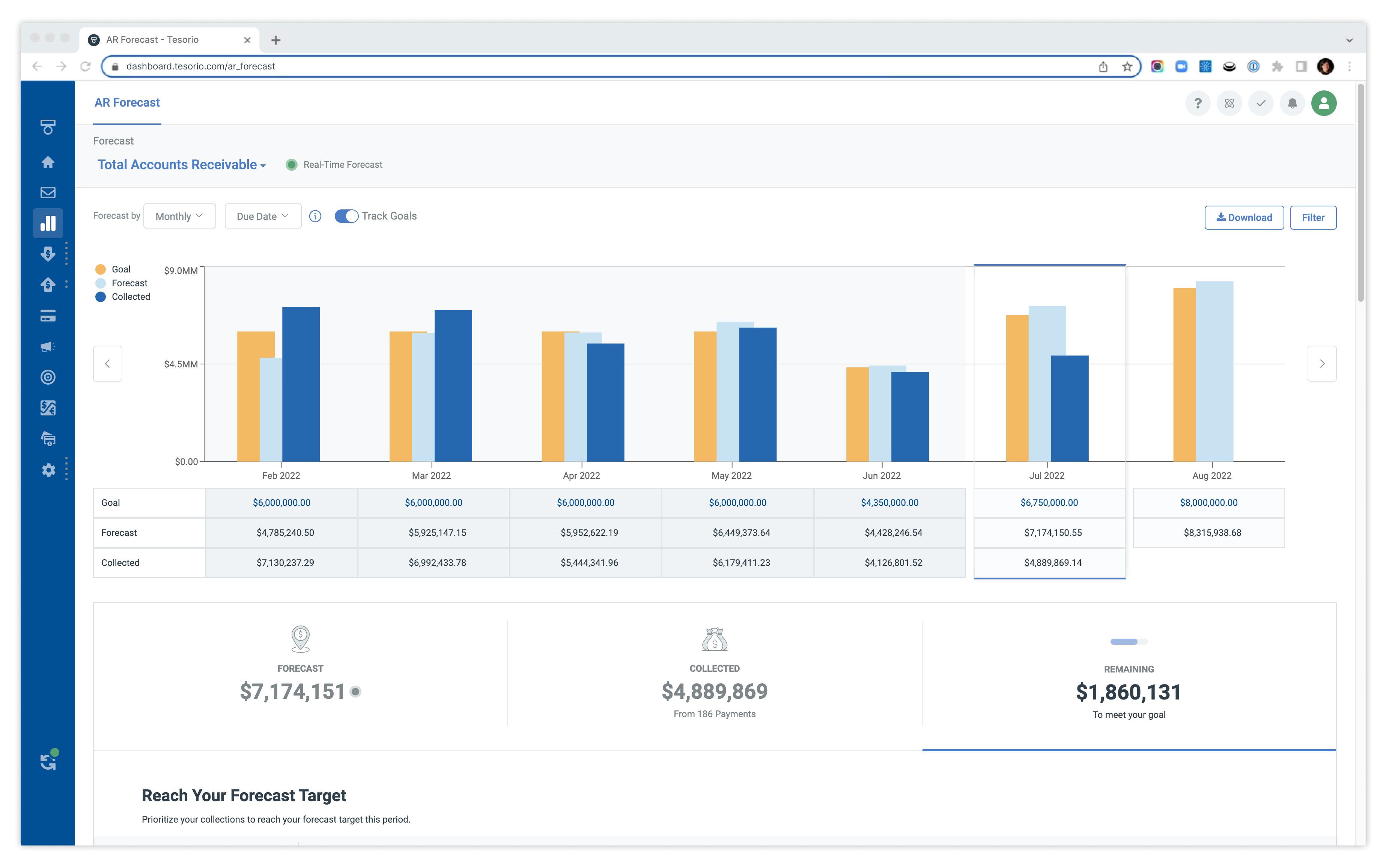

Forecast and track your collections with more accuracy, less effort, and higher confidence with Tesorio's newest product: AR Forecast.

- Automate your forecasting process and save yourself from the traditional tedious manual exercise.

- Use AI powered predictions to provide accurate and automatic insights, then augment with customer feedback.

- Track cash real time and help prioritize follow up activities for your team.

- Set goals for subsidiaries, individual collectors, and more. Measure your collections against your forecast and goals to help your team focus and prioritize.

Communicate with your customers in the way that makes the most sense for them regardless of how customer and invoice data is structured in your ERP.

Advanced grouping in Campaigns and Email Manager allow you to create emails across customers using shared criteria like ‘Bill To’, ‘Partners’, or other custom fields on your invoices.

Generate and attach statements that consolidate invoice data across customer records, so that you can send a single statement.

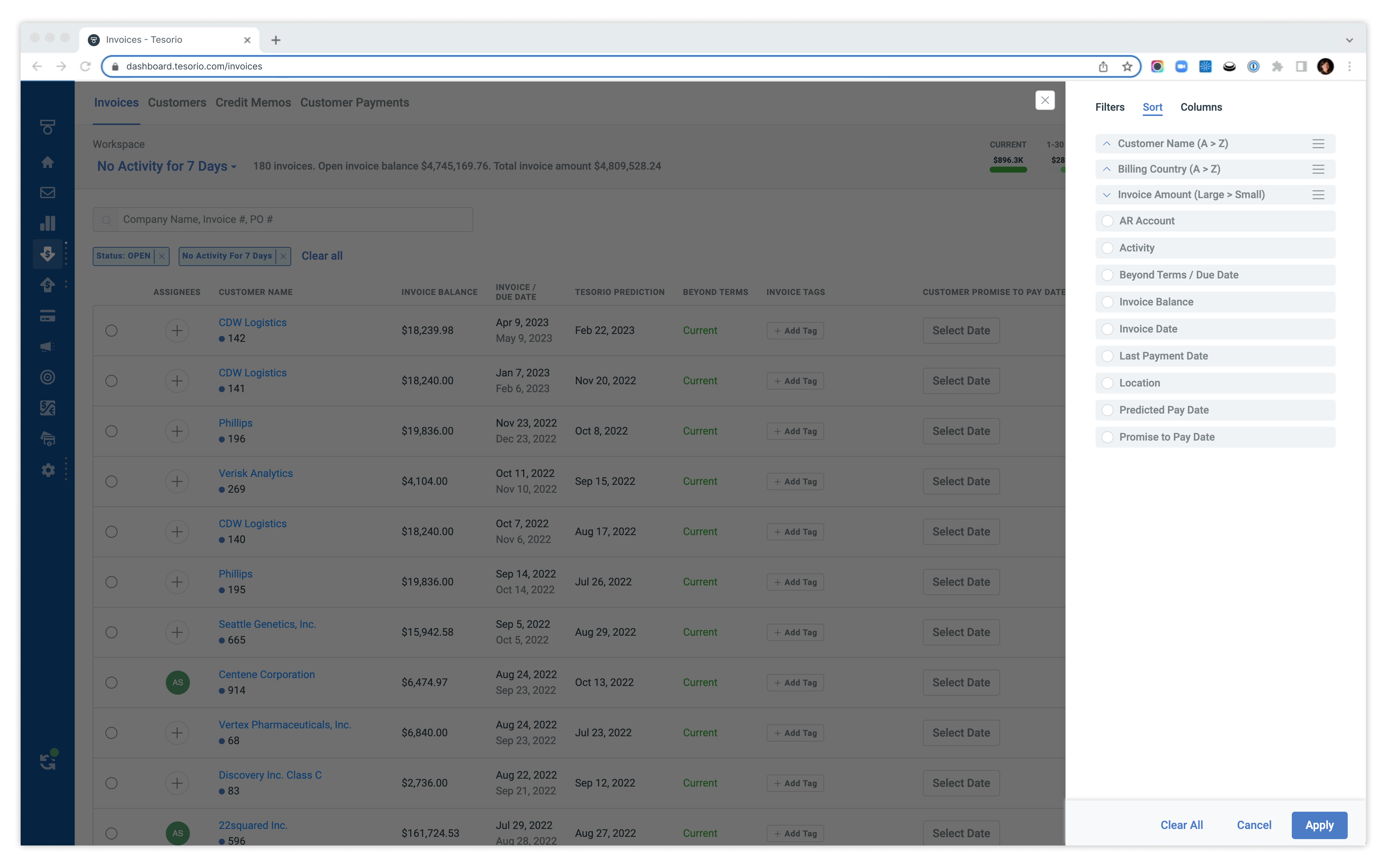

- Combined aging & invoice balance filters that allow for granular targeting and analysis.

Multi-level sorting and search within columns & filters.

- Bulk actions across all workspaces - additional action options, as well as ability to apply updates to all records that match the search in addition to the manually selected records.

- Visibility into Customers and Invoices in Action Center

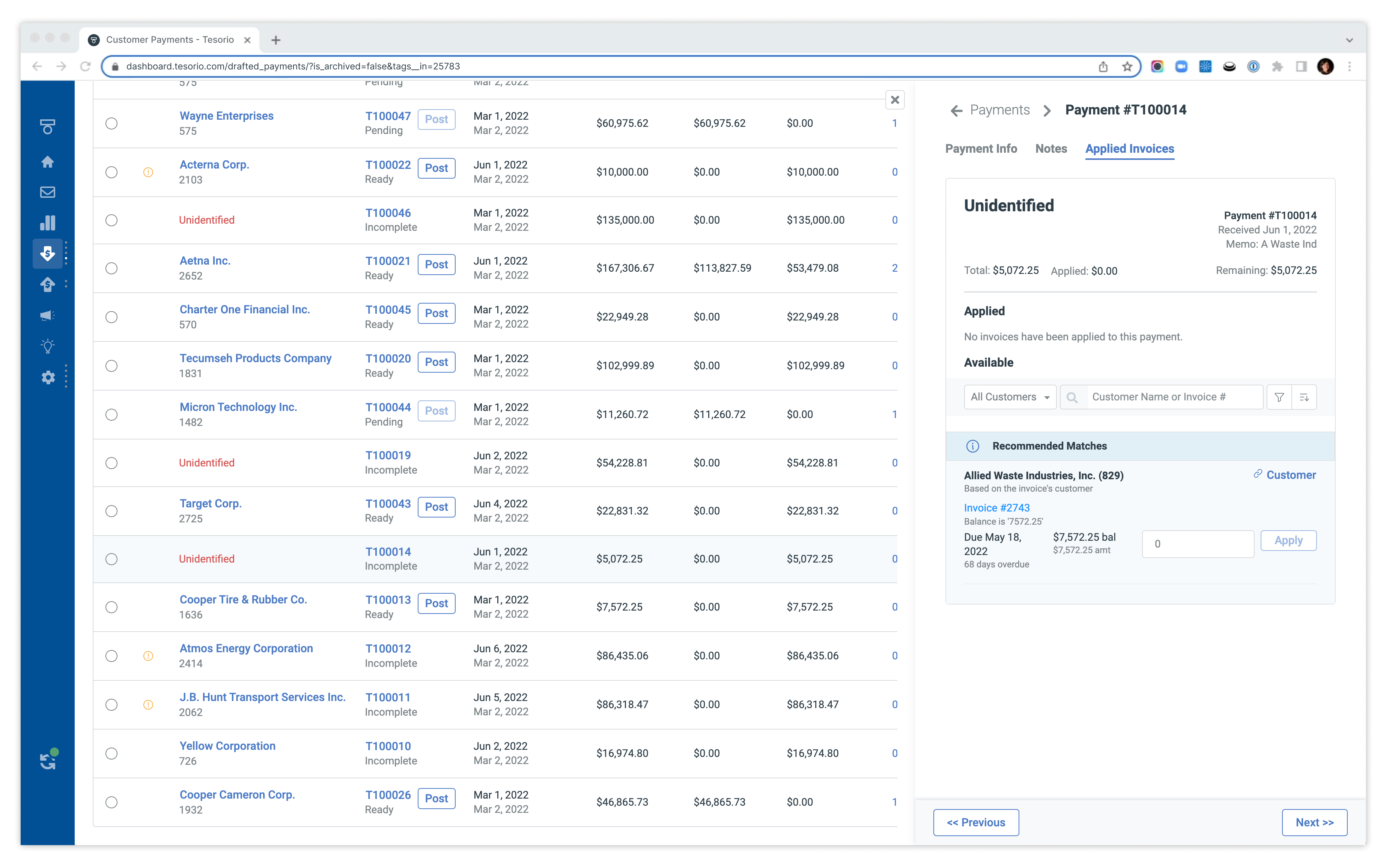

Early Access - Cash Application: Quickly apply cash directly in Tesorio. Reach out to your CSM if you’re interested in learning more and participating in our early access program for Cash Application.

*Note: Cash Application is currently only available for NetSuite customers

Q3 2022 Highlights

The Tesorio team has been busy this quarter innovating in Accounts Receivable Automation. Here are some quick highlights that were released this quarter.

AR Forecast

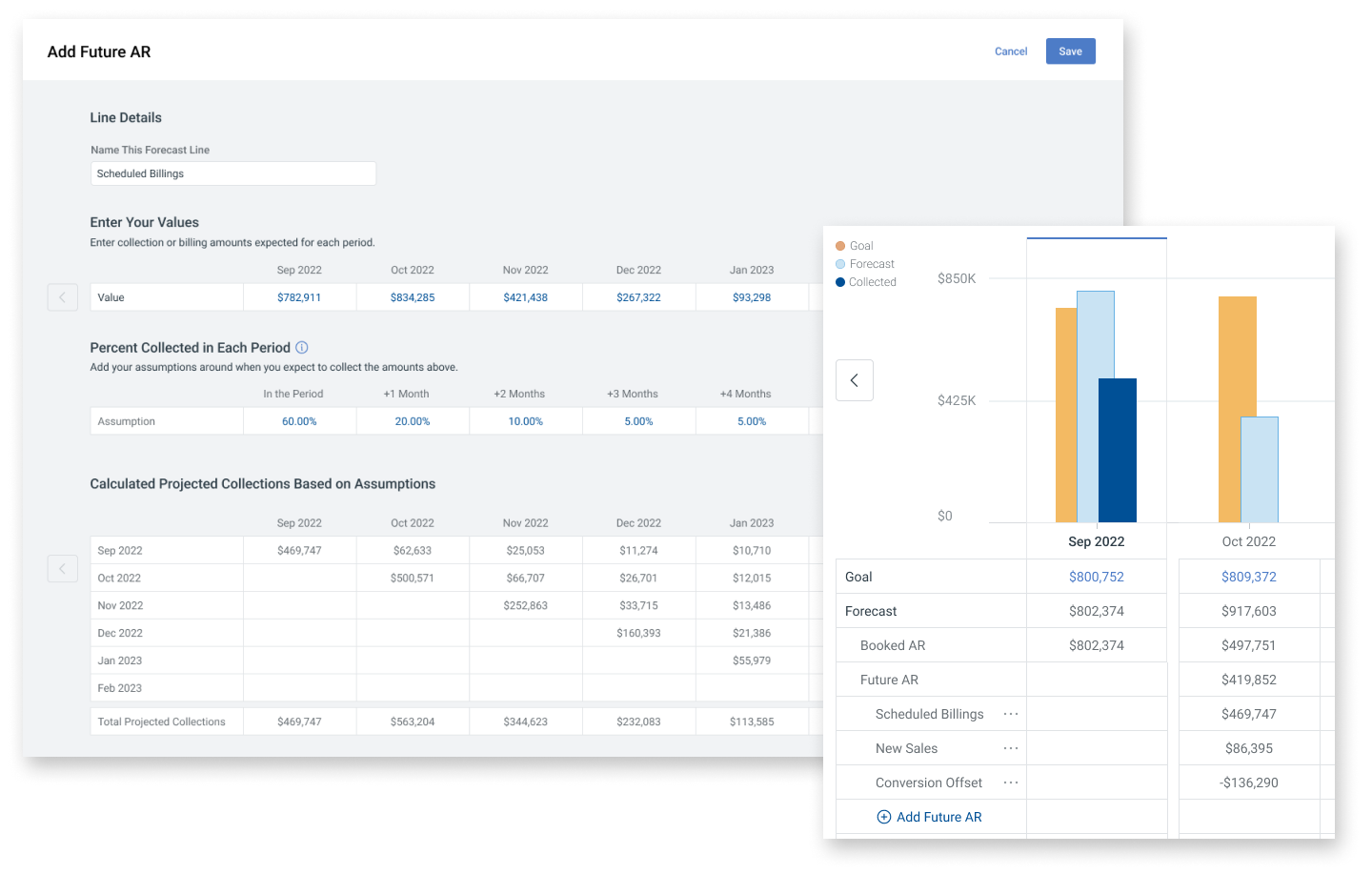

Three new features in AR Forecast give teams the ability to interact more deeply with their forecasts and compare their forecasts against historical performance.

Group your forecasts by quarter for an overall view of forecasted and actual collections

- Augment your forecasts with manual adjustments, positive or negative, to account for information like future billings that are not yet invoices in your ERP, so not yet included in Tesorio’s automated forecast.

- View a rich breakdown of your historical collections performance by aging bucket. And,

in a given period, understand how current forecasts and collections stack up against historical trends.

Financial Care Center

Streamline payment acceptance with AutoPay. Your customers can now configure invoices for auto payment on the due date, ensuring you get paid on time, and they do not need to process each invoice manually.

Also, users can now configure the expiration timing of portal links that are shared with customers. By default, links expire after 14 days, but you can increase or decrease this by subsidiary to ensure the portal is accessible whenever it’s needed.

Workspace Efficiencies

A number of new filters and workspace features enable you and your teams to work more efficiently and configure workflows that are tailored to your business.

- Configure default columns for Invoices and Customer Payments workspaces, so that each time you create a new workspace, your favorite columns are pre-selected.

New filters related to promise to pay dates let you easily identify invoices with or without promise to pay dates, as well as those where the promise to pay date is in the past or the future. Use the filters in workspaces as well as campaigns to identify invoices that are more or less at risk, and communicate with your customers accordingly.

NetSuite Integration Enhancements

NetSuite customers now experience faster sync times following our upgrade to NetSuite’s newest SuiteQL technology for integration. To take advantage of these performance improvements, customers must update their NetSuite bundles. All customers must migrate by December 30, 2022. You can find more information and instructions here.

Inbox Assignment Logic

To continue streamlining the process of communicating with customers, additional logic is now available in the Inbox in order to automatically link incoming emails with invoices and/or customers in Tesorio. When an invoice number is present in the email subject, the email is linked to the corresponding invoice and customer. When the sender or a recipient of the email is an invoice or customer level contact, the email is assigned to that invoice and/or customer. If the contact is associated with multiple customers, assignment is not done automatically. Contacts with the ‘Internal Contact’ label and contacts with the company’s internal domain are ignored.

Cash Application

Tesorio continues to expand our new Cash Application product with the support of CAMT53 files for customers with international bank accounts.

Q4 2022 Highlights

Monitor Your Collections Progress Against Goals and Extended Forecasts

AR Forecast, including collection goals, now available to all customers

With the base level of access, all customers can view Tesorio’s proprietary forecast for the current period and track collections progress against this forecast and company-defined goals.

New 13-week extended forecasting for better planning and cash flow predictability

Customers can upgrade to the full AR Forecast product to access a rich set of forecasting tools, including our new extended forecast with 13 week forecasting functionality which allows companies to build forecasts that include AR that hasn’t yet been billed. Enter expected billing amounts and collection assumptions, and Tesorio calculates the projected amount to include in the overall forecast. As new invoices are created, Tesorio automatically removes duplicates to ensure that your forecast is as up to date as possible.

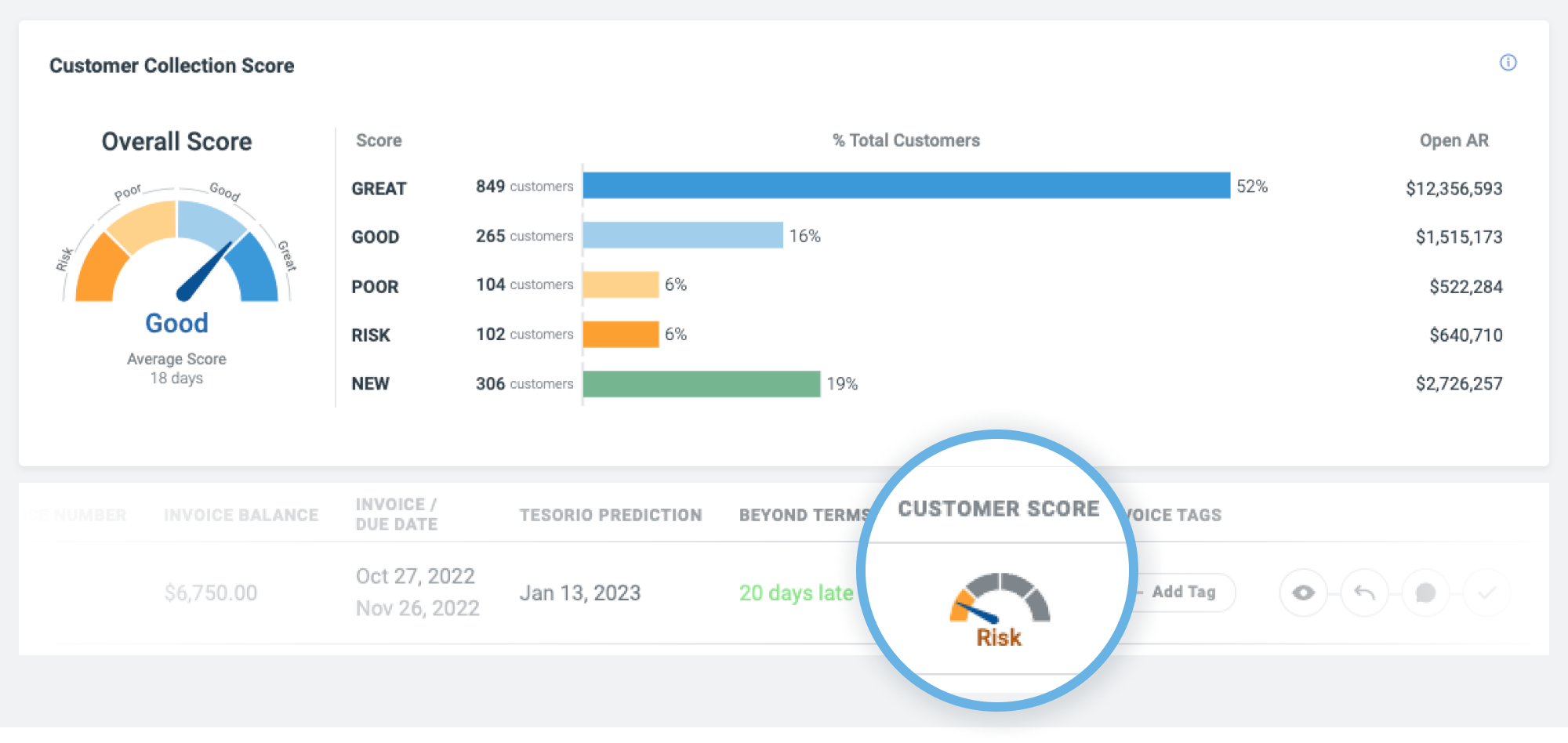

Understand Customer Behavior by Score Category

Quickly assess payment risk across your customer base with Tesorio's new Customer Collection Score. The Customer Collection Score categorizes customers into 5 groups based on past payment history, allowing your collections team to benchmark your customer's payment performance as well as understand your overall collections health. Learn more about best practices for incorporating the Customer Collection Score into your outreach process here.

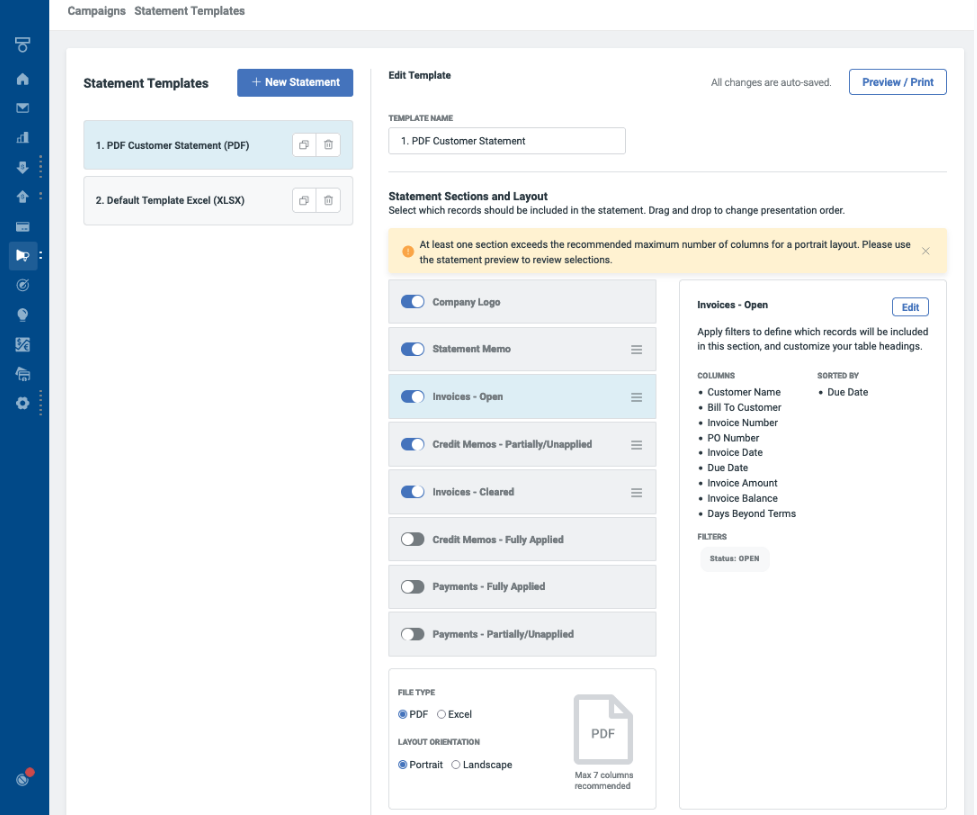

Share the Right Information with the Right Contact

Customized Statements

New statement template functionality allows you to finely tailor the data and layout of the statements that you send to customers - ensuring that the most important information is available to them. Add additional columns into your statements, including custom fields, to help customers identify the invoices, credit memos, and payments on their account. Use filters to exclude certain records from your statements when they are not relevant. When different types of customers require different information in their statements, create multiple statement templates and update your email templates to use different statements in different scenarios.

Contact Management

Upgraded contact management functionality gives you complete visibility into the source of contacts and additional control over which contacts are used in email communication. New source tags identify the specific field of origin in the ERP, including the role if one is defined, and can be used in email templates, ensuring that only the contact data that is confirmed up-to-date is used in your outreach. Create custom tags to further augment and categorize contacts in Tesorio. New contact functionality is rolling out to customers in batches. Reach out to your CSM to learn more about the timing of this feature release in your account.

Streamline Manual Tedious Tasks

CSV Import functionality allows customers to add customer tags, invoice tags, and assignees in bulk.

Use @mention functionality in notes to ensure that your team members see updates and know to respond. Add notes directly from workspaces, without opening the record drawers, for added efficiency as you’re reviewing a list of invoices or customers.

Q1 2023 Highlights

Tesorio's New Customer Collection Score

Quickly assess payment risk across your customer base with Tesorio's new Customer Collection Score. This new analytics feature enables you to immediately take strategic action to keep your cash flowing.

The Customer Collection Score categorizes customers based on past payment history, allowing your collections team to benchmark your customer's payment performance as well as understand your overall collections health.

Customer Collection Score Categories

After analyzing payment data across hundreds of companies & research with industry experts to understand typical performance patterns and best practices, the Tesorio team created 5 categories of customers:

Great: customers who pay, on average, early, on time, or no more than 15 days past the due date of an invoice. We incorporate a 15 day grace period into this category to account for situations such as the occasional payment delay, weekends/holidays, or check payments that have been mailed but received on a delay.

Good: customers who pay, on average, between 16 and 45 days late. Customers in this category are likely responsive to the first steps of collections campaign outreach, but their consistent late performance may indicate AP practices which are not concerned with proactive on-time payment but are responsive to reminders and follow-up inquiries for payment.

Poor: customers who pay, on average, between 46 and 90 days late. Customers in this category are consistently late payers. Their consistent late performance may indicate less sophisticated AP practices and workflows or frequent questions or disputes about invoice data which causes delays in the payment process. These customers may benefit from more frequent, and earlier, outreach related to invoice payment.

Risk: customers who pay, on average, more than 91 days late. These customers are consistently very late, and deserve focused attention from the collections team to understand the overall health of the relationship.

New: customers who do not have payment history in Tesorio yet are classified as new and there is no way to know which category a “New” customer may eventually fall into. It is common to not have the correct AP contact in place for new customers, which will put timely payment at risk. Collection teams are advised to consider these customers as cautiously high-risk due to the unknown nature of the relationship at this point in time.

How do your customers stack up?

At the time of this release, analysis of our entire customer database shows most customers are paying fairly close to the due date. Benchmark your Customer Collection Scores against the composition of customer risk across all Tesorio customers to see how your team is performing.

Best Practices

Once you understand your customers’ overall behavior, how do you decide what actions to take?

Best Practice #1

Tesorio always recommends asking for confirmation of receipt of invoice when it is first sent out to ensure it has been received by the correct contact and has all the necessary details for AP processing. If any required information is missing, such as a missing PO number, this step is the best time to get the matter resolved.

Best Practice #2

Tesorio recommends sending a reminder email before the due date. Some information that can be included in the message are to remind the customer of the upcoming due date, ask for confirmation that the invoice is being processed in the system, and to ask for a scheduled payment date.

With these two guiding principles in mind, use the categories below to take the following actions:

Great: Keep doing what you’re doing! Ensure that you’re communicating with customers early to identify any issues before invoices become due. Consider ways that you can thank these customers or show your appreciation for their great partnership.

Good: These customers may benefit from more frequent, and earlier, outreach related to invoice payment. Consider an audit of the most recent payments for some of these customers to identify common trends that may be causing delays. You may adjust the reminder email or create a new dunning campaign specific to the issue you discover.

Poor: These customers should have a more proactive approach to collection efforts, especially in the early days before an invoice is due. Strive to receive confirmation from the customer that the invoice has been received and that it has all the required details for processing. Consider getting other stakeholders involved earlier in the process if there is no response in your effort to receive verification that the invoice is processing and receive confirmation of a payment date. A manager, sales rep, or CSM may be able to get a quick response with a simple email where a collector is struggling to make contact.

Risk: Collaboration across stakeholder teams and escalation (internal and external) is likely necessary for customers in this category, and may take place even before an invoice is due. Strive to receive confirmation from these customers that invoices are received and that all required information for AP processing is correct, such as necessarily PO numbers. If no communication is received from the customer, or if communication stops, flag these customers for escalation as soon as possible and don’t wait until they are significantly past-due before raising them as an issue. Managers, AEs, CSMs, and even CFOs may have valuable ideas for next steps to help collect sooner from customers in this category.

New: Until their payment trends are established, customers in this category may benefit from outreach prior to invoice due dates so that your team can confirm the correct contacts and resolve any questions related to POs or supporting documentation prior to payment. Some customers may not begin counting down net terms until all the requirements are met, so it’s best to confirm these details are in place immediately after the invoice is created.

The Tesorio team has been busy the first quarter of 2023 innovating in Accounts Receivable Automation and building functionality that empowers AR Managers and Collectors to gain deep insights into their customers, track the overall Collections process, and streamline day-to-day workflow activities. Here are some quick highlights that were released this quarter.

Tesorio Announces GPT-3 Based AI Email Assistant

Tesorio has launched a new feature that leverages OpenAI’s GPT-3 to build an AI email assistant. This new feature will help you process your Accounts Receivable inbox and take care of your customers’ needs faster than ever before.

At Tesorio, we are dedicated to innovating for the accounts receivable teams who are on the frontlines making cash flow predictable. A/R teams are typically small, yet mighty teams managing the most delicate facet of the customer relationship - the part where you exchange cash. A/R Specialists used to lack A/R automation before Tesorio, but we are here to help them with the very important responsibility they have in helping companies with their cash flow.

“Previously we were using a mix of manual methods to keep track of invoices, now it is all in one central location and fully automated so that the manual process of following up with clients has been taken off our plate.” - Amber P. @ Domo

Read below for more information on what was released and stay tuned for more updates in the coming weeks!

AI Email Assistant Features

Suggested Email Responses

Breeze through your AR inbox using our AI’s suggested email responses. Save time drafting repetitive responses to emails. Instead of writing each email, you’ll be able to review the response generated, make any necessary edits & then send the reply to your customers when ready.

Email Tone Analysis

Quickly identify your customer’s sentiment in an email thread to help you tailor your responses. If tensions are high, focus on identifying which next steps and action items will quickly resolve issues and get your relationship with the customer back on track.

Monitor Collections & Team Activity more effectively with our upgraded configurable dashboard

New Dashboard updates allow users to more easily monitor collections & team activity. Get a comparative view into how team members or subsidiaries are performing or measure activity across different time periods by applying filters to individual widgets. Measure what matters most to your team by rearranging widgets into your preferred order and choose metrics from our growing Widget Library.

Accelerate your Cash Application process with new mapping rules & reporting

New mapping rules ensure that new transactions that sync to Tesorio from your bank are automatically coded correctly, eliminating manual, tedious, and error prone clicks for each payment. Over the course of the quarter, automated rules for the following fields were introduced:

Class, Department, and Location based on the bank account

Payment Method Mapping for BAI and CAMT53 files based on transaction codes

Additionally, new Cash Application reports make it easier for your team to monitor the performance of your posting process.

Prioritize campaign communications for customers who have multiple invoices

For customers with many open invoices, our new 'oldest invoice for customer filter’ allows you to minimize the number of notifications customers receive and reduce the risk of overwhelming them with too many reminders. By communicating about only the most relevant and oldest invoice, you ensure that your customer is focused on your highest-priority open invoice with them.

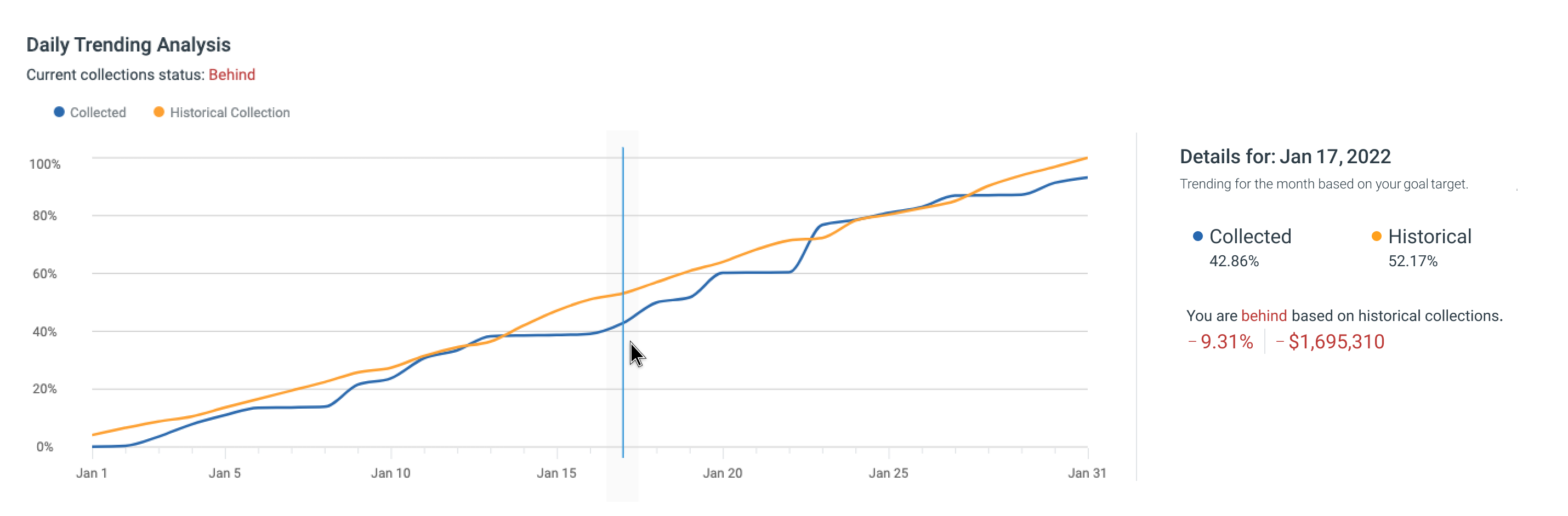

Compare your collections against historical trends to understand whether you’re behind or ahead

Daily Trend Analysis allows users to see how collections are tracking against historical daily averages. You can now compare daily collections against historical trends to see how far behind or ahead collections are tracking.

Streamline manual tasks

Collection teams are busy juggling many competing priorities. Tesorio is always working to improve the experience of the day to day activities that teams are completing in the application. Here are a few of our favorite efficiency updates we’ve introduced this quarter:

Add notes directly from the workspace tables. Notes are one of the most commonly used features in Tesorio, and collections teams are constantly reviewing & adding notes to invoices and customers while working through their accounts receivable portfolios. By adding notes directly from the tables, collections teams are able to document their activities even more quickly.

Bulk Import. Building off of the release of our popular CSV Bulk Import functionality last quarter, we’ve extended support to allow import of Promise to Pay Dates, Customer Notes, and Invoice Notes. This is in addition to being able to import customer tags, invoice tags, customer assignees and invoice assignees.

Campaign Step Preview. Ever need to quickly verify which invoices meet a specific campaign step’s criteria today? Step Preview capability gives users this answer in one click.

Write better emails, more quickly and with higher confidence

This trio of email enhancements allows your team to breeze through their emails without sacrificing quality.

Tesorio AI Email Assistant: Tired of writing responses to emails and determining next steps? Our assistant utilizes GPT-3, OpenAI’s language model, to analyze your incoming emails in real time, provide insights into the sender’s sentiment, and suggest responses that you can send as is, or edit as needed.

Drag & drop attachments when drafting emails. Eliminate the need to browse through your file folders to locate the attachments you want to include.

Contact validation. Have you ever drafted an email and accidentally sent it to the wrong contact? Validation in the email editor now flags any email with unrecognized recipients for additional review, making it easy to double check that you’re sending your email to the intended recipient.

If your organization is ready to gain a better understanding of your customers and collections processes, contact Tesorio today.

Q2 2023 Highlights

Eliminate manual Cash Application processing with new Auto Match rules

With Tesorio Auto Match, reduce the time spent on manual cash application matching processes by 50% or more. At the time of implementation, 50%-60% of transactions are automatically matched to customers and invoices. Over time, see this percentage improve - drastically improving the efficiency and speed of your cash application process and eliminating errors along the way!

Tesorio Cash Application is now available to Intacct customers

Automating the cash application process saves significant time and effort and enables Finance teams to focus on more strategic activities. Contact your CSM to enable Cash Application for your account.

Monitor and maintain team workloads directly from the Dashboard

Last quarter, we released our updated Dashboard. This quarter, we’ve released our new Customer Allocation widget, which provides visibility into the AR portfolio balance among team members, including unassigned AR. View the portfolio load by open invoice balance, count of invoices, or count of customers to ensure the work is properly distributed across the team.

In addition to launching this new widget, we added four email widgets to the Dashboard gallery - Deleted Campaign Emails, Email Stats by Campaign, Emails Sent - Campaigns vs. Manual, and Sent Campaign Emails. Used in conjunction with the Customer Allocation widget, these reports give your team insight into how automations are supporting your collection efforts.

Keep your payment processing costs in check by sharing fees with your customers

Recoup some payment processing fees by configuring flat or percentage based fees by payment method in the Financial Care Center. These rules allow you to balance the convenience of offering many payment methods to your customers with the importance of reducing expensive costs for your organization. Contact your CSM today to enable Financial Care Center fees in your account.

Build perfectly formatted, customized emails with our upgraded email editor

Upgraded, intuitive controls and a real-time preview make creating stunning and professional emails easier than ever before. Pair these new formatting capabilities with our email variables to effortlessly customize and format your emails to perfection, saving time and maximizing impact with your customers.

And once you have the perfect emails and campaign sequences configured, use the new Copy Campaign to quickly duplicate, so that you’re not starting from scratch when building new campaigns.

Managing workflows by customers rather than invoices? These improvements help you find the highest priority customers.

New filters and columns on the customer workspace give you visibility into overdue counts and balances by the customer. Pair this with the existing column filters for total count and total balance to understand the health of their current open portfolios and prioritize the customers with the largest overdue balances.

From the invoices workspace, quickly navigate to a customer workspace, filtered by the same criteria.

Full insight into ERP contacts in Tesorio

With the rollout of our upgraded Tesorio contact management feature to Workday and Tesorio Connect customers, this enhanced functionality is now available for all Tesorio customers.

In addition, Tesorio now clearly displays what contact information updates are pushed back to your ERP. Fields that sync between systems remain editable, and fields that exist only in Tesorio remain editable. Users will no longer see an edit option to make changes that cannot be synced to the ERP in order to prevent data inconsistencies between systems.

Reflect all collected cash in one place

Tesorio now supports customer payments recorded as Deposits in NetSuite. Customers using this NetSuite transaction type to record customer payments now have the ability to reflect customer cash collected in Tesorio more accurately and provide more accurate statements and AR forecasts.

Tesorio Connect

We added a number of improvements to our flexible Tesorio Connect integration. We improved our file upload error handling and enhanced our error messages, adding more descriptive information to help our customers understand and diagnose reasons for file or record rejection.

To allow customers to bring additional information into Tesorio, we now support custom fields for Customer Payments. Customers can now also include contacts as custom fields in their customer and invoice files.

Protect your eyes with Dark Mode

Our new dark mode setting is in beta and available for every user from the settings menu.

A Year of Innovation: Tesorio’s 2023 Recap

Tesorio closed out 2023 with a number of enhancements focused on driving cash flow performance & increasing the efficiency of your teams. Take a look at how our newest updates in Q4 build on the momentum from earlier in 2023 to help you maximize your cash flow in 2024.

To Accounts Receivable and beyond–bring in AP and Bank data to fully automate your Cash Flow Forecasting in Tesorio

Cash is the lifeblood of your business — how can you live without knowing how money is flowing in and out? Because inflows are the most unpredictable part of Cash Flow, from the very beginning we’ve focused on building tools to help you project and then hit your inflow targets by automating Accounts Receivable. In 2023, we made our first steps towards full-blown cash flow analysis and forecasting by incorporating transactional bank data and Accounts Payable data from your ERP into Tesorio.

Over the past few months, we’ve worked with beta customers to import and automatically categorize bank transactions, enabling immediate, rich historical data analysis, and build powerful forecasts using a multitude of forecast drivers to eliminate the time-consuming, manual processes that are traditionally required to build and manage your forecast scenarios. What’s more, we’ve extended our ERP-data forecasting capabilities to include Accounts Payable data as well. We bring these together in the Cash Flow Performance Center, your finance team’s control tower, giving you real-time views of current and forecasted cash as well as the levers and proactive insights to drive your cash inflows and outflows.

We couldn’t be more excited to launch these powerful forecasting tools more broadly in 2024.

The Cash Flow Performance Center gives you a single view of your AR, AP, and bank cash.

Elevate your CashApp experience with even more ways to connect your bank data

Additional flexibility and configuration options have been added to the CSV and BAI file importers, ensuring that your transaction data is imported automatically and accurately, regardless of idiosyncrasies across bank formats. And, to ensure ease of implementation, new SFTP options have been added, including support for SSH Authentication to externally hosted SFTPs and an option to use a Tesorio-hosted SFTP when needed.

Take advantage of these new connection options to achieve 85% auto-match rates with all of your payment types across all of your banks. In 2023, we added CashApp support for Intacct — and more integrations are coming soon! Don’t just take our word for it — hear from your peers about the benefits of automating your cash application process.

If you’re interested in adding Cash Application to your account, please reach out to support@tesorio.com or your Customer Success Manager.

Offer your customers easy self-service options—but don’t break the bank!

Our online payment portal consistently gets high satisfaction ratings from your customers (88% give it 4 or 5 stars). We’ve continued to add enhancements, like customizable text links in email, that help get cash in the door faster via online transactions. And, speaking of transactions, Tesorio now offers surcharging to help manage transaction fees. We provide a flexible range of options for specifying when a surcharge is added and for how much, so you can hit just the right balance between vendor and customer. And, when you are researching particular payments, our deep integration with Stripe enables you to seamlessly navigate between Tesorio and Stripe to find all the answers you need.

If you’re interested in adding Financial Care Center to your account, please reach out to support@tesorio.com or your Customer Success Manager.

Our surcharging functionality provides a flexible range of options for setting surcharge amounts.

A new look to liven up the new year

You may notice some color and style changes in Tesorio, including a new color block behind our logo and an updated font/typeface. So many other exciting updates are happening with the application that we thought it was only right to add a fresh look and feel as well. And, when your eyes are feeling the strain of a long day, click on the Profile icon (upper right) and try out Dark Mode.

Enjoy new colors and fonts in Tesorio for 2024, and rest your eyes with Dark Mode.

A little AI assistance to streamline your day?

Workspaces are the backbone of your Tesorio experience, and AI-generated workspaces make creating and editing workspaces a breeze. Pair this with the AI email assistant, and you’re on your way to a lot more free time in 2024! Find this in the Invoice and Customers workspace dropdown: “Generate Workspace”.

Use Tesorio’s AI workspace generator to get the data you need using natural language.

Personalize and customize your communication at scale

To rise above the noise in your customers’ inboxes, your emails need to stand out and communicate information quickly and concisely. And you need to do this at scale. Tesorio customers sent more than 2 million emails in 2023, with the vast majority of those sent via Campaigns. In Q4, we’ve added font selection, additional alignment options, and the ability to customize the text of variable links to the rich text editor that we introduced earlier in 2023 so that you can craft perfect emails every time.

Use text and layout enhancements in our email editor to fully personalize your customer messages.

A few of our favorite communication enhancements from 2023 include drag-and-drop attachments, images embedded inline, and configurable statement templates. And emails are only as good as the contacts you are sending them to. That’s why we devoted a lot of time in the first half of the year to upgrade all customers to our enhanced contact tagging feature and rolled out additional contact verification and editing functionality.

Attachments can now be added to invoice, customer, and payment records in Tesorio.

Your data, your team, your way—it's never been easier to connect and interpret your AR data

You can’t do your work or understand its impact if you don’t have all of the data. In 2023, Tesorio added connections to numerous new data types so that, no matter how many systems your data is stored in, you can bring it all together in Tesorio through a combination of native API connections, automated imports, and ad-hoc bulk imports. But wrangling all of this data into required file formats and configuring import logic can still be a chore—that's why in Q4 we released default import templates with dynamic mapping for all AR data. Don’t delay a Tesorio implementation due to a lack of IT resources to define your data strategy—we've done the heavy lifting for you!

With Tesorio Connect anyone can upload their data into the application without a native integration.

Once your data is imported, put Tesorio to work for you. Upgraded campaign audience filter options now match invoice workspace filtering, so no matter how you like to slice and dice your invoices, you can now craft and preview campaigns in the same way.

And, last but not least, your day isn’t complete without an understanding of what’s happening with your collections process. New reporting capabilities in Q4 such as the deleted email report in campaigns, build on our 2023 theme of enhancing our monitoring and dashboarding capabilities. Our configurable dashboard was introduced early in the year, with powerful widgets for tracking team performance following in Q2 and Q3 with the Customer Allocation and Touch Activity trackers. Pair these insights into team activities with your Daily Collections Trend Analysis on the AR Forecast to get the full picture of where you stand with your collections.

Monitor outreach activity and stay accountable with the Touch Activity dashboard widget.

Stay tuned for more updates!