The AI-Powered Future of Cash Flow: How Finance Teams Are Transforming Operations

By Carlos Vega

For finance teams, cash flow management has always been a high-stakes challenge. It’s not just about tracking payments—it’s about ensuring that companies can operate efficiently, reinvest capital effectively, and maintain financial stability in a rapidly changing economy.

But let’s be honest—traditional cash flow processes are broken. Too often, finance teams rely on manual, error-prone workflows that slow down collections, create forecasting blind spots, and leave businesses scrambling for liquidity. That’s exactly why I co-founded Tesorio.

"Cash flow isn’t just about accounting—it’s about making sure businesses can grow without hitting liquidity roadblocks," I often say. "If you don’t know where your cash is going in real time, you’re operating in the dark."

With AI and automation, we now have the tools to eliminate inefficiencies, improve predictability, and create a truly connected financial operation. The future of finance isn’t just about faster data—it’s about smarter decision-making.

Why Cash Flow is a Data Problem, Not Just a Finance Problem

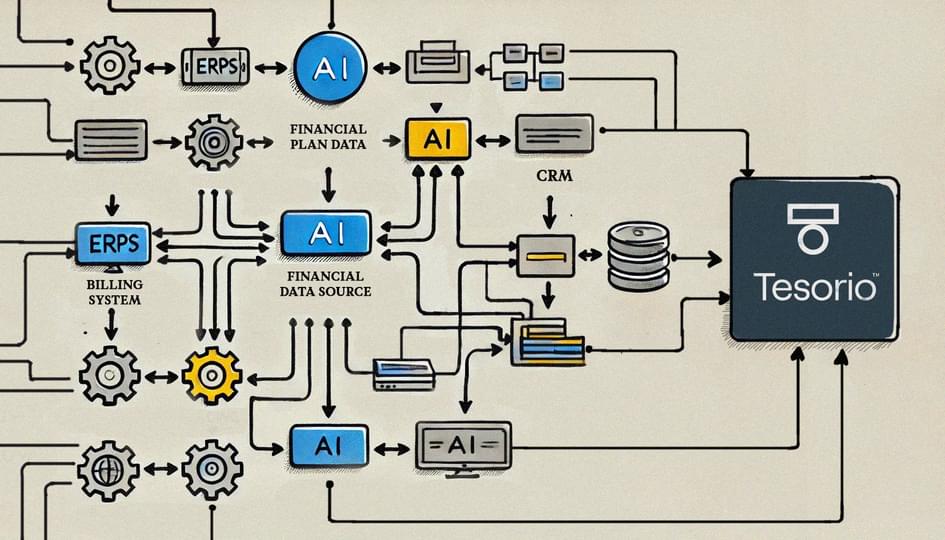

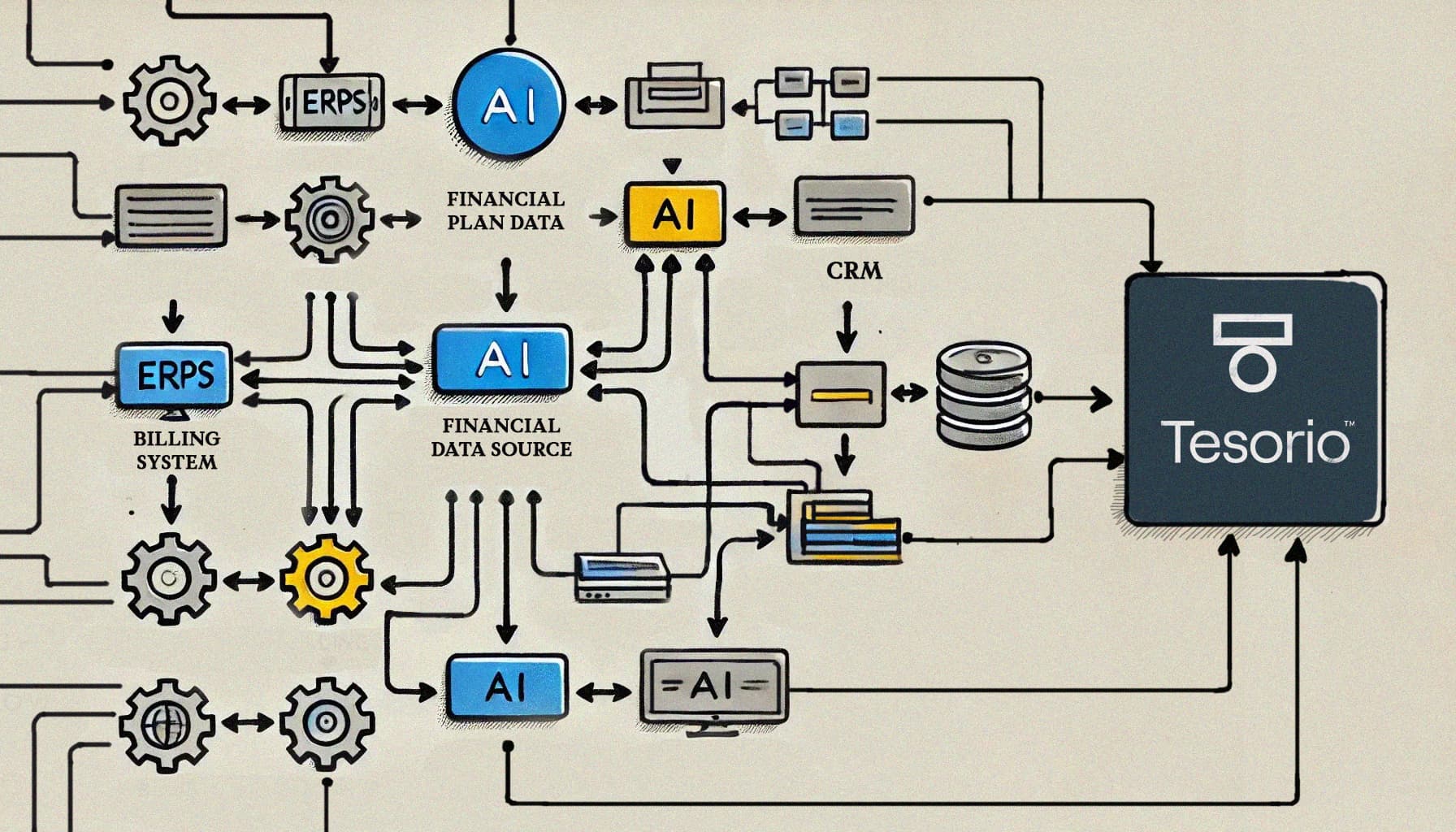

For years, we’ve approached cash flow management as a finance issue—but the real bottleneck isn’t just accounting. The core problem is data.

Think about it:

- The information that drives cash flow decisions comes from multiple disconnected sources—ERPs, CRMs, billing systems, procurement tools, and even Slack messages.

- Payment delays often come from bad data inputs—like incorrect purchase order numbers, missing invoice details, or outdated customer records.

- Forecasting models rely on historical averages instead of real-time transaction patterns, making them reactive rather than predictive.

"When your data is scattered across different systems, you’re always playing catch-up instead of being proactive," I tell finance leaders. "The key is structuring data at the source so AI can provide real-time, reliable insights."

At Tesorio, we take a different approach. By structuring and cleaning financial data at its source, AI can provide finance teams with real-time visibility into their cash flow—without manual work.

AI is Fixing the Most Painful Finance Workflows

AI isn’t just about making processes faster—it’s about eliminating friction points entirely. Here’s how it’s solving three major cash flow challenges:

1. Cleaning Up Bad Data at the Source

One of the biggest pain points in finance operations is that 50-70% of payment delays come from incorrect data. Think about how many times invoices are rejected because of missing fields or mismatched details.

Instead of relying on humans to catch these errors, AI can automatically validate invoice data against signed contracts, PO numbers, and customer records. This eliminates mistakes before they disrupt cash flow.

"AI doesn’t just speed things up—it ensures accuracy at scale," I often emphasize. "A human might catch one or two errors in a batch of invoices, but AI can scan thousands in seconds."

2. Predicting Customer Payment Behaviors

Most companies forecast collections by applying a generalized Days Sales Outstanding (DSO) metric to their entire customer base. But that’s a blunt tool—it doesn’t account for customer-specific behaviors.

With AI, finance teams can analyze every past invoice and payment pattern for each customer, building predictive models that anticipate when they will actually pay—not just when they are “supposed” to pay. This means finance leaders can forecast with precision instead of guesswork.

3. Automating the Invoice-to-Cash Cycle

Traditionally, getting paid is a slow, manual process:

✅ Sales closes a deal

✅ An invoice is manually created

✅ A collections team follows up with the customer

✅ Payments are reconciled in the ERP

With AI, this entire process can be orchestrated automatically. From generating invoices based on contract data to triggering personalized follow-ups based on customer segmentation, finance teams can remove friction at every stage.

Finance Teams Must Adapt—Or Be Left Behind

The shift to AI-powered finance isn’t a trend—it’s a fundamental transformation. Companies that embrace automation will have a major advantage, while those that rely on outdated processes will struggle to keep up.

Here’s what finance leaders should be asking themselves right now:

- Are we still relying on spreadsheets and static reports for cash flow forecasting?

- How much time does our team spend fixing invoice errors or chasing payments?

- Do we have real-time visibility into our cash position, or are we constantly playing catch-up?

"Finance teams that don’t embrace automation will spend more time fixing problems than preventing them," I often remind people. "It’s not about replacing people—it’s about giving them the tools to focus on what really matters."

The reality is, finance is no longer just about compliance and reporting. It’s about driving efficiency, making proactive decisions, and helping businesses scale faster. AI is the tool that makes this possible.

Final Thoughts: The Future of Cash Flow is AI-Driven

At Tesorio, we believe that revenue isn’t real until you get paid. And to get paid faster, companies need more than just dashboards—they need intelligent, automated finance operations.

The companies that succeed in the next five years won’t be the ones with the most funding or the biggest finance teams. They’ll be the ones that leverage AI to work smarter, not harder.

Now is the time for finance leaders to step up, embrace automation, and transform the way their teams operate. Because in today’s world, you can’t afford to wait.