The Current State of Cash Flow Forecasting: Insights from Tesorio’s Latest Survey

Amidst the pressures of maintaining financial stability and achieving growth targets, the art of cash flow forecasting has never been more crucial for finance professionals. As organizations strive to navigate economic uncertainties and capitalize on growth opportunities, the ability to accurately predict cash flow becomes a vital component of strategic decision-making. At Tesorio, we conducted a comprehensive survey of 225 finance executives to explore the current state of cash flow forecasting. The findings reveal significant insights and emerging trends that can help finance leaders stay ahead of the curve.

Increasing Focus on Cash Flow Forecasting

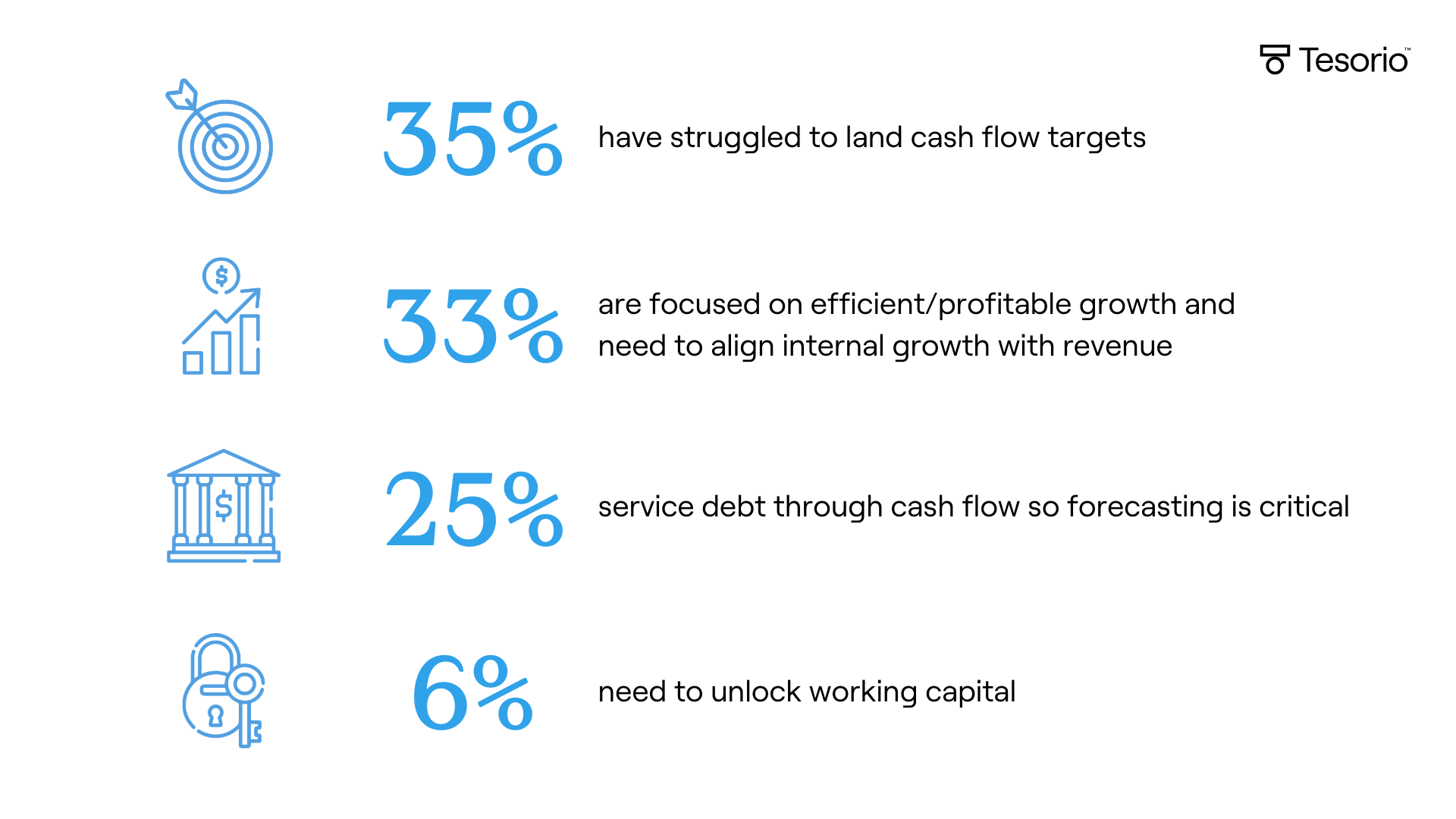

Our survey highlights a growing trend: 70% of finance leaders are placing greater emphasis on cash flow forecasting compared to previous years. But why is this happening?

This shift is driven by several factors. Many organizations are finding it challenging to meet their cash flow targets consistently. As businesses aim for efficient and profitable growth, aligning internal growth with revenue has become a crucial focus area. Additionally, the necessity to service debt accurately and unlock working capital is pushing finance teams to refine their forecasting processes.

This increased focus underscores a broader recognition that traditional forecasting methods, which often rely on historical data and static models, are insufficient in today’s dynamic environment. Finance leaders are advocating for more advanced tools and real-time data analytics to enhance forecasting accuracy and responsiveness.

Overcoming Challenges in Cash Flow Forecasting

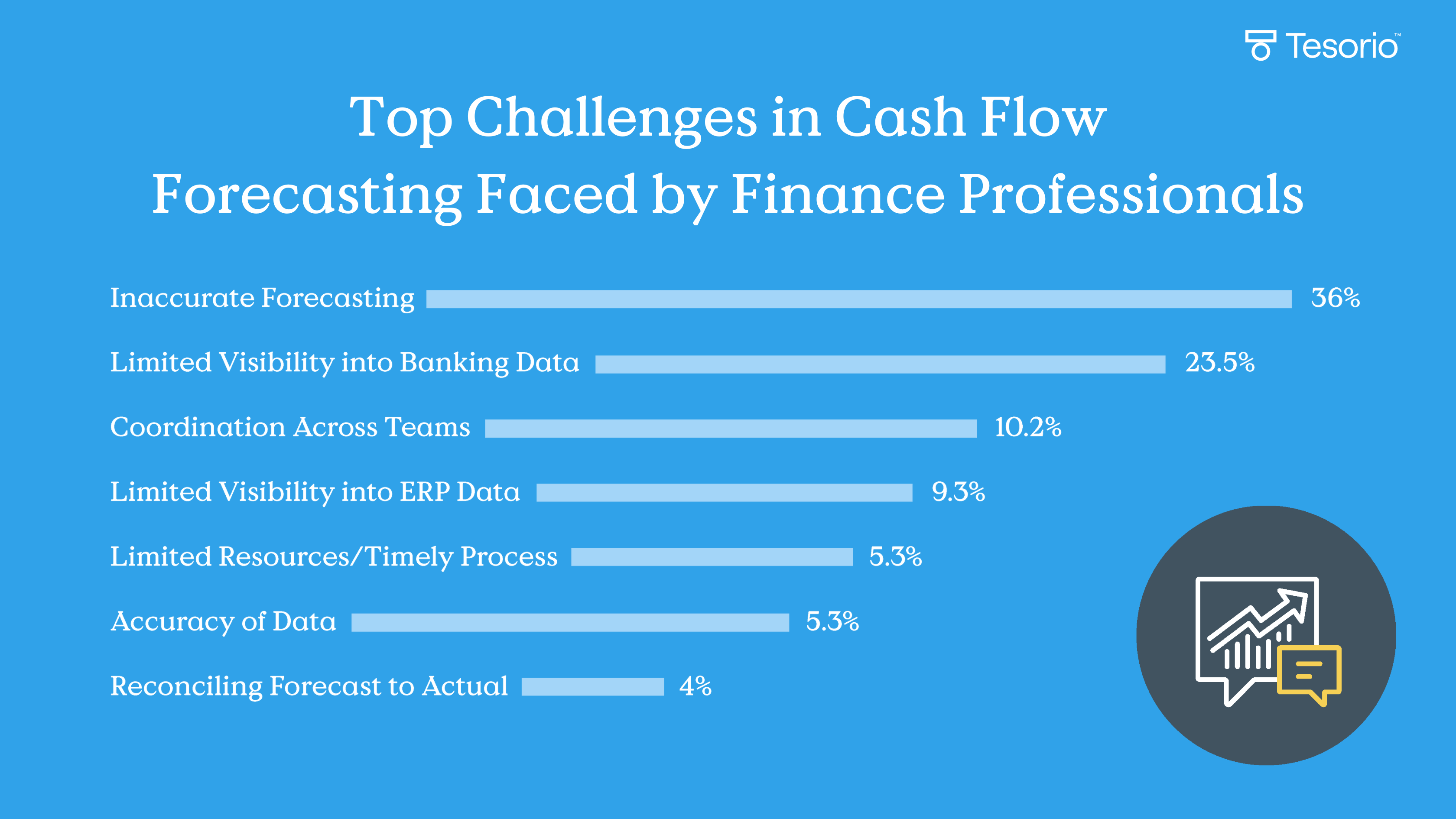

Despite its critical importance, cash flow forecasting presents numerous challenges. One of the most significant hurdles is the inaccuracy of forecasts, which can lead to financial missteps and missed opportunities. Limited visibility into banking data and ERP systems further complicates the process as finance teams struggle to obtain a comprehensive view of their cash positions.

Coordination across different teams within an organization also poses a challenge. Siloed information and lack of communication can hinder the effectiveness of forecasting efforts. This fragmentation often results in outdated or incomplete data, making it difficult to produce reliable forecasts. As a solution, there is a growing need for unified platforms that integrate disparate data sources and foster collaboration across departments.

The Role of Technology in Modern Forecasting

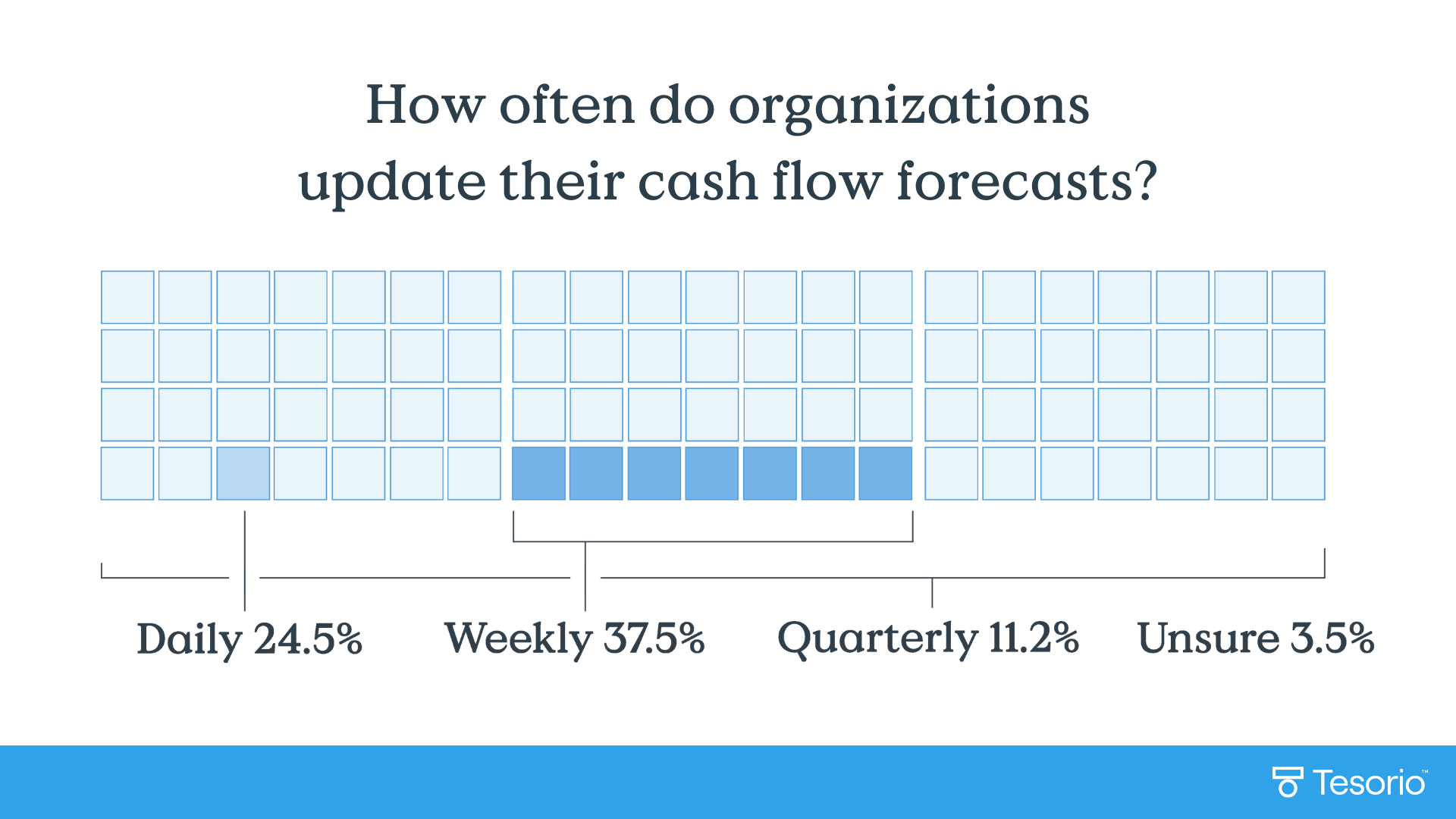

While some businesses update their forecasts daily or weekly to stay agile, others opt for quarterly updates, focusing on long-term trends. Regardless of the frequency, the key to successful forecasting lies in leveraging technology to streamline the process.

By leveraging AI, cash flow forecasting could be fully automated for finance teams. Tesorio’s AI-powered Cash Flow Management is revolutionizing how finance teams operate and forecast cash. With real-time insights and automated routine tasks, finance professionals are empowered to focus on strategic analysis and decision-making. By adopting these tools, organizations can enhance the accuracy and efficiency of their forecasting efforts, ultimately driving better financial outcomes.

Effective Communication of Financial Performance

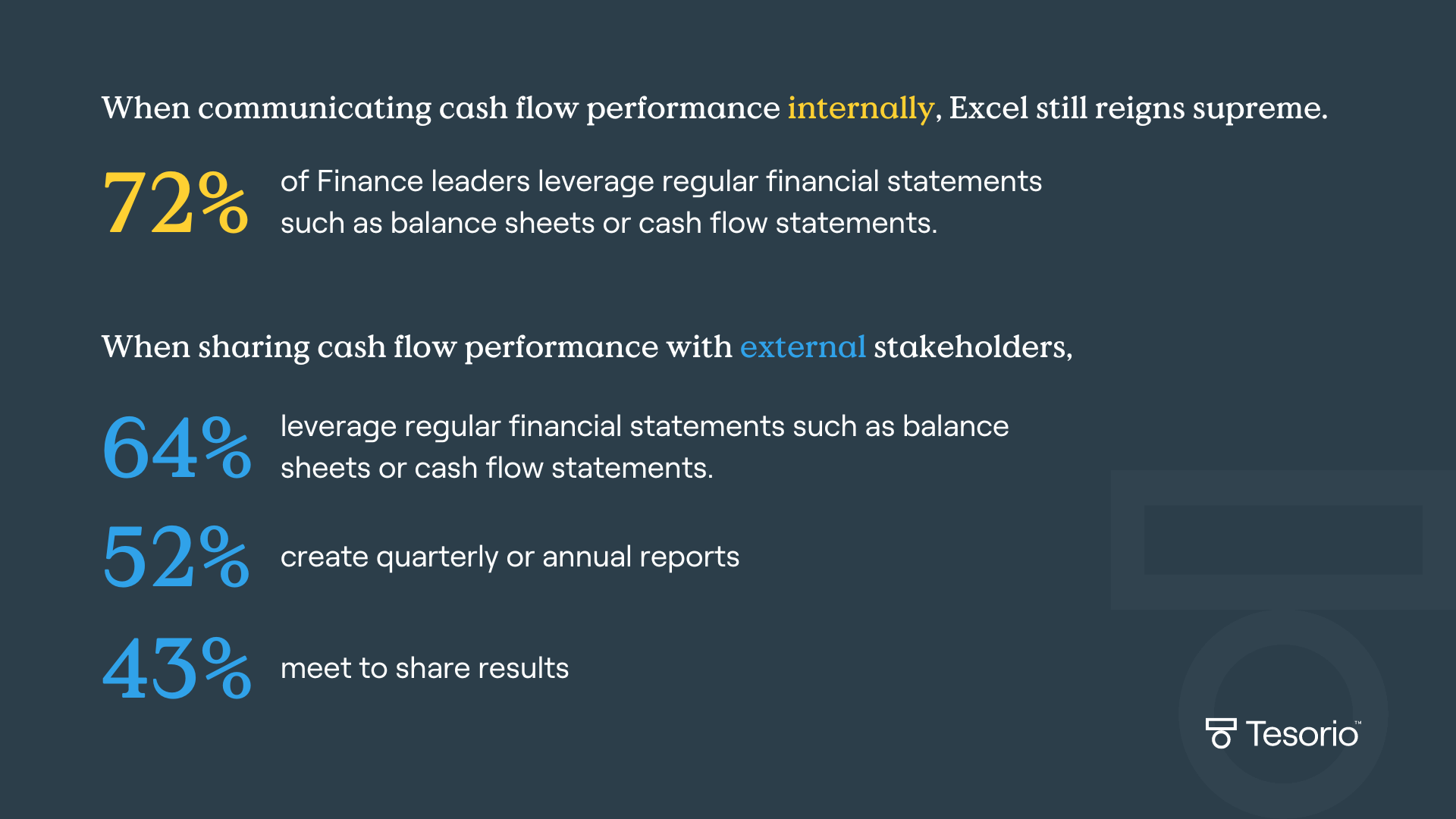

Efficient communication and reporting on an organization’s financial performance are pivotal in cash flow management. Internally, 72% of finance leaders stated they still rely on Excel for balance sheets and regular financial statements. While Excel is trusted, its limitations are clear in today's fast-paced environment.

Externally, consistent reporting builds trust and transparency with stakeholders. Regular updates and detailed reports help stakeholders understand the organization's financial health.

Transitioning from error-prone spreadsheets to smart solutions allows organizations to present financial data actionably, enhancing understanding and engagement in real time.

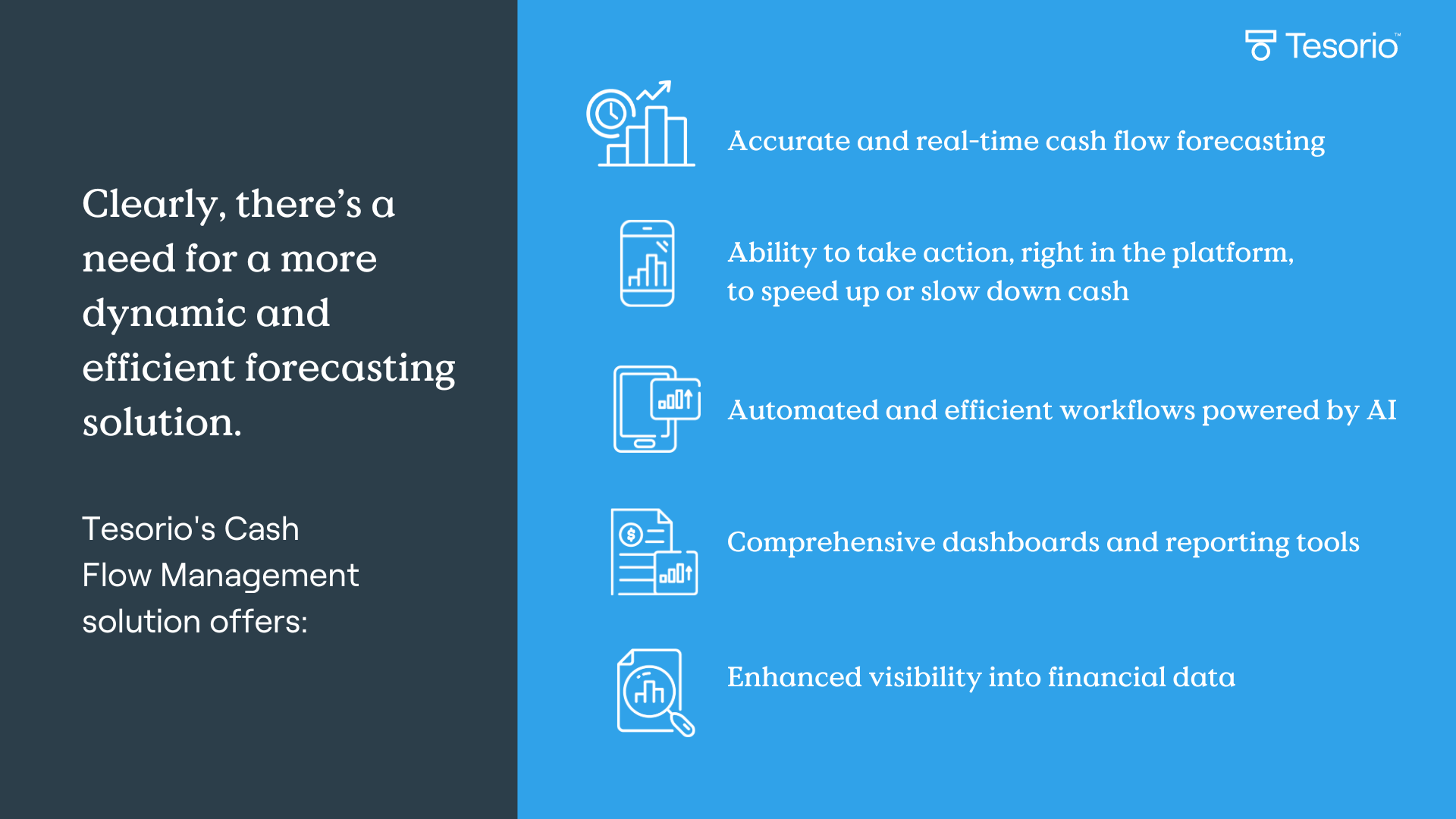

The Path Forward: Embracing Dynamic Solutions

The insights from the survey underline the need for more dynamic and efficient cash flow forecasting solutions. The old way of forecasting begins to look like fortune-telling in comparison. Companies are drowning in data, yet they are starving for actionable guidance. The future isn't something to predict but something to create and act on today.

At Tesorio, we offer a comprehensive Cash Flow Management solution designed to address these challenges head-on. Our platform provides accurate and real-time forecasting, actionable insights, and automated workflows powered by AI. With comprehensive dashboards and enhanced visibility into financial data, finance leaders can transform their cash flow management processes and drive strategic growth.

Discover how Tesorio can revolutionize your cash flow forecasting process. Visit tesorio.com to learn more and schedule a demo.