The Quiet Revolution: 5 Ways AR Automation Transforms Your Financial Foundation

Cash flow, the lifeline of any growing business, is only as strong as your ability to collect payments. Traditional methods, spreadsheets, manual emails, outdated invoices, and isolated systems, create bottlenecks that stall your collections and ultimately your company’s growth. Most finance teams would gladly leave these legacy processes behind, but transitioning to automated workflows might seem intimidating or unclear.

This guide will demystify Accounts Receivable (AR) automation, walk you through the five specific ways AR automation will fundamentally transform your business’s financial operations, and illustrate with real-world examples how innovative finance leaders use platforms like Tesorio to turn AR into a strategic growth engine.

The Power of AR Automation in the Modern Enterprise

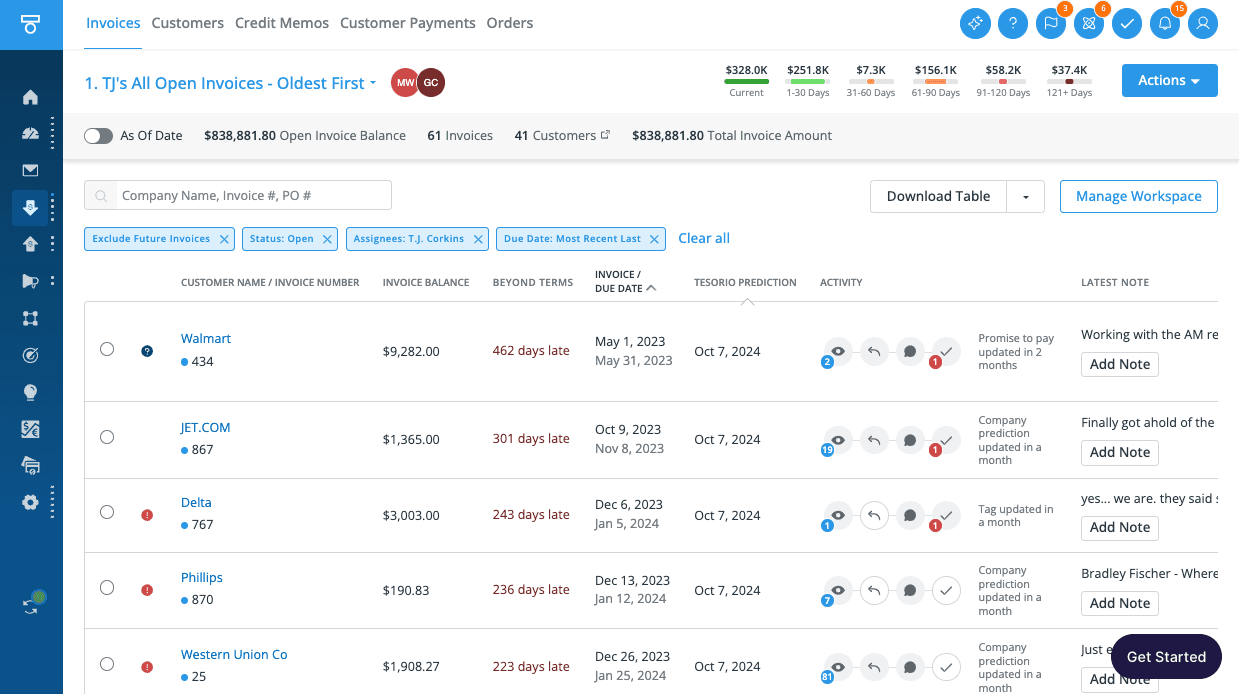

AR automation refers to digital platforms and tools that automate formerly manual AR processes. Unlike conventional AR methods, modern automation solutions such as Tesorio enable finance teams to strategically and proactively accelerate cash flow. From smart reminders and real-time payment insights to intelligent cash forecasting, AR automation is shaping financial management into a more agile and high-performing area.

Let’s explore the five key benefits your team can unlock by adopting AR automation today.

1. Accelerate Collections & Reduce Days Sales Outstanding (DSO)

Reducing Days Sales Outstanding (DSO) is the cornerstone of maintaining healthy cash flow. Traditional AR processes often increase DSO due to delayed invoicing, inconsistent follow-ups, and friction in payment processes. AR automation directly addresses these pain points by deploying personalized communication, instant payment links in emails, and risk-based follow-ups triggered automatically.

Tesorio customers commonly demonstrate remarkable gains in accelerating collections. Discovery Education, for example, reduced their DSO dynamically from 128 days to just 43 days—an improvement of 66 percent after adopting Tesorio’s automation platform.

Pro Tip: Implement automated segmented campaigns based on customer size, payment behaviors, past-due invoice age, and risk profiles. Companies running targeted AR automation campaigns typically reduce overdue invoices by up to 50%.

2. Empower Real-Time Cash Flow Visibility & Better Forecasting

Manual AR processes mostly rely on Excel sheets, involving slow, error-prone data entry and stale information. Finance professionals spend too much effort extracting valuable insights from outdated data. With AR automation, your financial team accesses intuitive dashboards providing instant visibility into AR aging, collections status, customer payment behaviors, and cash forecasting.

Real-time visibility is transformative because it gives your team proactive alerting and actionable insights. Couchbase, using Tesorio, cut down their cash forecasting cycle dramatically—from 10 cumbersome days to a matter of hours. Such rapid forecasting frees finance leaders to shift from data wrangling toward accountable decisions on liquidity management.

Pro Tip: Set up real-time dashboards tracking invoice aging buckets and predicting cash inflow scenarios, aligning forecasts closer to actual performance while reducing manual intervention by 80%.

3. Improve Collections Team Productivity & Scale without Adding Headcount

Manual collections processes consume valuable team hours and divert resources from strategic tasks. By automating repetitive AR tasks (e.g., sending reminders, invoice matching, and reporting), your finance team can shift their focus from repetitive manual tasks to relationship-building customer interactions and process improvements.

Companies leveraging Tesorio’s automation typically triple collections productivity, cut manual intervention by over 50%, and reallocate saved hours into value-added financial analysis and decision-making. Automation enables rapid scaling for growing financial teams—without the need to expand headcounts unnecessarily.

Pro Tip: Empower your team with automated reminders and clear priority lists recommended by AI, ensuring they spend their valuable time proactively addressing high-priority accounts and customer relationship management.

4. Enhance Customer Experience & Strengthen Relationships

Today's customers demand simplicity and clarity. When a customer’s payment experience is frictionless, it improves debt recovery rates, builds trust, and enhances your entire customer relationship. Automated AR lets your customers conveniently self-manage payments within intuitive payments portals. You can offer flexibility—ACH, credit cards, wire payments—all in one portal.

Customers appreciate convenience: when payments and invoice management become frictionless, disputes drop significantly. Businesses implementing Tesorio’s payments portal typically achieve a 25% faster invoice resolution rate through improved self-service functions.

Pro Tip: Provide integrated features such as one-click payment options, automatic payment scheduling, and easy invoice disputes directly accessible within reminder communications, boosting customer responsiveness and satisfaction.

5. Drive Accuracy & Simplified Reconciliations with Automated Cash Application

Manual matching and reconciliation of incoming payments and open invoices remain inefficient, error-prone, and repetitive. Automation in cash application uses intelligent AI-enabled algorithms to match payments directly with invoices swiftly, ensuring perfect synchronization across AR ledger systems. Tesorio’s automated cash application integrates directly with your banking and ERP systems, processing payments in minutes instead of hours.

Efficient cash application drastically reduces mistakes, expedites financial close, and helps finance teams keep the AR ledger accurate and timely. Tesorio users routinely reduce cash application time by over 75%, streamlining their financial reconciliation process.

Pro Tip: Integrate Tesorio directly with your existing ERP (NetSuite, Sage Intacct) and bank accounts, setting up intelligent rules for automatic invoice matching. Initiating automated reconciliations can fundamentally simplify your monthly close process.

Addressing Common AR Automation Challenges Head-On

Transitioning to AR automation might trigger initial concerns in some finance teams. Let’s briefly discuss a few common challenges and solutions:

1. Resistance to Change

Teams accustomed to legacy methods can be skeptical. Start incrementally with a single workflow, demonstrate quick wins, and expand automation gradually.

2. Data Silos

Disconnected data can challenge automation effectiveness. Deploy fully integrated AR platforms like Tesorio, consolidating fragmented ERP and bank data into one intuitive dashboard.

3. Manual Flexibility and Overrides

Automation should enhance—not restrict—your workflow. Ensure your automation platform provides flexible manual overrides and approval workflows as Tesorio does.

4. Visibility Gaps and Real-Time Dashboards

Predictive analytics overcome visibility delays, allowing proactive decisions and meaningful interactions across customer accounts.

Real-Life Success Story: Discovery Education

Discovery Education, an industry-leading global EdTech company, realized measurable strategic results from AR automation. Adopting Tesorio, they unified collections, automated routine follow-ups, and synced collections data into real-time forecasting. Results were outstanding:

- Lowered DSO by 66% within a few months (from 128 to 43 days).

- Saved over 200 team-hours quarterly, shifting energy toward strategic analysis and planning.

FAQs

What does Smart AR Automation include?

Tesorio's automation encompasses campaigns, cash application, online payment portals, and AI-driven predictive insights. Tesorio modules can be selected individually or deployed together seamlessly.

Can I easily integrate Tesorio?

Absolutely. Tesorio integrates quickly with NetSuite, Sage Intacct, various CRMs, and even your banking platforms, all data exchanges seamlessly remain bi-directional.

Does AR Automation decrease DSO?

On average, Tesorio customers typically lower DSO by between 33 and 66 days, notably improving cash flow and working capital.

How quickly can we implement Tesorio?

Most companies launch successfully within weeks, guided by Tesorio's onboarding specialists, modular design, and ready-to-tailor campaign templates.

Your Next Step Forward with AR Automation

Accounts receivable automation is not simply another technology purchase, it's a paradigm shift turning your AR function into a proactive business partner that strategically speeds up cash flow. Companies leveraging AR automation are becoming more agile, proactive, and strategically valuable within their organizations.

Ready to supercharge your finance team and unlock faster collections with less effort? Book your personalized demo of Tesorio’s AR automation platform today and take your finance operations to the next level!