The Silent Killer of Growth: Cash Flow Blind Spots (And How to Fix Them)

Every conversation I have with CFOs reveals a consistent challenge hiding in plain sight, cash flow blind spots. These aren't just minor inefficiencies, they’re strategic vulnerabilities that silently restrict growth potential while remaining undetected by traditional financial monitoring.

The Hidden Cost of Cash Flow Inefficiency

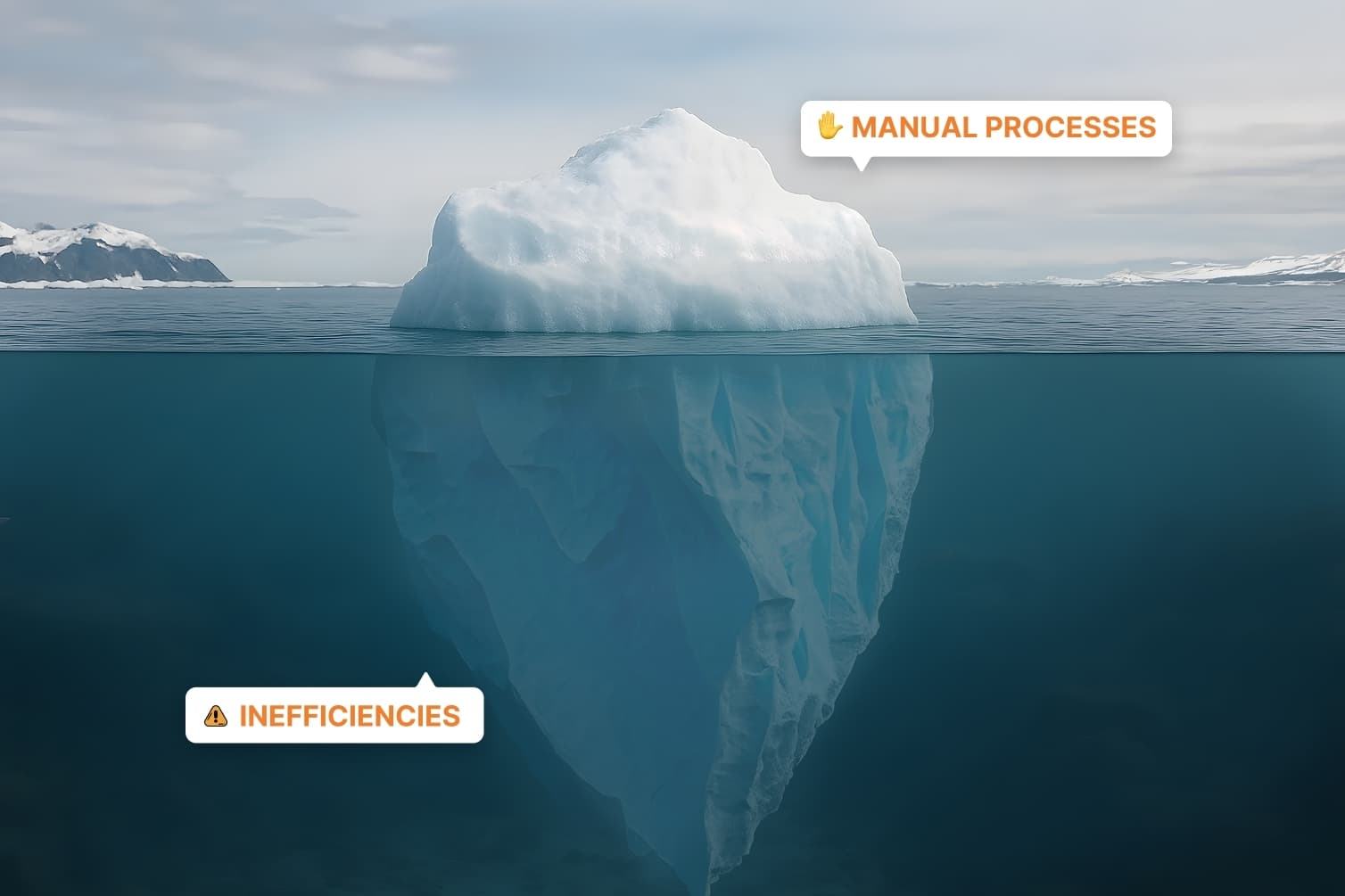

What makes these blind spots particularly dangerous is their subtlety. A delayed receivable here, a manual reconciliation process there, individually, they appear manageable. Collectively, they create a significant drag on your organization's financial agility and strategic capabilities.

The real cost isn’t just in the cash that’s temporarily unavailable, it’s in the opportunities missed while your capital remains trapped in inefficient processes.

Three Critical Blind Spots Undermining Your Financial Performance

1. Fragmented Data Leading to Forecasting Failures

When finance teams navigate 10+ disconnected systems (as 63% do according to recent research), accurate cash forecasting becomes nearly impossible. The result, strategic decisions based on incomplete information.

The fix, implement a centralized cash flow management platform that integrates with your existing financial ecosystem. This creates a single source of truth, eliminating the 10+ hours per month that 45% of finance teams spend manually reconciling data.

2. Reactive Collections Processes Extending DSO

Many organizations still rely on manual, calendar-based collection approaches rather than intelligent, behavior-based systems. This reactive stance means capital remains unnecessarily tied up in accounts receivable.

The fix, deploy AI-driven collections that can predict payment behavior and proactively manage follow-ups. Leading companies using this approach have reduced Days Sales Outstanding significantly, freeing up cash that was previously locked in the balance sheet.

3. Invisible Operational Inefficiencies

The most insidious blind spots are the processes so embedded in your operations that they’re never questioned, manual cash application, redundant approval workflows, or subscription services that continue long after their utility has ended.

The fix, implement automated cash application and regular process audits powered by intelligent systems that can identify patterns and anomalies human reviewers might miss. This transforms finance from a reactive function to a strategic driver of efficiency.

Building a Culture of Cash Flow Intelligence

Addressing these blind spots requires more than technological solutions, it demands a shift in organizational mindset. Forward-thinking CFOs are creating a “culture of cash” where:

- Cash flow literacy extends beyond finance to all departments

- Real-time visibility replaces monthly reporting cycles

- Predictive analytics anticipate challenges before they impact operations

- Cross-functional collaboration optimizes the DSO-to-DPO ratio

The Strategic Advantage of Cash Flow Mastery

Companies that eliminate these blind spots gain more than just improved liquidity, they develop a significant competitive advantage. With capital freed from inefficient processes, these organizations can respond more quickly to market opportunities, weather economic uncertainty, and fund innovation without additional financing.

As one former Oracle CFO noted, improvements in collections and cash flow management are “like free money”, they release cash already earned but trapped in your balance sheet.

The most successful finance leaders understand that cash flow optimization isn’t just about financial health, it’s about enabling the entire organization to move with greater speed and confidence toward its strategic objectives.

What blind spots might be hiding in your cash flow processes today?