Transforming Financial Operations: Reducing DSO and Optimizing Collection

The way organizations manage cash flow and optimize collections is fundamentally changing. Traditional finance departments, burdened with disconnected systems and manual processes, face a perpetual cycle of reactive collections, labor-intensive reconciliations, and elevated Days Sales Outstanding (DSO) that constrain working capital and hinder growth. At Tesorio, we know that finance teams are solving for inbox volume instead of cash visibility. The future of finance is connected, data-driven, and empowered by AI. Our purpose-built platform not only automates the entire cash conversion cycle but also equips finance operations teams with the actionable insights needed to reduce DSO and improve collections efficiency.

Learning Objectives and the Evolving Role of Financial Operations

Recent sessions with industry leaders have focused on critical learning objectives, including: • Gaining insights on the evolving role of financial operations professionals • Evaluating technology that is reshaping collections and cash flow forecasting • Harnessing the power of clean, structured data across multiple systems • Identifying future skills required to thrive in modern finance • Exploring the advanced features and functionality of Tesorio’s software

These discussions highlight that when financial data is centralized and workflows are automated, organizations shift from reactive to proactive collections, ultimately reducing DSO and propelling growth.

Breaking Down Data Silos and Empowering Financial Teams

One root cause of DSO challenges is disconnected financial systems that leave crucial data unstructured and siloed. When key information resides in multiple databases, spreadsheets, and legacy systems, finance teams waste invaluable time reconciling data instead of creating actionable insights. Tesorio’s connected platform integrates ERP, CRM, banking, and other financial systems into one unified source of truth, streamlining operations and providing a clear view of customer payment behavior.

By centralizing financial data, organizations can eliminate manual reconciliations, automate routine tasks, and empower teams to target overdue invoices long before they threaten cash flow. This transformation shifts collections from an inbox-chasing exercise to a strategic, automated process that reduces DSO and maximizes working capital.

Key Pillars for Transforming Collections and Reducing DSO

Centralize Financial Data for Complete Visibility The fragmented nature of legacy systems forces finance teams to spend excessive time on manual reconciliation. Tesorio brings all financial data together into one dashboard by synchronizing data from major systems such as NetSuite, Oracle, and Salesforce. This integration enables real-time visibility into payment histories and outstanding invoices, ensuring that every transaction is accurately tracked and mitigating the risk of delayed collections.

Implement AI-Powered Payment Prediction Traditional collections focus solely on payment due dates rather than understanding actual customer behavior. Tesorio’s advanced machine learning analyzes historical payment patterns to predict when an invoice will realistically be paid. This predictive insight allows teams to prioritize follow-ups on invoices at risk of becoming delinquent, ensuring that collections are proactive rather than reactive. As a result, companies have seen dramatic reductions in DSO by acting on these insights before cash flow is compromised.

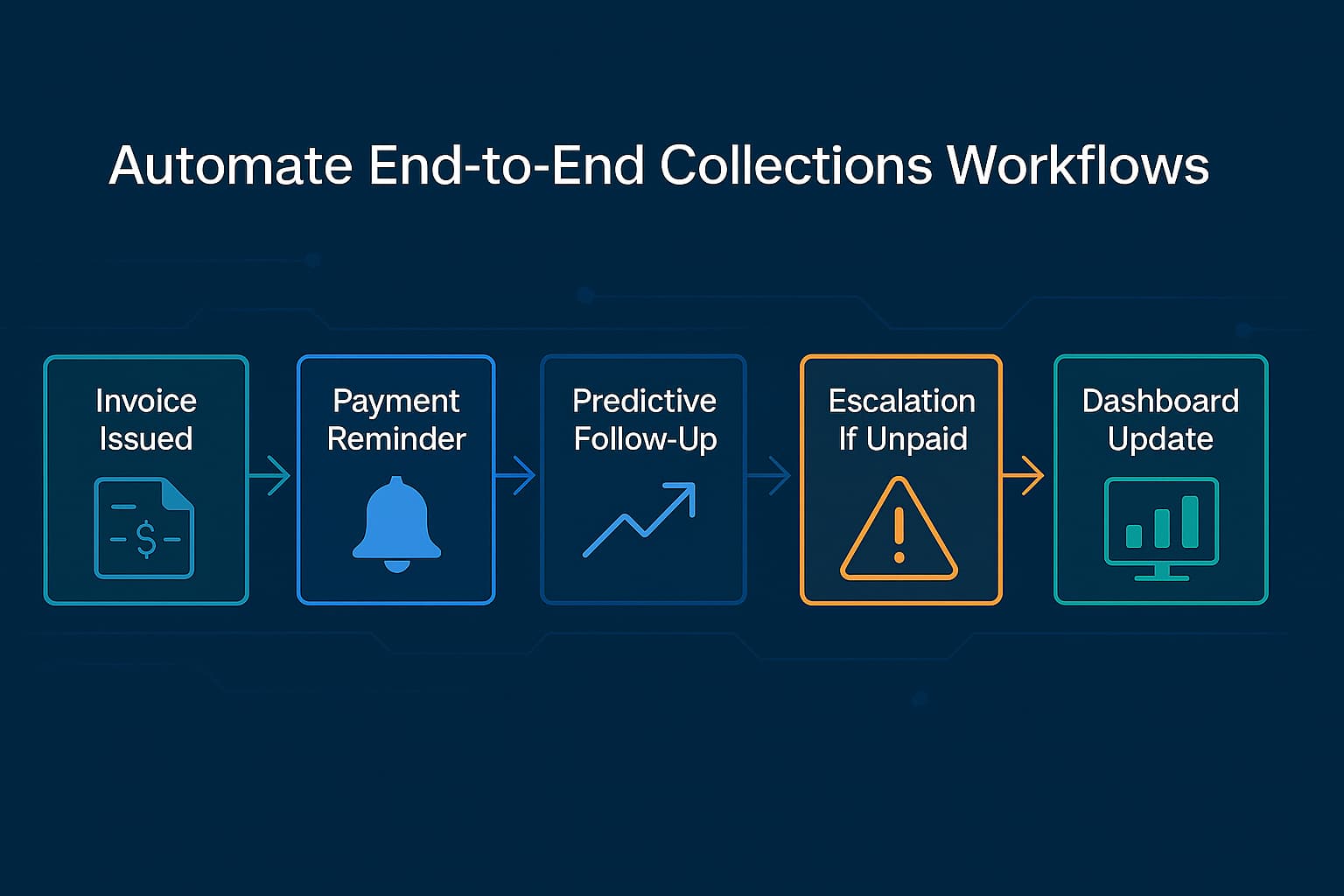

Automate End-to-End Collections Workflows Manual collections processes not only slow down operations but also increase the chance for errors. Tesorio automates steps throughout the collections cycle—from issuing invoice reminders and escalating overdue accounts to integrating follow-up actions. Automated, personalized outreach campaigns that are triggered based on customer segmentation ensure that the system remains both efficient and customer-friendly, preserving positive relationships while improving collections effectiveness.

Leverage Real-Time Analytics for Strategic Decision-Making Access to timely, accurate data is a game-changer for financial operations. Tesorio’s platform delivers real-time dashboards and careful analytics on key performance indicators like DSO, aging buckets, and cash flow trends. With this visibility, finance leaders can instantly identify trends, spot anomalies, and make informed decisions to further reduce DSO. By using data to drive decision-making, companies can address issues before they escalate, maintaining liquidity and supporting strategic investments.

Enable Cross-Functional Collaboration Collections efforts benefit tremendously from integrating input across departments. Tesorio’s solution extends its visibility to sales, customer success, and other relevant stakeholders, ensuring that the entire revenue-to-cash cycle is aligned. When sales teams and finance operations share data insights, they can collaboratively address delays in cash collections and enhance overall customer experiences. This collaboration not only reduces DSO but also builds stronger, data-backed relationships with clients.

The Future of Financial Operations: Talent, Technology, and Transformation

The evolution of financial operations now calls for finance professionals who can blend traditional accounting expertise with skills in process optimization, data interpretation, and technology management. As these roles expand beyond transactional work into strategic planning, upskilling becomes vital. Organizations that embrace AI, predictive analytics, and integrated systems are better positioned to reduce DSO, accelerate cash flow, and drive overall business performance.

Real-World Transformation: Success Stories and Measurable Results

The impact of transforming financial operations with Tesorio is clear:

• Many companies have reduced their DSO by an average of 33 days.

• Clients like Couchbase have doubled collections per analyst and slashed cash flow forecasting time from days to hours.

• Improved data integration has led to more accurate cash flow forecasting and heightened responsiveness in collections efforts.

These results illustrate that when finance teams transition from managing fragmented inboxes to harnessing a connected platform, the entire cash conversion cycle is optimized, resulting in faster cash inflows, enhanced working capital management, and the ability to reinvest in business growth.

Take Control of Your Cash Flow Today

The era of disconnected spreadsheets and manual processes is over. With Tesorio’s AI-powered and connected platform, finance teams can finally convert revenue into cash faster, reduce DSO, and unlock opportunities for growth. Clean, centralized data, proactive collections automation, and intelligent predictive analytics combine to create a future where financial operations drive strategic advantage.

Are you ready to transform your cash flow management? Embrace the Tesorio way: Reduce DSO, optimize collections, and empower your finance team with the connected intelligence they need to lead the way in modern finance. Schedule a demo to see how Tesorio can revolutionize your financial operations and deliver tangible, measurable returns.

FAQs

What is DSO, and why is it important?

DSO stands for Days Sales Outstanding. It is a key financial metric that indicates the average number of days a company takes to collect payment after a sale. A lower DSO reflects a more efficient collections process and healthier cash flow, which is crucial for maintaining working capital and supporting business growth.

How does Tesorio’s connected platform help reduce DSO?

Tesorio’s platform centralizes financial data from disparate systems—such as ERP, CRM, and banking solutions, into one unified dashboard. This integration enables real-time visibility into invoices and payment histories, facilitating proactive collections and automated workflows. By leveraging AI-powered payment prediction, the platform can identify overdue invoices before they threaten cash flow, effectively reducing DSO.

What challenges do traditional finance departments face?

Traditional finance operations often struggle with:

- Disconnected systems that store data in silos.

- Manual, error-prone processes such as data reconciliation and chasing inbox volumes.

- Reactive collections efforts that focus on overdue invoices rather than preventing delays. These challenges can result in elevated DSO, inefficient cash management, and a loss of strategic focus.

How does centralizing financial data benefit an organization?

Centralizing data streamlines operations by eliminating the need to reconcile information across multiple systems. With all relevant financial information in one place, finance teams can monitor customer payment behavior, automate routine tasks, and quickly identify bottlenecks in the cash conversion cycle. This visibility promotes timely actions to accelerate collections and improve cash flow.

What role does AI play in transforming collections?

AI technology within Tesorio’s platform analyzes historical payment patterns to predict when invoices are likely to be paid. This predictive capability allows finance teams to target follow-ups more accurately and intervene before an account becomes significantly overdue. By shifting the focus from simply managing due dates to proactively managing customer behavior, AI helps in reducing the DSO and improving collections efficiency.

What features make Tesorio’s platform unique?

Key features of Tesorio’s solution include:

- Centralized Dashboards: Provides a single source of truth by integrating data from major systems.

- AI-Powered Payment Prediction: Forecasts realistic payment dates to prioritize follow-ups.

- Automated Collections Workflows: Streamlines tasks such as sending reminders and escalating overdue accounts.

- Real-Time Analytics: Offers immediate insights into critical performance indicators like aging buckets and cash flow trends.

- Cross-Functional Collaboration: Involves teams from sales, customer success, and finance to ensure alignment throughout the revenue-to-cash cycle.

How does automation improve collections processes?

By automating end-to-end collections workflows, Tesorio’s platform reduces manual intervention, minimizes errors, and accelerates the collections process. Automated, personalized outreach ensures that customers receive timely reminders, while the system escalates issues based on risk indicators, thus safeguarding cash flow and reducing DSO.

What is the impact of integrating real-time analytics?

Real-time analytics provide finance teams with up-to-the-minute data on key performance metrics. This access allows leaders to quickly spot trends and anomalies, make informed decisions, and proactively address potential issues. As a result, companies can maintain liquidity, support strategic investments, and drive overall performance.

How does the platform support cross-functional collaboration?

Tesorio’s solution extends its visibility beyond finance by incorporating inputs from sales, customer success, and other relevant departments. This holistic approach ensures that every department is informed and aligned regarding payment behavior and customer interactions. Improved collaboration leads to a smoother revenue-to-cash cycle and strengthens overall customer relationships.

What measurable results have companies achieved with Tesorio?

Many organizations have witnessed significant improvements after implementing Tesorio’s platform. For example, several companies have reduced their DSO by an average of 33 days. Clients such as Couchbase have reported doubling collections per analyst and drastically shortening cash flow forecasting times from days to hours. These outcomes highlight the platform’s effectiveness in optimizing financial operations and driving business growth.