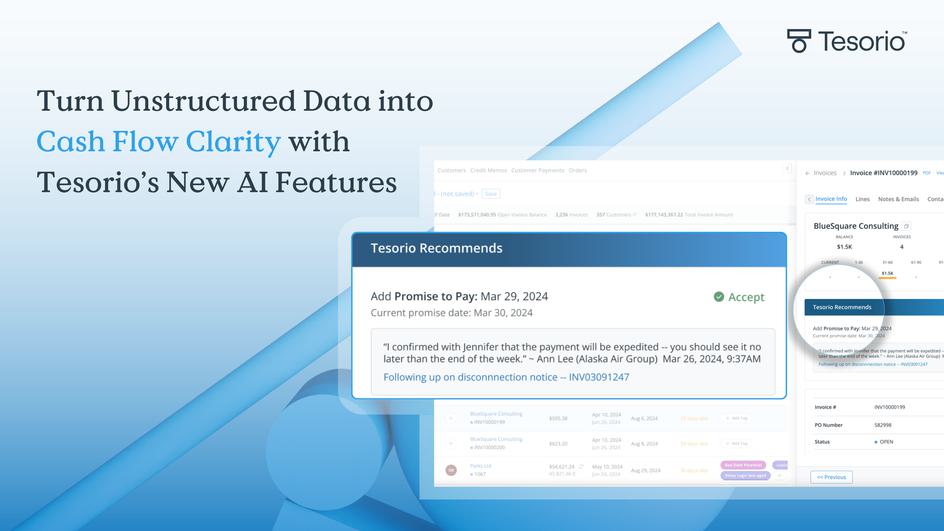

Turn Unstructured Data into Cash Flow Clarity with Tesorio’s New AI Features

At Tesorio, we’ve been hard at work building new capabilities to help finance teams turn revenue into cash even faster. Today, we’re excited to announce the powerful innovations we’ve rolled out over the past few quarters—designed to give finance teams greater control, clarity, and efficiency.

At the core of our latest innovations is a challenge that has long plagued finance teams:

Structuring Unstructured Data to Unlock Cash Flow Clarity

As Carlos Vega, Co-founder and CEO of Tesorio, puts it, “You know when you will pay everyone. The unknown variable is when you'll get paid. But payment timing is discoverable—you're someone else's vendor so they know when they'll pay you. It's just a matter of accessing and structuring that info. This is where AI comes in.”

The issue isn’t a lack of data—it’s that critical payment signals are buried in emails, invoices, and fragmented communications. Tesorio’s AI transforms this unstructured data into real-time cash flow intelligence, helping finance teams predict, plan, and collect with greater accuracy.

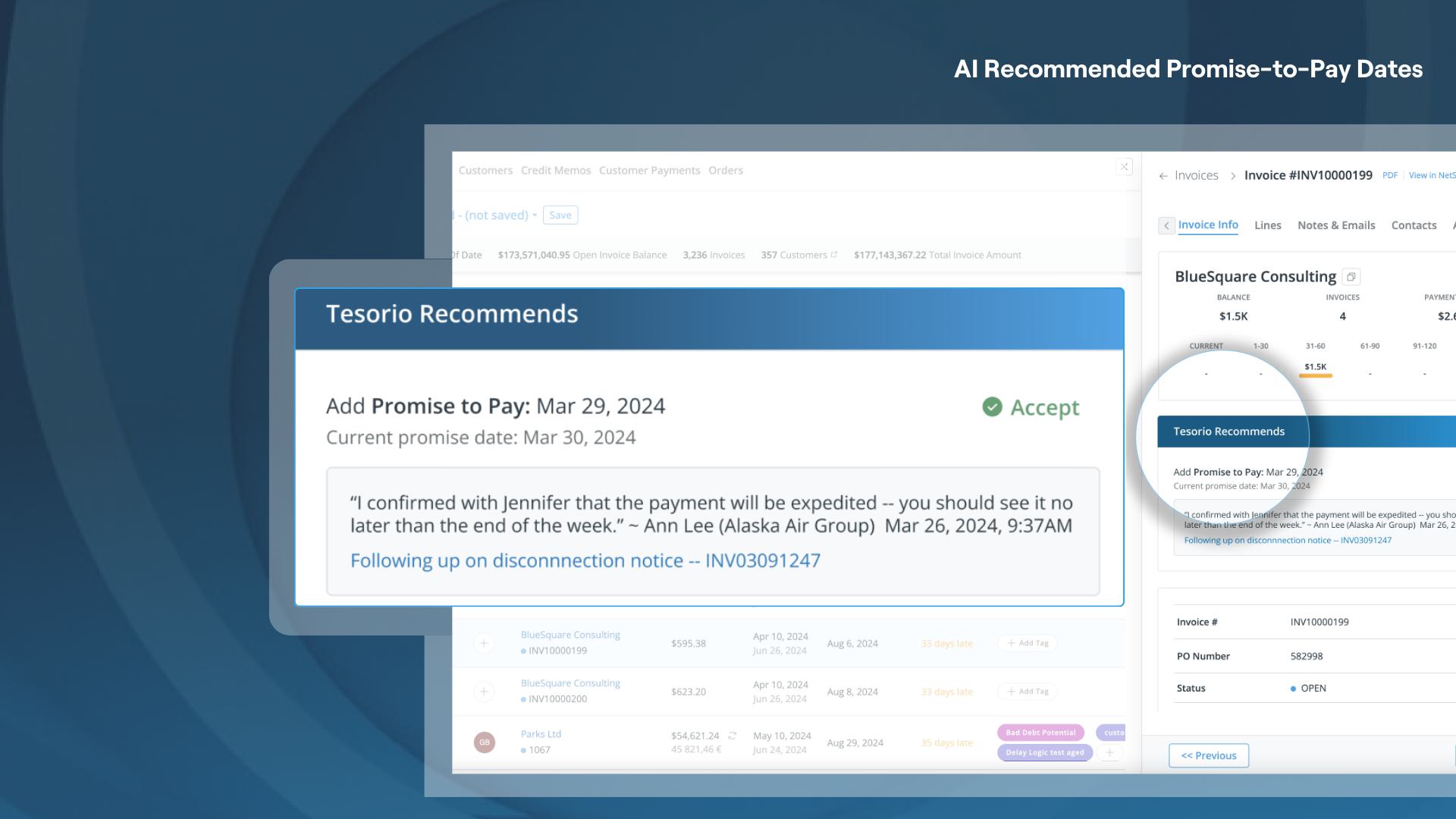

- AI Promise-to-Pay Date Detection: No more searching through emails for payment commitments. Tesorio’s AI extracts payment commitments hidden in emails and automatically detects promise-to-pay dates and integrates them into forecasts— improving accuracy without manual work. To date, this feature has extracted over 12,700 promise-to-pay dates with a 90% acceptance rate, reducing uncertainty and streamlining collections.

"The extracted pay dates have improved our forecasting and our customer relationships, plus save us time on dunning since we filter out accounts with a future payment promise," said Dave Hoskins, Credit & Collections Manager at PingIdentity.

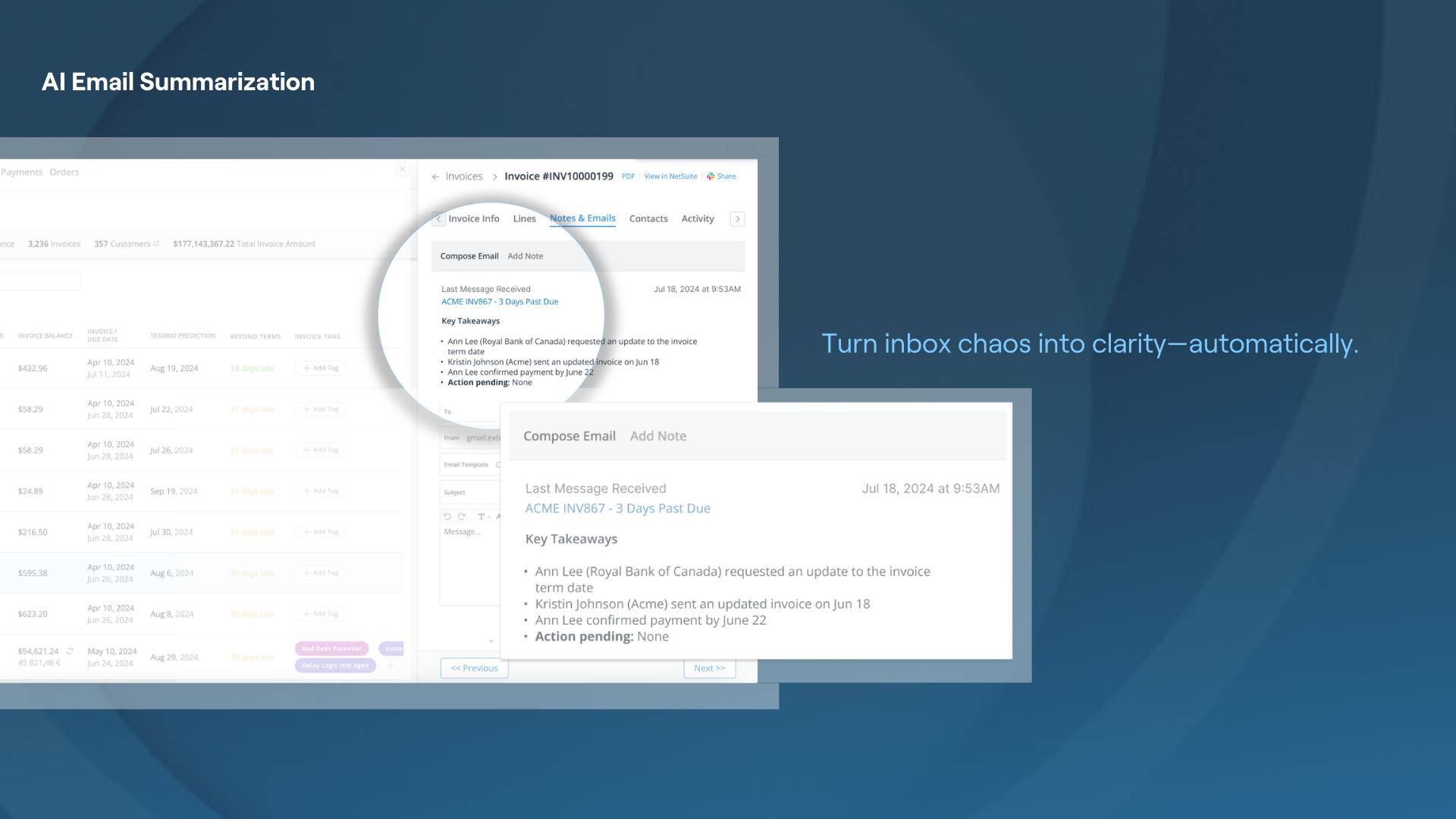

- AI Email Summaries: Stop sifting through email threads. Tesorio’s AI instantly summarizes customer messages, invoices, and billing updates—so teams can focus on action instead of inbox management.

- Customer Graph: A continuously evolving, network-powered system that leverages aggregate and anonymized data from across hundreds of thousands of businesses. For example, detecting invalid AP contacts before payment delays happen, ensuring invoices always reach the right person.

"50-70% of payment delays are self-inflicted due to missing or incorrect data," says Tesorio’s Co-founder and CTO Fabio Fleitas. "That's why cash flow is more of a data problem than a finance problem. Our latest innovations turn messy, unstructured data into real-time visibility—solving cash flow challenges today.

From Data Chaos to Cash Flow Clarity

By structuring previously unstructured data, finance teams can shift from tedious manual tasks to strategic activities that drive business value. These AI-driven capabilities fundamentally transform how teams work—bringing order to chaos, surfacing key insights, and making collections more predictable.

When unstructured data becomes structured:

Forecasts sharpen with real-time payment insights

Collections accelerate with automated payment signal extraction

Communications strengthen with AI-powered email summaries and tracking

Finance teams move faster, reducing time spent on manual tasks

Want to see how structured data can transform your cash flow? Book a demo today.